Halford Corporation expects to have earnings this coming yea

Halford Corporation expects to have earnings this coming year of $2.892 per share. Halliford plans to retain all of its earnings for the next two years. Then, for the subsequent two years, the firm w I retain 49% of its earnings. It will retain 19% of its earnings from that point onward. Each year, retained earnings ill be invested in new projects with an expected return o 22.9% per year. Any earnings that are not retained will be paid out as di dends. Assume Hall ford\'s share count remains constant and all eamings growth comes om he investment o retained earnings f Ha d\'s equity cost o capital is 8.9%, what price would you estimate for Halliford stock? The stock price will be $ (Round to the nearest cent.)

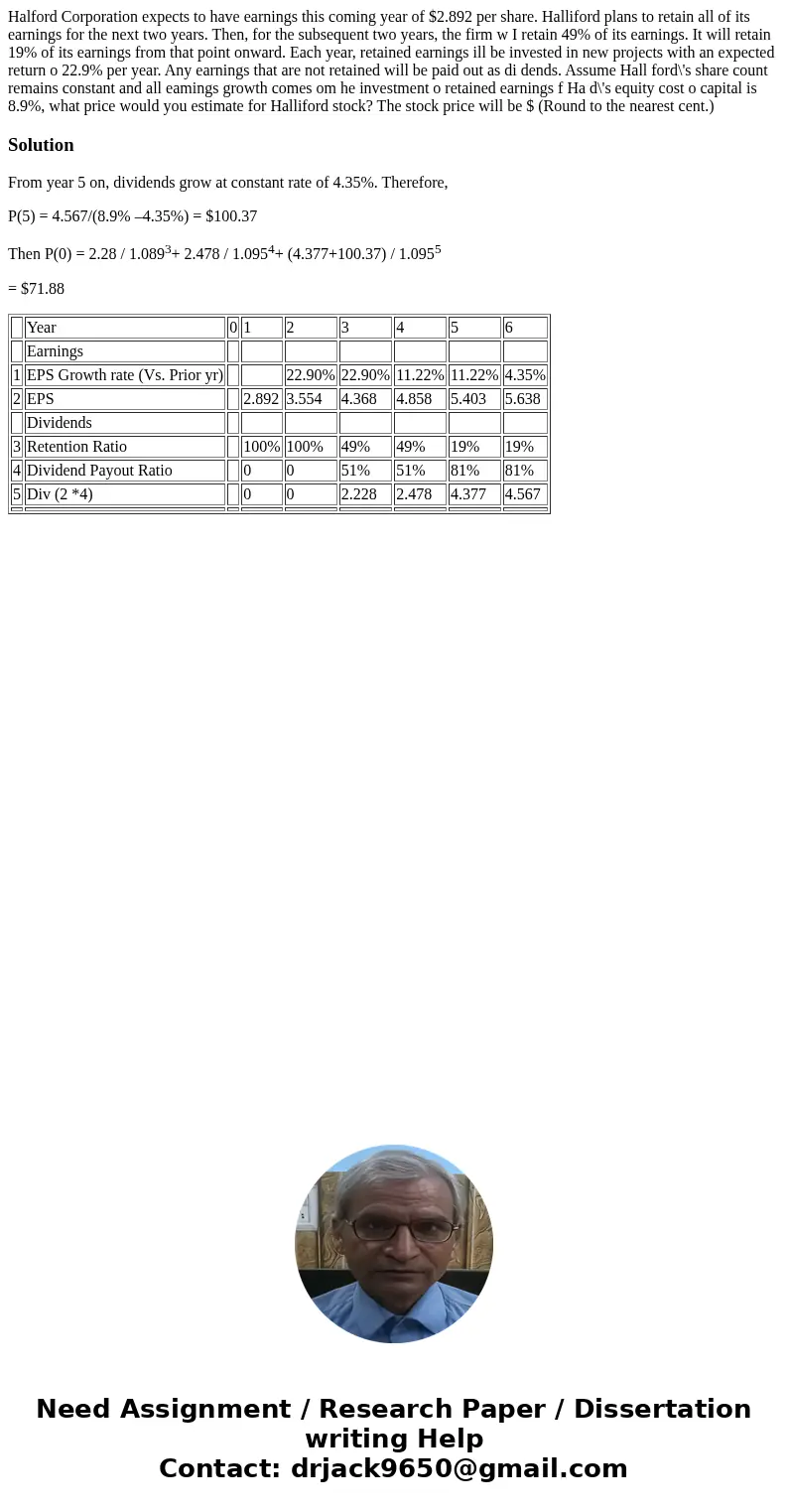

Solution

From year 5 on, dividends grow at constant rate of 4.35%. Therefore,

P(5) = 4.567/(8.9% –4.35%) = $100.37

Then P(0) = 2.28 / 1.0893+ 2.478 / 1.0954+ (4.377+100.37) / 1.0955

= $71.88

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | |

| Earnings | ||||||||

| 1 | EPS Growth rate (Vs. Prior yr) | 22.90% | 22.90% | 11.22% | 11.22% | 4.35% | ||

| 2 | EPS | 2.892 | 3.554 | 4.368 | 4.858 | 5.403 | 5.638 | |

| Dividends | ||||||||

| 3 | Retention Ratio | 100% | 100% | 49% | 49% | 19% | 19% | |

| 4 | Dividend Payout Ratio | 0 | 0 | 51% | 51% | 81% | 81% | |

| 5 | Div (2 *4) | 0 | 0 | 2.228 | 2.478 | 4.377 | 4.567 | |

Homework Sourse

Homework Sourse