Two alternatives have the following cash flows At a 5 intere

Two alternatives have the following cash flows: At a 5% interest rate, which alternative should be selected? Neither A or B A Both A and B |B

Solution

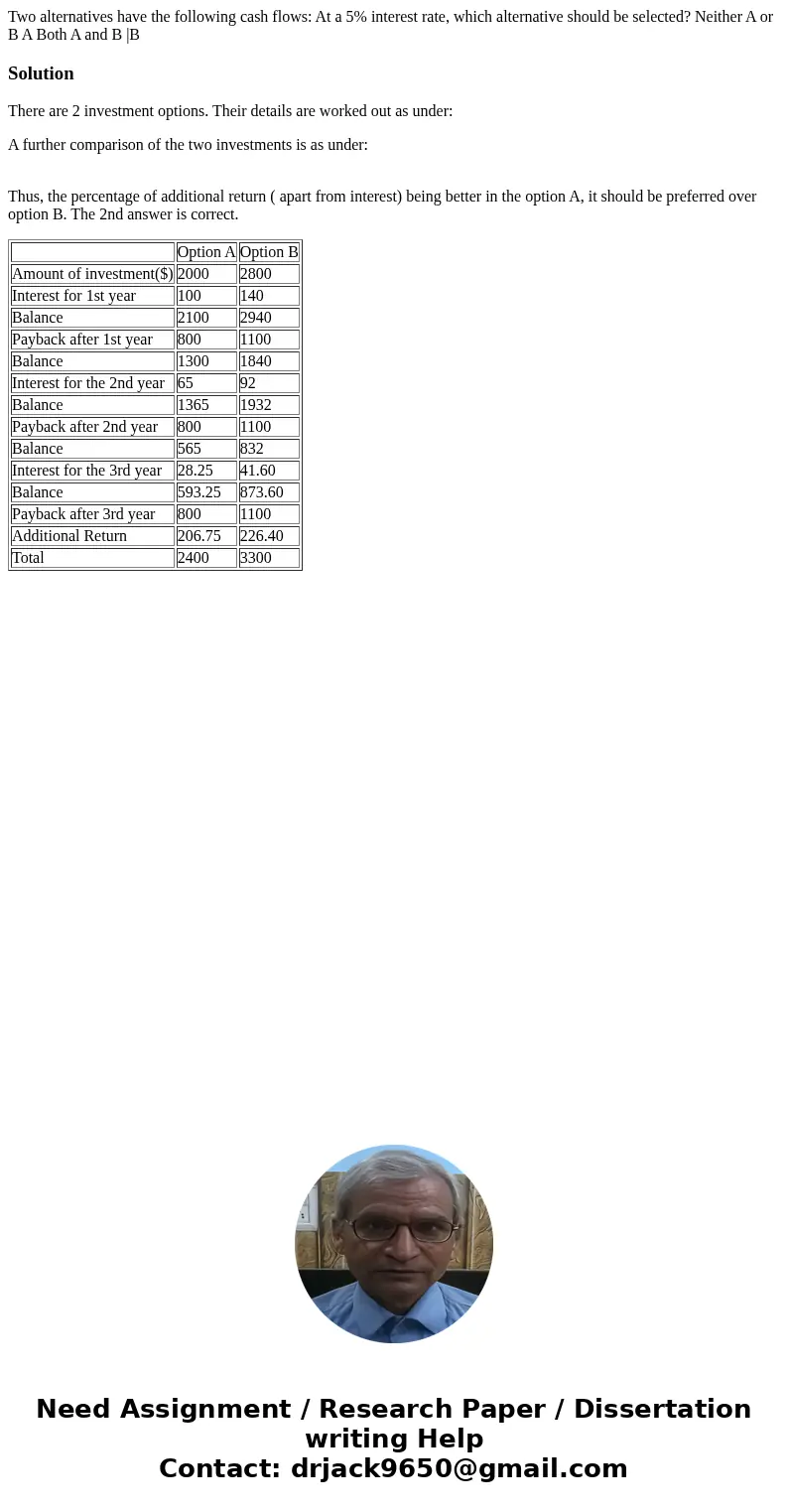

There are 2 investment options. Their details are worked out as under:

A further comparison of the two investments is as under:

Thus, the percentage of additional return ( apart from interest) being better in the option A, it should be preferred over option B. The 2nd answer is correct.

| Option A | Option B | |

| Amount of investment($) | 2000 | 2800 |

| Interest for 1st year | 100 | 140 |

| Balance | 2100 | 2940 |

| Payback after 1st year | 800 | 1100 |

| Balance | 1300 | 1840 |

| Interest for the 2nd year | 65 | 92 |

| Balance | 1365 | 1932 |

| Payback after 2nd year | 800 | 1100 |

| Balance | 565 | 832 |

| Interest for the 3rd year | 28.25 | 41.60 |

| Balance | 593.25 | 873.60 |

| Payback after 3rd year | 800 | 1100 |

| Additional Return | 206.75 | 226.40 |

| Total | 2400 | 3300 |

Homework Sourse

Homework Sourse