The following transactions are July activities of Craigs Bow

The following transactions are July activities of Craig’s Bowling, Inc.

a. Craig’s collected $14,900 from customers for games played in July.

b. Craig\'s sold bowling merchandise inventory from its pro shop for $7,200; received $3,700 in cash and customers owed the rest on account. [The cost of goods sold (expense) related to these sales is $2,990.]

c. Craig’s received $2,000 from customers who purchased merchandise in June on account.

d. The men’s and ladies’ bowling leagues gave Craig’s a deposit of $3,000 for the upcoming fall season.

e. Craig’s paid $1,200 on the electricity bill for June (recorded as expense in June).

f. Craig’s paid $4,200 to employees for work in July.

g. Craig’s purchased $1,560 in insurance for coverage from July 1 to October 1. (Part is an expense for July and part is a prepaid expense to be used in future months.)

h. Craig’s paid $1,800 to plumbers for repairing a broken pipe in the restrooms.

i. Craig’s received the July electricity bill for $2,500 to be paid in August.

Prepare an income statement for Craig’s Bowling, Inc., for the month of July.

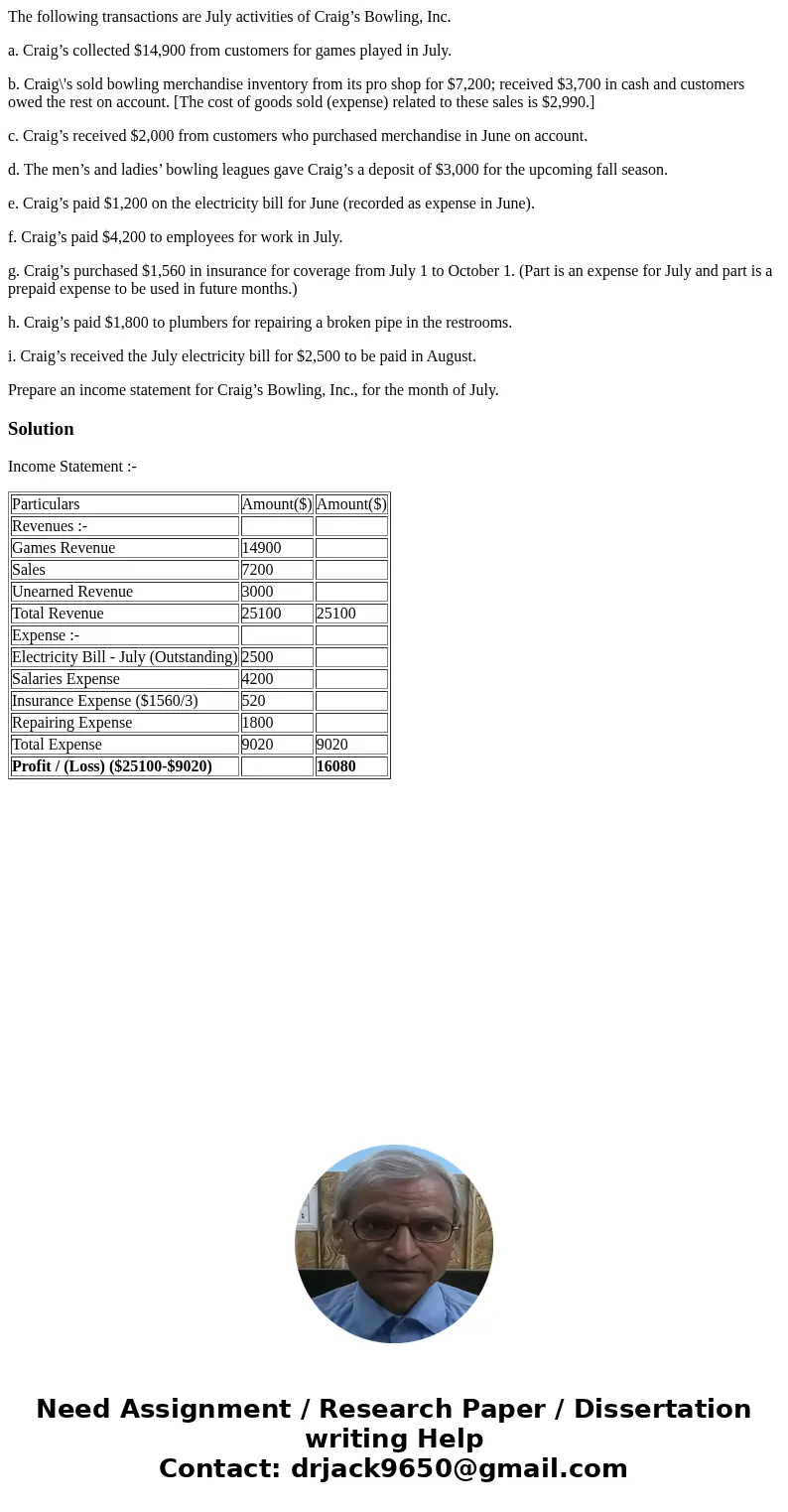

Solution

Income Statement :-

| Particulars | Amount($) | Amount($) |

| Revenues :- | ||

| Games Revenue | 14900 | |

| Sales | 7200 | |

| Unearned Revenue | 3000 | |

| Total Revenue | 25100 | 25100 |

| Expense :- | ||

| Electricity Bill - July (Outstanding) | 2500 | |

| Salaries Expense | 4200 | |

| Insurance Expense ($1560/3) | 520 | |

| Repairing Expense | 1800 | |

| Total Expense | 9020 | 9020 |

| Profit / (Loss) ($25100-$9020) | 16080 |

Homework Sourse

Homework Sourse