A collar is established by buying a share of stock for 62 bu

A collar is established by buying a share of stock for $62, buying a six-month put option with exercise price $55, and writing a six-month call option with exercise price $65. Based on the volatility of the stock, you calculate that for an exercise price of $55 and maturity of six months, N(d1) = 0.7147, whereas for the exercise price of $65, N(d1) = 0.6555.

What will be the gain or loss on the collar if the stock price increases by $1? (Input the amount as a positive value. Round your answer to 3 decimal places.)

(Click to select)GainLoss of $

Solution

Answer: gain of 0.0592

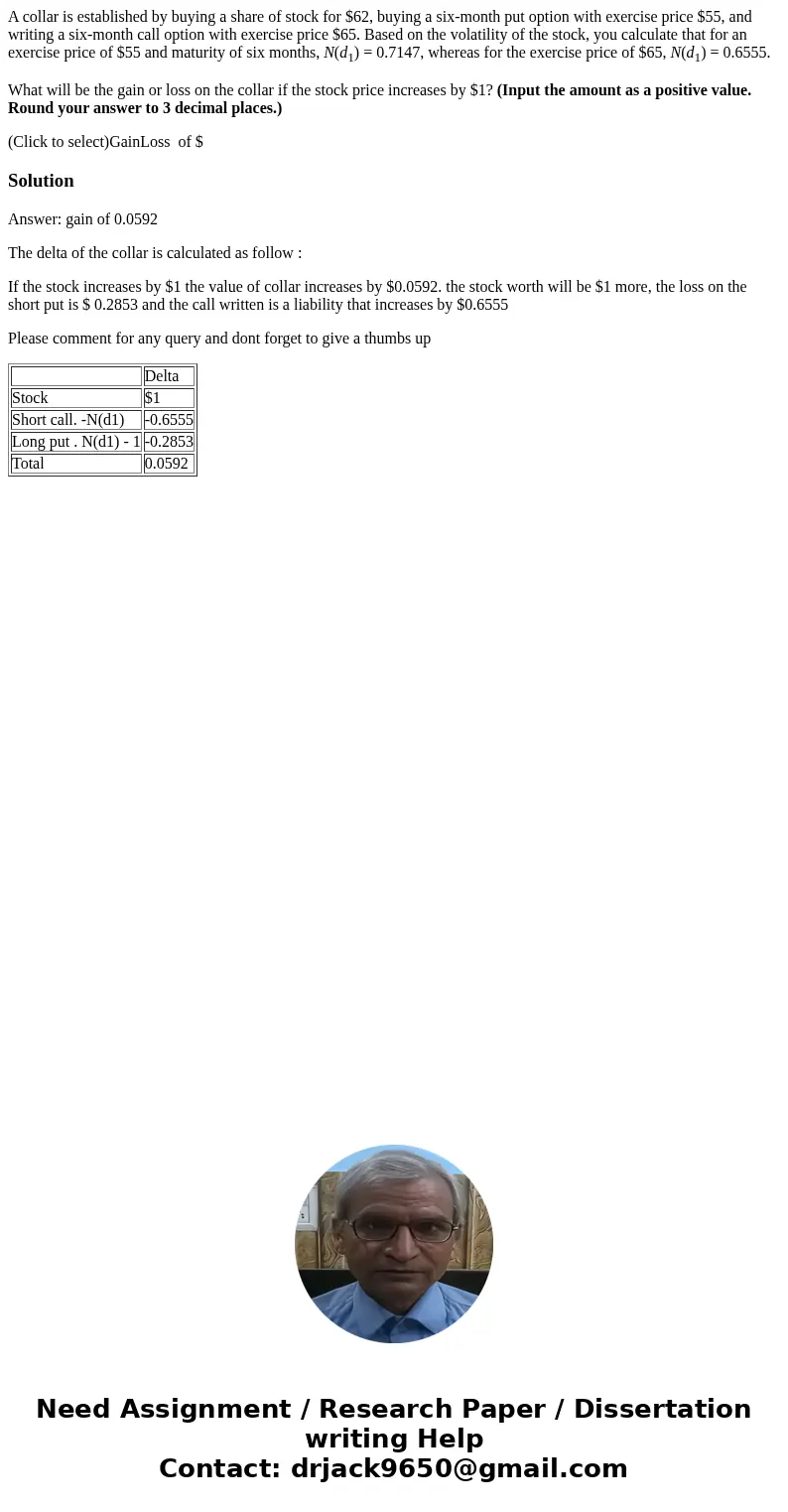

The delta of the collar is calculated as follow :

If the stock increases by $1 the value of collar increases by $0.0592. the stock worth will be $1 more, the loss on the short put is $ 0.2853 and the call written is a liability that increases by $0.6555

Please comment for any query and dont forget to give a thumbs up

| Delta | |

| Stock | $1 |

| Short call. -N(d1) | -0.6555 |

| Long put . N(d1) - 1 | -0.2853 |

| Total | 0.0592 |

Homework Sourse

Homework Sourse