11 Education Tax Credit Obi 2 In 2016 Paul and Karen Mitchel

11. Education Tax Credit. (Obi. 2) In 2016, Paul and Karen Mitchell pay $12,000 for their daughter\'s tuition for the Spring and Fall semesters. Their daughter is a full-time graduate student. The Mitchells also paid 33.800 for their son\'s tuition for the Spring and Fall semesters n the Fall of 2016, their son, Ron began his sophomore year of college. The son atten college full-time. 3,340- Compute the Mitchells\' 2016 education tax credit if their AGI is $121,600. How much of their credit is refundable versus nonrefundable? a. b. Same as in Part a., except that the Mitchells\' AGI is $174,360. 159

Solution

Answer

(a) if AGI is $122600 than Mr Mitchells get $2000 per studend hence $4000 tax credit as refund and no deduction form AGI

(B) if AGI is $ 174360 than Mr Mitchells get nothing as tax credit as well as no deduction from AGI.

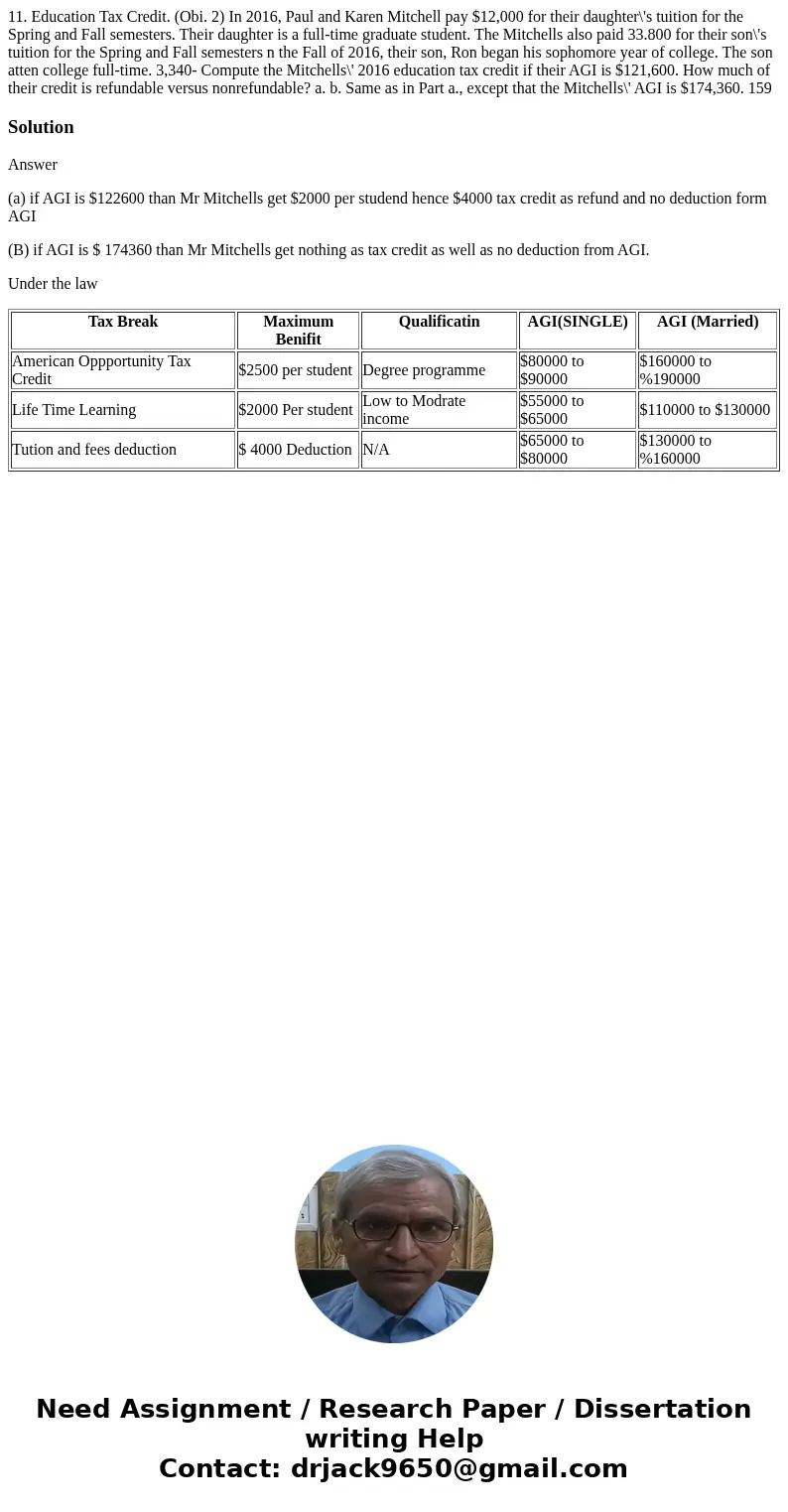

Under the law

| Tax Break | Maximum Benifit | Qualificatin | AGI(SINGLE) | AGI (Married) |

|---|---|---|---|---|

| American Oppportunity Tax Credit | $2500 per student | Degree programme | $80000 to $90000 | $160000 to %190000 |

| Life Time Learning | $2000 Per student | Low to Modrate income | $55000 to $65000 | $110000 to $130000 |

| Tution and fees deduction | $ 4000 Deduction | N/A | $65000 to $80000 | $130000 to %160000 |

Homework Sourse

Homework Sourse