At year end the balance in AR is 525000 of which 4 is estima

At year end, the balance in A/R is $525,000, of which 4% is estimated to be uncollectible. The Allowance for Doubtful Accounts has a debit balance of $7,000 before adjustment. The journal entry necessary to record bad debt expense is:

debit Bad Debt Expense for $21,000; credit Allowance for Doubtful Accounts for $21,000

debit Allowance for Doubtful Accounts for $21,000; credit Bad Debt Expense for $21,000

debit Allowance for Doubtful Accounts for $7,000; credit Bad Debt Expense for $7,000

debit Allowance for Doubtful Accounts for $28,000; credit Bad Debt Expense for $28,000

debit Bad Debt Expense for $7,000; credit Allowance for Doubtful Accounts for $7,000

debit Bad Debt Expense for $28,000; credit Allowance for Doubtful Accounts for $28,000

| debit Bad Debt Expense for $21,000; credit Allowance for Doubtful Accounts for $21,000 | ||

| debit Allowance for Doubtful Accounts for $21,000; credit Bad Debt Expense for $21,000 | ||

| debit Allowance for Doubtful Accounts for $7,000; credit Bad Debt Expense for $7,000 | ||

| debit Allowance for Doubtful Accounts for $28,000; credit Bad Debt Expense for $28,000 | ||

| debit Bad Debt Expense for $7,000; credit Allowance for Doubtful Accounts for $7,000 | ||

| debit Bad Debt Expense for $28,000; credit Allowance for Doubtful Accounts for $28,000 |

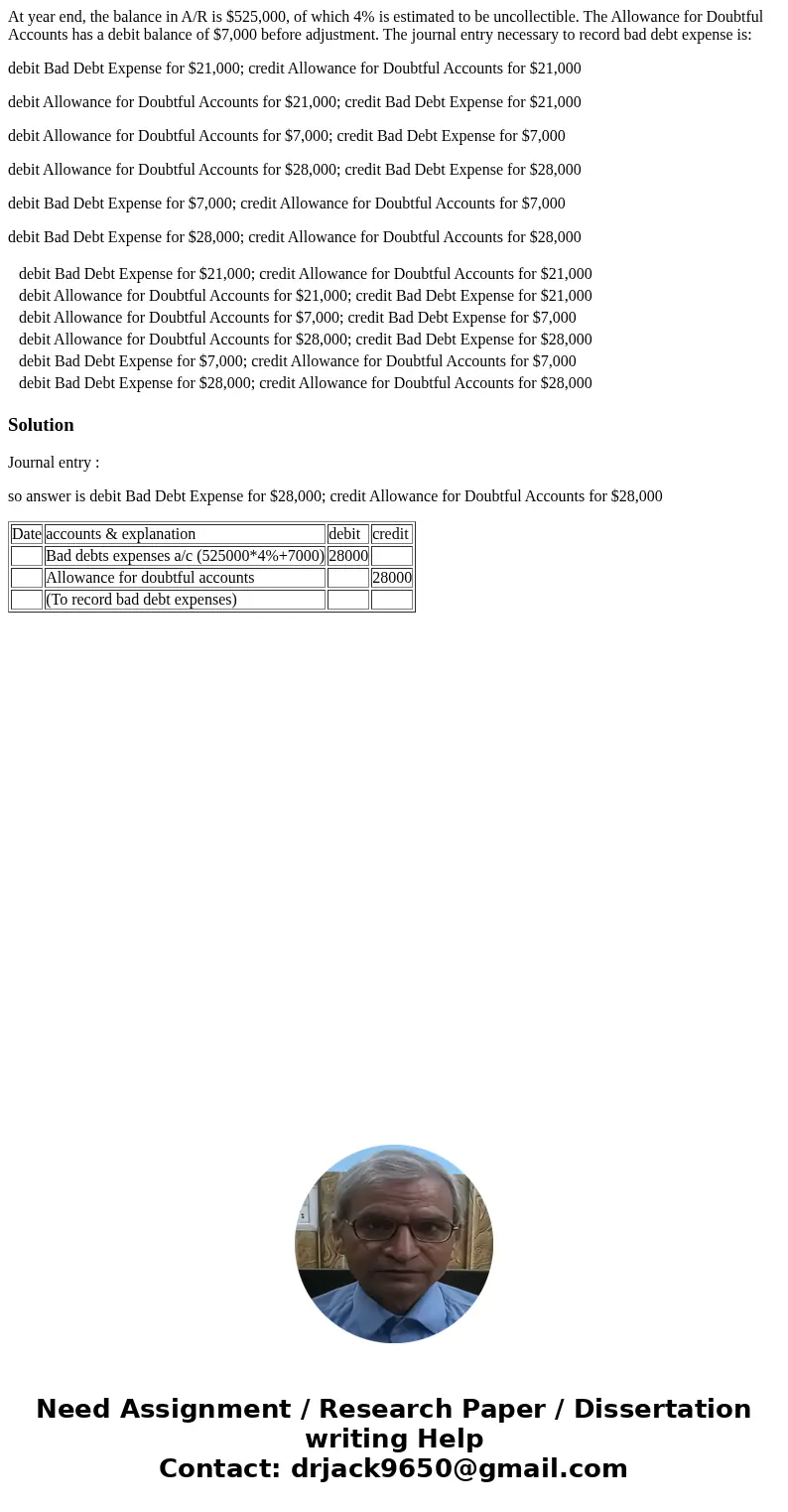

Solution

Journal entry :

so answer is debit Bad Debt Expense for $28,000; credit Allowance for Doubtful Accounts for $28,000

| Date | accounts & explanation | debit | credit |

| Bad debts expenses a/c (525000*4%+7000) | 28000 | ||

| Allowance for doubtful accounts | 28000 | ||

| (To record bad debt expenses) |

Homework Sourse

Homework Sourse