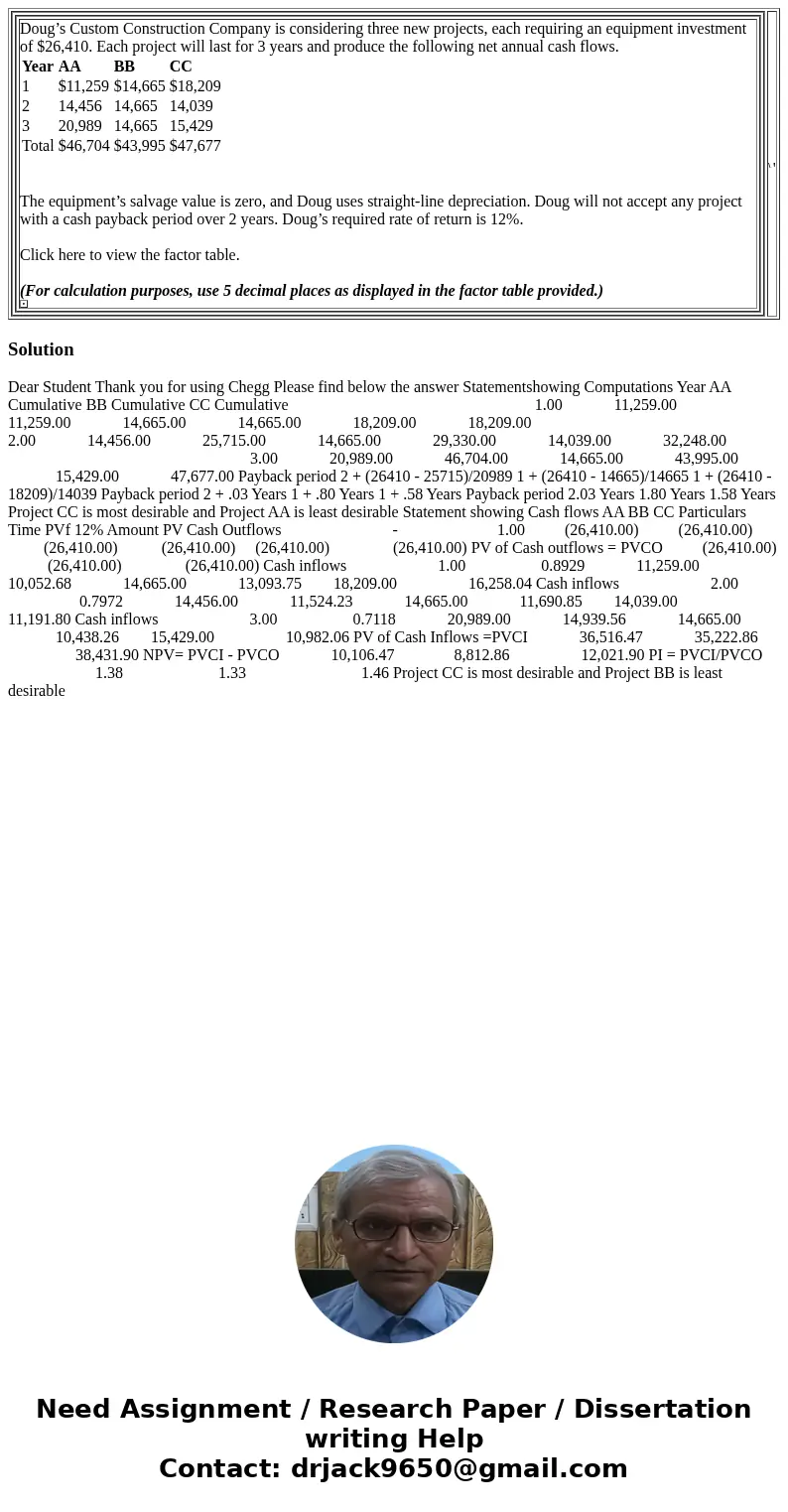

Doug’s Custom Construction Company is considering three new projects, each requiring an equipment investment of $26,410. Each project will last for 3 years and produce the following net annual cash flows.

| Year | | AA | | BB | | CC | | | 1 | | $11,259 | | $14,665 | | $18,209 | | | 2 | | 14,456 | | 14,665 | | 14,039 | | | 3 | | 20,989 | | 14,665 | | 15,429 | | | Total | | $46,704 | | $43,995 | | $47,677 | |

The equipment’s salvage value is zero, and Doug uses straight-line depreciation. Doug will not accept any project with a cash payback period over 2 years. Doug’s required rate of return is 12%.

Click here to view the factor table.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.) | | |  |

Dear Student Thank you for using Chegg Please find below the answer Statementshowing Computations Year AA Cumulative BB Cumulative CC Cumulative 1.00 11,259.00 11,259.00 14,665.00 14,665.00 18,209.00 18,209.00 2.00 14,456.00 25,715.00 14,665.00 29,330.00 14,039.00 32,248.00 3.00 20,989.00 46,704.00 14,665.00 43,995.00 15,429.00 47,677.00 Payback period 2 + (26410 - 25715)/20989 1 + (26410 - 14665)/14665 1 + (26410 - 18209)/14039 Payback period 2 + .03 Years 1 + .80 Years 1 + .58 Years Payback period 2.03 Years 1.80 Years 1.58 Years Project CC is most desirable and Project AA is least desirable Statement showing Cash flows AA BB CC Particulars Time PVf 12% Amount PV Cash Outflows - 1.00 (26,410.00) (26,410.00) (26,410.00) (26,410.00) (26,410.00) (26,410.00) PV of Cash outflows = PVCO (26,410.00) (26,410.00) (26,410.00) Cash inflows 1.00 0.8929 11,259.00 10,052.68 14,665.00 13,093.75 18,209.00 16,258.04 Cash inflows 2.00 0.7972 14,456.00 11,524.23 14,665.00 11,690.85 14,039.00 11,191.80 Cash inflows 3.00 0.7118 20,989.00 14,939.56 14,665.00 10,438.26 15,429.00 10,982.06 PV of Cash Inflows =PVCI 36,516.47 35,222.86 38,431.90 NPV= PVCI - PVCO 10,106.47 8,812.86 12,021.90 PI = PVCI/PVCO 1.38 1.33 1.46 Project CC is most desirable and Project BB is least desirable

Homework Sourse

Homework Sourse