2 Car loan 1 or 2 sheets A sheet with explanations of your t

Solution

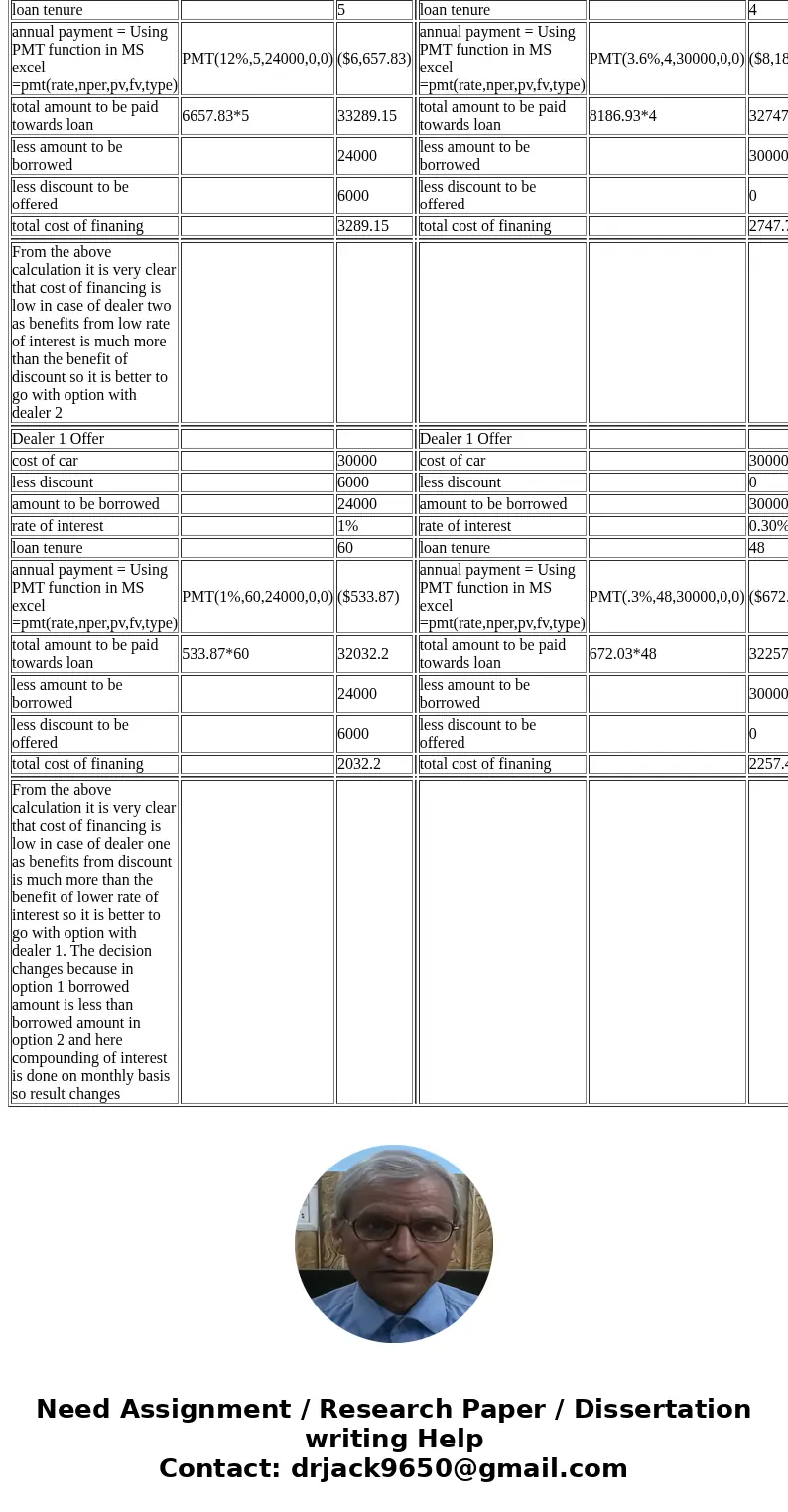

Dealer 1 Offer

Dealer 1 Offer

cost of car

30000

cost of car

30000

less discount

6000

less discount

0

amount to be borrowed

24000

amount to be borrowed

30000

rate of interest

12%

rate of interest

3.60%

loan tenure

5

loan tenure

4

annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type)

