Hoppers Corp is in the business of making sports shoes Curre

Hoppers Corp is in the business of making sports shoes. Currently, they have two lines of shoes namely Supreme Hyper and Supreme Duper. Each pair of SH and SD retails at $110 and $80 respectively. A feasibility study costing $10 million shows that there is a huge market for a lower priced shoe. The firm is considering introducing a lower priced sport shoe, Supreme Jumper. Each pair of SJ will be priced at $50 year 1. Due to intense competition in the sports shoes business, Hoppers Corp. anticipates the price of the SJ shoe to decline by 10% per year after 1 until year 5. After 5 years, SJ shoe will go out of fashion. The projected sales volume (pairs of SJ) and other variables are presented below

Year

1

2

3

4

5

Sales Volume (pairs of SJ in million)

60

70

100

80

50

Variable cost per pair per year

$15

Fixed production cost per year ($million)

500

SG&A expenses ($million)

300

400

650

600

500

Reduction in sales volume (pairs in million) of SD

5

4

3

2

2

The introduction of SJ will reduce sales volume of SD as shown in the table. However, it will not affect the sales volume of SH. To manufacture SJ, Hoppers will buy specialized equipment at a cost of $200 million. For depreciation purposes, the equipment is a 7 year asset class. The applicable MACRS depreciation rates are as follows:

Year

1

2

3

4

5

6

7

8

Depreciation rate

0.1429

0.2449

0.1749

0.1249

0.0893

0.0892

0.0893

0.0446

Hoppers estimate that it will be able to sell the equipment at a price equal to 20% of the initial cost at the end of 5 years of production of SJ. The $200 million initial cost of the equipment will be financed as follows:

$100 million from internally-generated cash

$100 million from a 5 year, 5% APR amortized loan. Interest will be paid at the end of each year.

Currently, Hoppers own a building which it acquired 10 years ago at $50million. The building is leased out to other smaller businesses. Hoppers Corp. generates after-tax rental income of $15 per year. Last year, Hoppers gave its tenants a vacation notice so that it can convert the building into a manufacturing facility at a cost of $20 million. The building was recently appraised at $130 million.

Hoppers will $200 million immediate investment in net working capital (NWC). Thereafter. NWC will average 10% of gross sales revenue of SJ.

The marginal corporate tax rate is 30% and is expected to remain fairly constant for the next 5 years. The firm pays 50% of net income as common dividends.

Required

Depreciation per year for the equipment and the after tax salvage of the equipment

Changes in net working capital (NWC) per year and the amount of NWC recovered at the end of the projects life

Projected income statement for year 1 through 5

Projected cash flow from assets (CFA) or free cash flows (FCF) for years 0 through 5

The amount of Cash Flows to Debt Holders (CFD), clearly showing the interest and the principal

Cash Flows to Shareholders (CFS)

