la eBook Dividends Per Share Michelangelo Inc a software dev

Solution

Answer

As we know that the Preferred Stock is cumulative, so if a company is nt able to pay dividend to Preference Shareholders than there dividend will be collected i.e. Carry forward and will be paid in future (i.e. Old and New ).

Preference Dividend per year = 1% * (10,000 shares * $25)

Preference Dividend = $2,500 per year

Dividend Per share = Dividend Paid / No. of Shares

1st Year

2nd Year

3rd Year

4th Year

Preference Dividend Due

2,500

4,000(1500 Last Year + 2500 Current Year)

5,200 (2700 Last Year + 2500 Current Year

2,500

Preferred Dividend Paid

1,000

1,300

5,200

2,500

Preferred Stock (Dividend Per share)

$0.10

($1,000/10,000)

$0.13

($1,300/10,000)

$0.52

($5,200/10,000)

$0.25

($2,500/10,000)

Common Share Dividend

-

-

10,790

(15990 - 5,200)

36,660

(39160 -2,500)

Common Stock (Dividend Per share)

-

-

$0.83

($10,790 /13,000)

$2.82

($36,660/13,000)

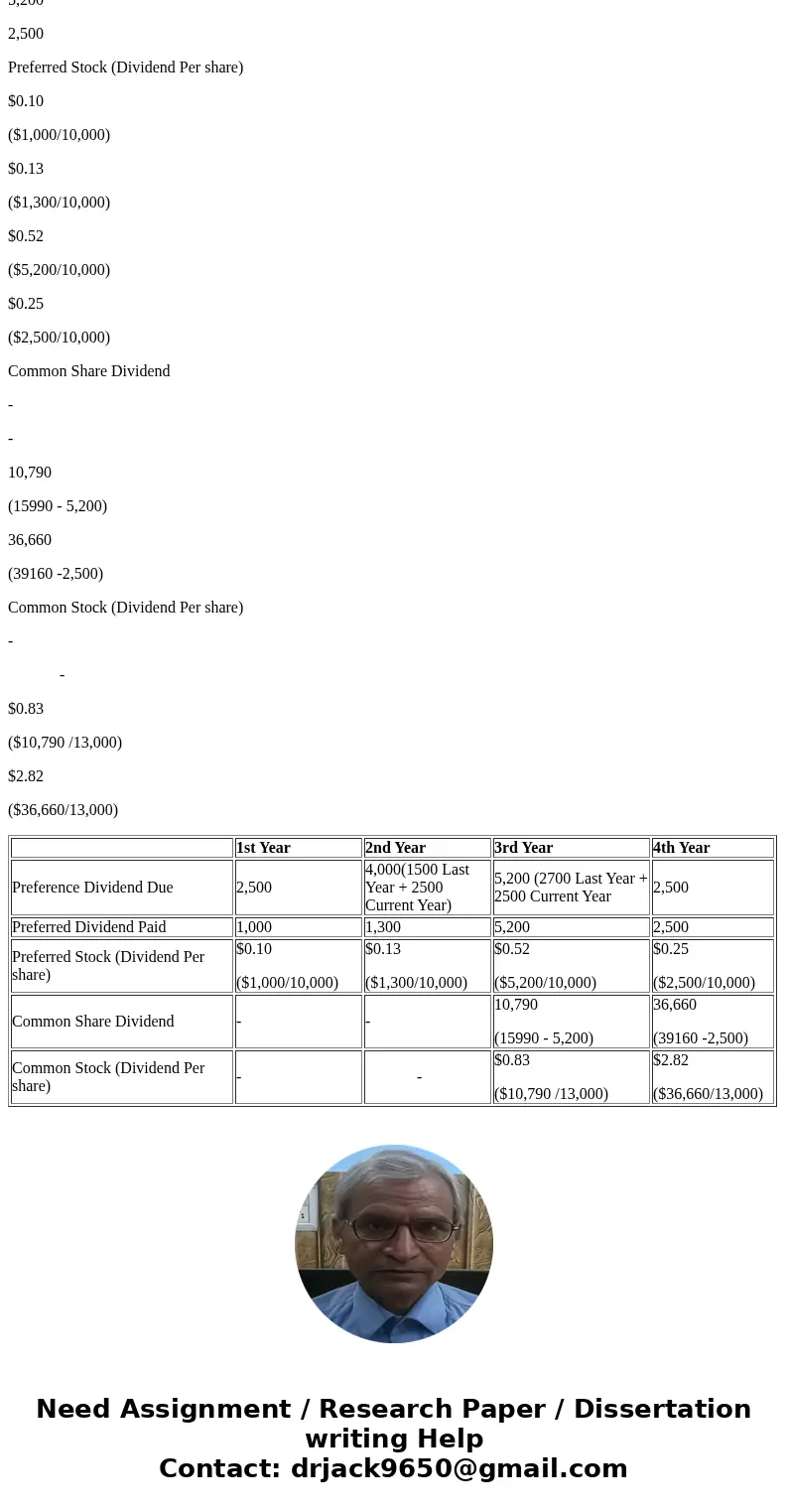

| 1st Year | 2nd Year | 3rd Year | 4th Year | |

| Preference Dividend Due | 2,500 | 4,000(1500 Last Year + 2500 Current Year) | 5,200 (2700 Last Year + 2500 Current Year | 2,500 |

| Preferred Dividend Paid | 1,000 | 1,300 | 5,200 | 2,500 |

| Preferred Stock (Dividend Per share) | $0.10 ($1,000/10,000) | $0.13 ($1,300/10,000) | $0.52 ($5,200/10,000) | $0.25 ($2,500/10,000) |

| Common Share Dividend | - | - | 10,790 (15990 - 5,200) | 36,660 (39160 -2,500) |

| Common Stock (Dividend Per share) | - | - | $0.83 ($10,790 /13,000) | $2.82 ($36,660/13,000) |

Homework Sourse

Homework Sourse