PMT(12%,5,24000,0,0)

($6,657.83)

annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type)

PMT(3.6%,4,30000,0,0)

($8,186.93)

total amount to be paid towards loan

6657.83*5

33289.15

total amount to be paid towards loan

8186.93*4

32747.72

less amount to be borrowed

24000

less amount to be borrowed

30000

less discount to be offered

6000

less discount to be offered

0

total cost of finaning

3289.15

total cost of finaning

2747.72

From the above calculation it is very clear that cost of financing is low in case of dealer two as benefits from low rate of interest is much more than the benefit of discount so it is better to go with option with dealer 2

Dealer 1 Offer

Dealer 1 Offer

cost of car

30000

cost of car

30000

less discount

6000

less discount

0

amount to be borrowed

24000

amount to be borrowed

30000

rate of interest

1%

rate of interest

0.30%

loan tenure

60

loan tenure

48

annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type)

PMT(1%,60,24000,0,0)

($533.87)

annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type)

PMT(.3%,48,30000,0,0)

($672.02)

total amount to be paid towards loan

533.87*60

32032.2

total amount to be paid towards loan

672.03*48

32257.44

less amount to be borrowed

24000

less amount to be borrowed

30000

less discount to be offered

6000

less discount to be offered

0

total cost of finaning

2032.2

total cost of finaning

2257.44

From the above calculation it is very clear that cost of financing is low in case of dealer one as benefits from discount is much more than the benefit of lower rate of interest so it is better to go with option with dealer 1. The decision changes because in option 1 borrowed amount is less than borrowed amount in option 2 and here compounding of interest is done on monthly basis so result changes

