2 Mason Company makes sales on which an 6 sales tax is asses

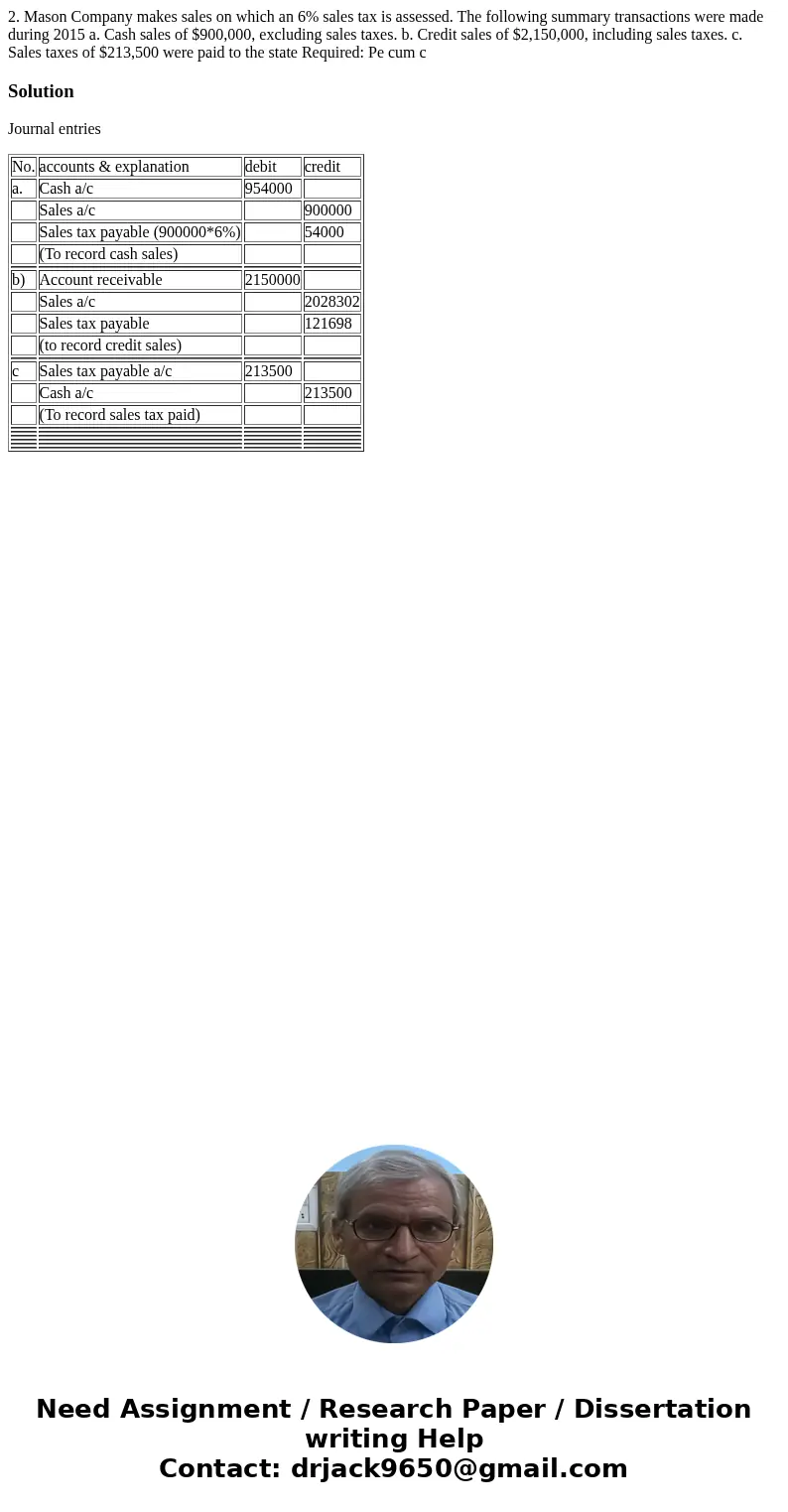

2. Mason Company makes sales on which an 6% sales tax is assessed. The following summary transactions were made during 2015 a. Cash sales of $900,000, excluding sales taxes. b. Credit sales of $2,150,000, including sales taxes. c. Sales taxes of $213,500 were paid to the state Required: Pe cum c

Solution

Journal entries

| No. | accounts & explanation | debit | credit |

| a. | Cash a/c | 954000 | |

| Sales a/c | 900000 | ||

| Sales tax payable (900000*6%) | 54000 | ||

| (To record cash sales) | |||

| b) | Account receivable | 2150000 | |

| Sales a/c | 2028302 | ||

| Sales tax payable | 121698 | ||

| (to record credit sales) | |||

| c | Sales tax payable a/c | 213500 | |

| Cash a/c | 213500 | ||

| (To record sales tax paid) | |||

Homework Sourse

Homework Sourse