Stbinning ostng system and applies overhead costs to jobs on

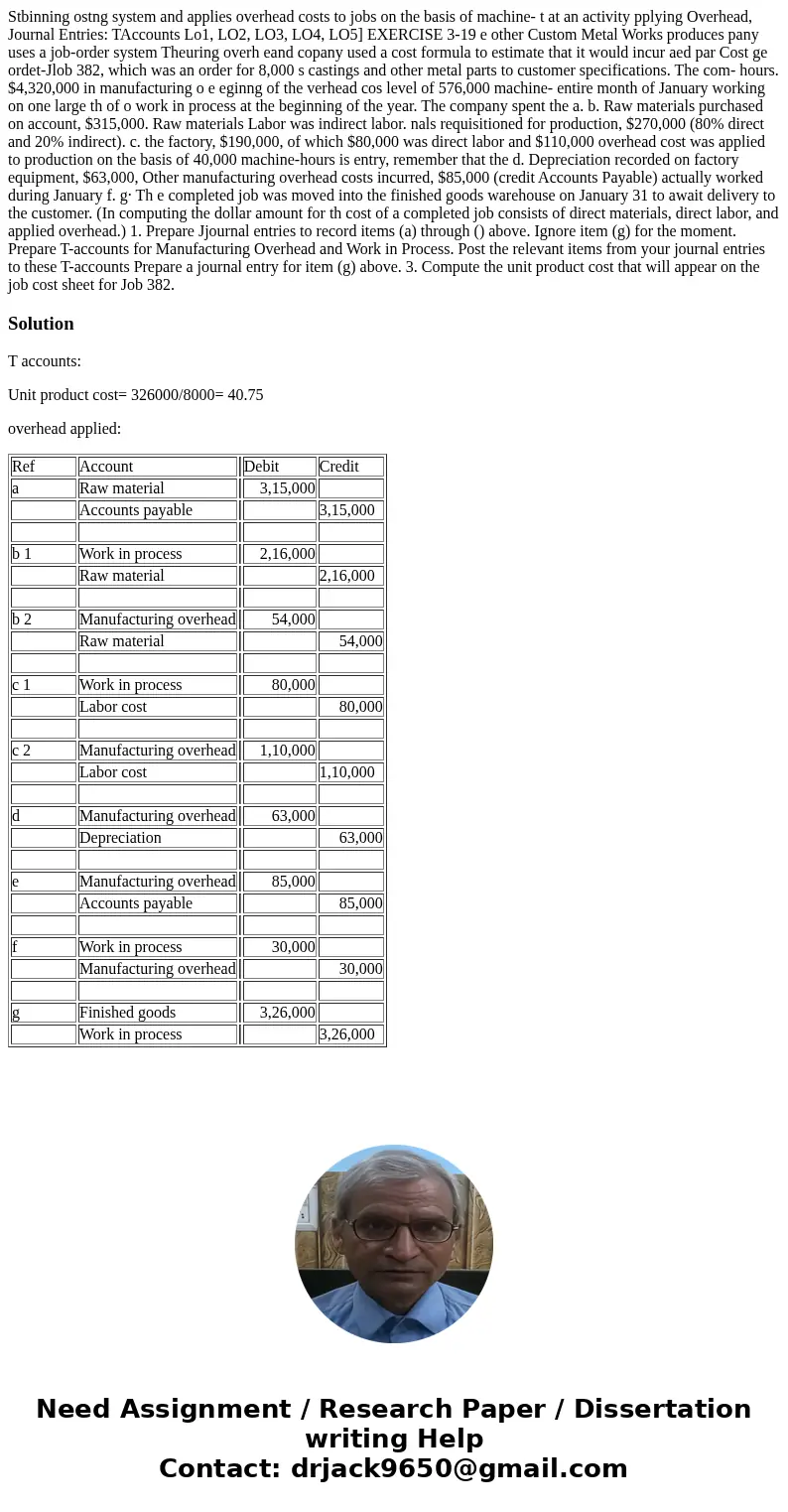

Stbinning ostng system and applies overhead costs to jobs on the basis of machine- t at an activity pplying Overhead, Journal Entries: TAccounts Lo1, LO2, LO3, LO4, LO5] EXERCISE 3-19 e other Custom Metal Works produces pany uses a job-order system Theuring overh eand copany used a cost formula to estimate that it would incur aed par Cost ge ordet-Jlob 382, which was an order for 8,000 s castings and other metal parts to customer specifications. The com- hours. $4,320,000 in manufacturing o e eginng of the verhead cos level of 576,000 machine- entire month of January working on one large th of o work in process at the beginning of the year. The company spent the a. b. Raw materials purchased on account, $315,000. Raw materials Labor was indirect labor. nals requisitioned for production, $270,000 (80% direct and 20% indirect). c. the factory, $190,000, of which $80,000 was direct labor and $110,000 overhead cost was applied to production on the basis of 40,000 machine-hours is entry, remember that the d. Depreciation recorded on factory equipment, $63,000, Other manufacturing overhead costs incurred, $85,000 (credit Accounts Payable) actually worked during January f. g· Th e completed job was moved into the finished goods warehouse on January 31 to await delivery to the customer. (In computing the dollar amount for th cost of a completed job consists of direct materials, direct labor, and applied overhead.) 1. Prepare Jjournal entries to record items (a) through () above. Ignore item (g) for the moment. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant items from your journal entries to these T-accounts Prepare a journal entry for item (g) above. 3. Compute the unit product cost that will appear on the job cost sheet for Job 382.

Solution

T accounts:

Unit product cost= 326000/8000= 40.75

overhead applied:

| Ref | Account | Debit | Credit | |

| a | Raw material | 3,15,000 | ||

| Accounts payable | 3,15,000 | |||

| b 1 | Work in process | 2,16,000 | ||

| Raw material | 2,16,000 | |||

| b 2 | Manufacturing overhead | 54,000 | ||

| Raw material | 54,000 | |||

| c 1 | Work in process | 80,000 | ||

| Labor cost | 80,000 | |||

| c 2 | Manufacturing overhead | 1,10,000 | ||

| Labor cost | 1,10,000 | |||

| d | Manufacturing overhead | 63,000 | ||

| Depreciation | 63,000 | |||

| e | Manufacturing overhead | 85,000 | ||

| Accounts payable | 85,000 | |||

| f | Work in process | 30,000 | ||

| Manufacturing overhead | 30,000 | |||

| g | Finished goods | 3,26,000 | ||

| Work in process | 3,26,000 |

Homework Sourse

Homework Sourse