| Year | 1 | 2 | 3 | 4 | 5 | |

| Sales Volume (pairs of SJ in million) | 60 | 70 | 100 | 80 | 50 | |

| Variable cost per pair per year | $15 | |||||

| Fixed production cost per year ($million) | 500 | |||||

| SG&A expenses ($million) | 300 | 400 | 650 | 600 | 500 | |

| Reduction in sales volume (pairs in million) of SD | 5 | 4 | 3 | 2 | 2 |

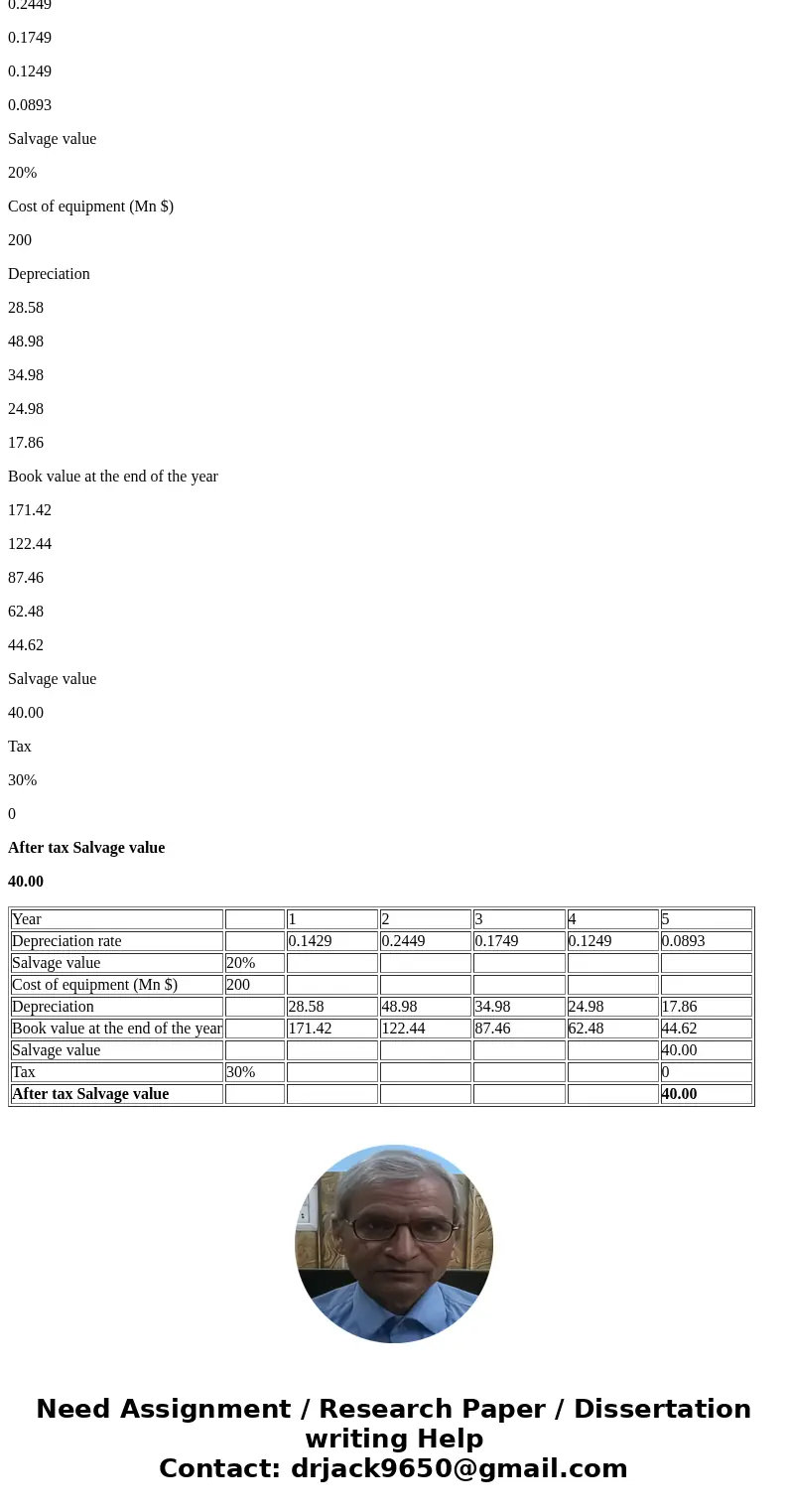

Solution

Year

1

2

3

4

5

Depreciation rate

0.1429

0.2449

0.1749

0.1249

0.0893

Salvage value

20%

Cost of equipment (Mn $)

200

Depreciation

28.58

48.98

34.98

24.98

17.86

Book value at the end of the year

171.42

122.44

87.46

62.48

44.62

Salvage value

40.00

Tax

30%

0

After tax Salvage value

40.00

| Year | 1 | 2 | 3 | 4 | 5 | |

| Depreciation rate | 0.1429 | 0.2449 | 0.1749 | 0.1249 | 0.0893 | |

| Salvage value | 20% | |||||

| Cost of equipment (Mn $) | 200 | |||||

| Depreciation | 28.58 | 48.98 | 34.98 | 24.98 | 17.86 | |

| Book value at the end of the year | 171.42 | 122.44 | 87.46 | 62.48 | 44.62 | |

| Salvage value | 40.00 | |||||

| Tax | 30% | 0 | ||||

| After tax Salvage value | 40.00 |

Homework Sourse

Homework Sourse