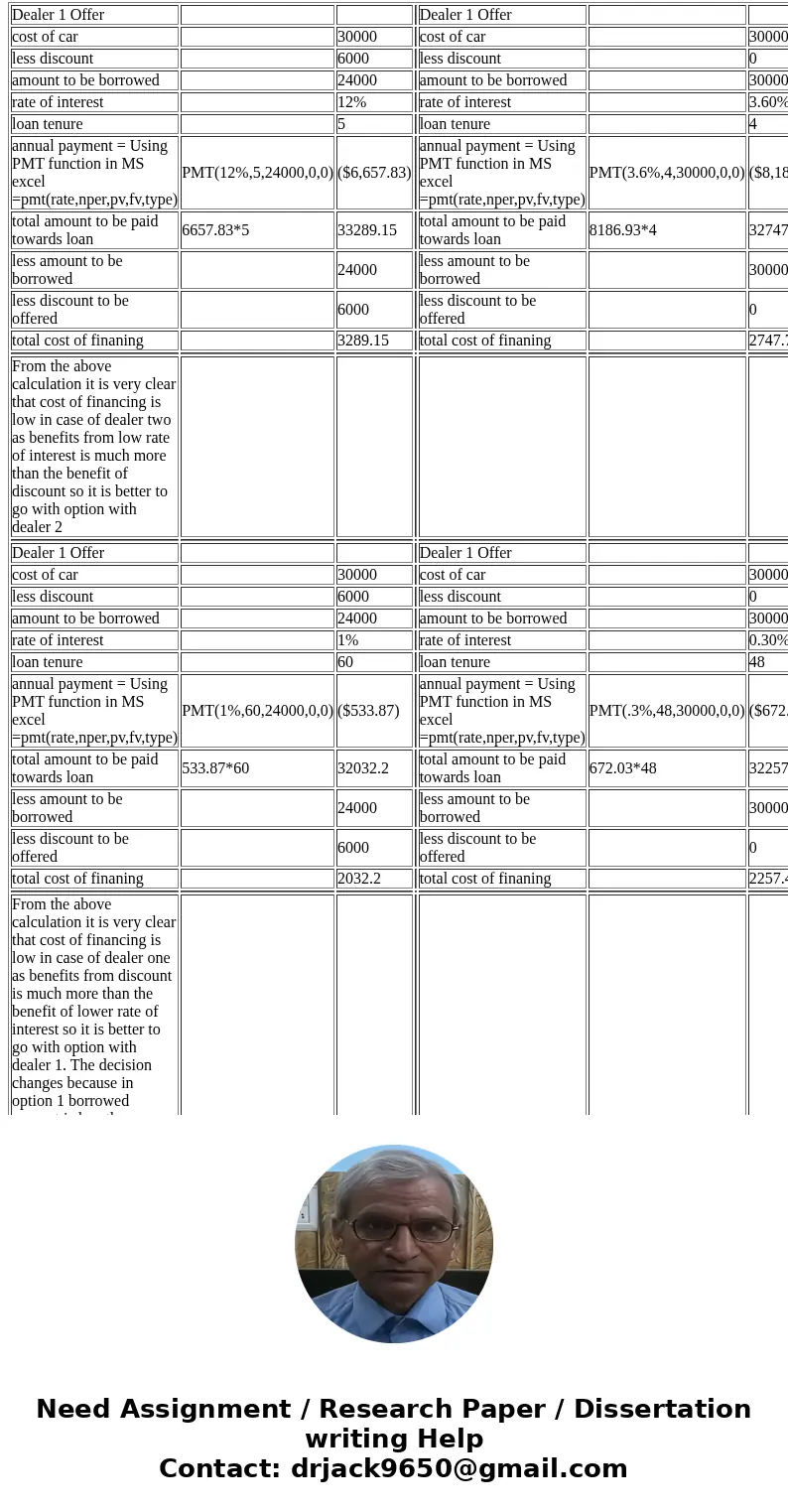

| Dealer 1 Offer | Dealer 1 Offer | |||||

| cost of car | 30000 | cost of car | 30000 | |||

| less discount | 6000 | less discount | 0 | |||

| amount to be borrowed | 24000 | amount to be borrowed | 30000 | |||

| rate of interest | 12% | rate of interest | 3.60% | |||

| loan tenure | 5 | loan tenure | 4 | |||

| annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type) | PMT(12%,5,24000,0,0) | ($6,657.83) | annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type) | PMT(3.6%,4,30000,0,0) | ($8,186.93) | |

| total amount to be paid towards loan | 6657.83*5 | 33289.15 | total amount to be paid towards loan | 8186.93*4 | 32747.72 | |

| less amount to be borrowed | 24000 | less amount to be borrowed | 30000 | |||

| less discount to be offered | 6000 | less discount to be offered | 0 | |||

| total cost of finaning | 3289.15 | total cost of finaning | 2747.72 | |||

| From the above calculation it is very clear that cost of financing is low in case of dealer two as benefits from low rate of interest is much more than the benefit of discount so it is better to go with option with dealer 2 | ||||||

| Dealer 1 Offer | Dealer 1 Offer | |||||

| cost of car | 30000 | cost of car | 30000 | |||

| less discount | 6000 | less discount | 0 | |||

| amount to be borrowed | 24000 | amount to be borrowed | 30000 | |||

| rate of interest | 1% | rate of interest | 0.30% | |||

| loan tenure | 60 | loan tenure | 48 | |||

| annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type) | PMT(1%,60,24000,0,0) | ($533.87) | annual payment = Using PMT function in MS excel =pmt(rate,nper,pv,fv,type) | PMT(.3%,48,30000,0,0) | ($672.02) | |

| total amount to be paid towards loan | 533.87*60 | 32032.2 | total amount to be paid towards loan | 672.03*48 | 32257.44 | |

| less amount to be borrowed | 24000 | less amount to be borrowed | 30000 | |||

| less discount to be offered | 6000 | less discount to be offered | 0 | |||

| total cost of finaning | 2032.2 | total cost of finaning | 2257.44 | |||

| From the above calculation it is very clear that cost of financing is low in case of dealer one as benefits from discount is much more than the benefit of lower rate of interest so it is better to go with option with dealer 1. The decision changes because in option 1 borrowed amount is less than borrowed amount in option 2 and here compounding of interest is done on monthly basis so result changes |

Homework Sourse

Homework Sourse