Selected account balances before adjustment for Alantic Coas

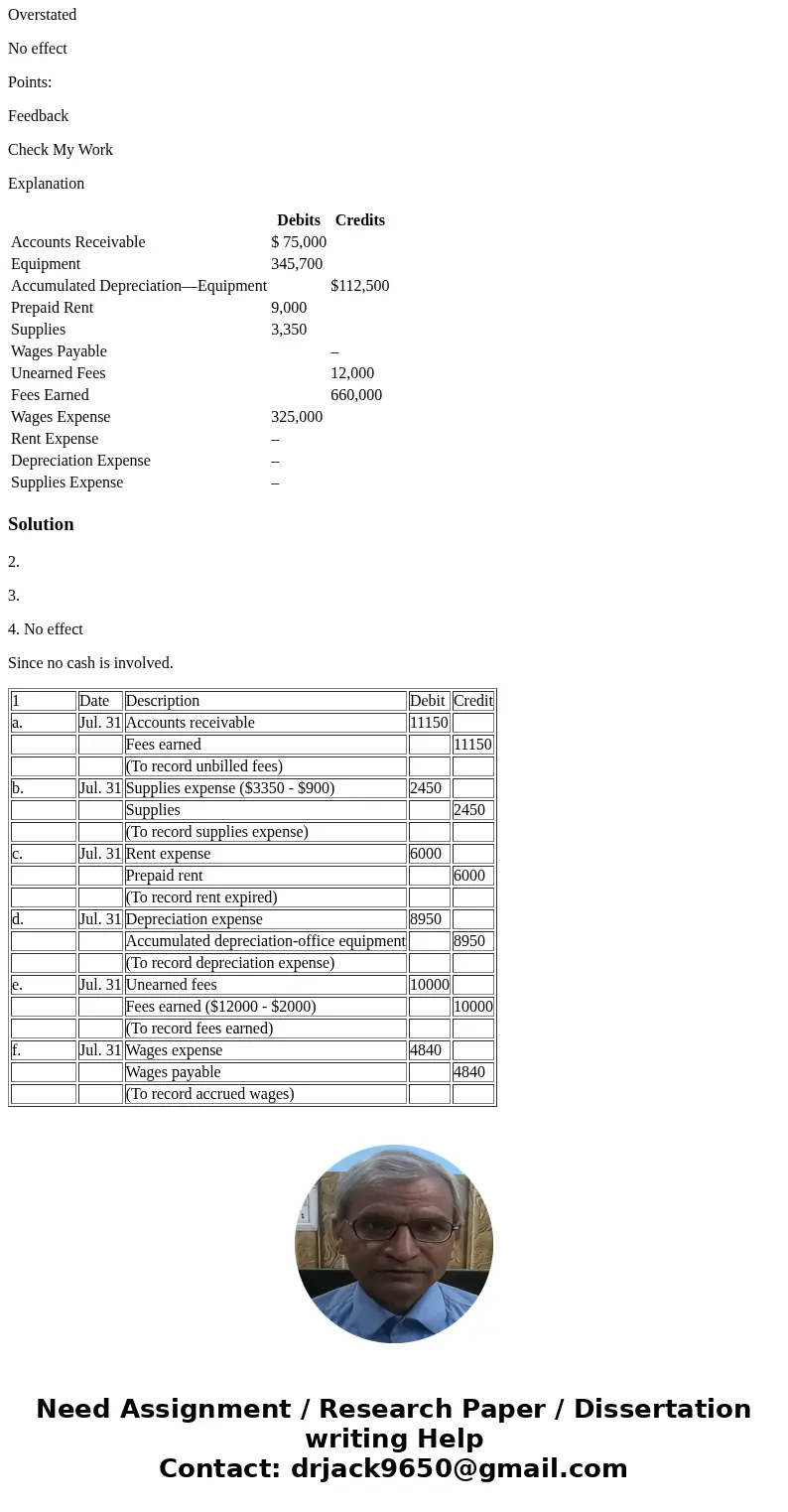

Selected account balances before adjustment for Alantic Coast Realty at July 31, 2016, the end of the current year, are as follows:

Debits

Credits

Data needed for year-end adjustments are as follows:

The systematic periodic transfer of the cost of a fixed asset to an expense account during its expected useful life.

none

X

Chart of Accounts

none

X

Journal

1. Journalize the six adjusting entries required at July 31, based on the data presented. Refer to the Chart of Accounts for exact wording of account titles.

PAGE 10

JOURNAL

1

Adjusting Entries

2

3

4

5

6

7

8

9

10

11

12

13

Solution

1

Adjusting Entries

2

3

4

5

6

7

8

9

10

11

12

13

Points:

Feedback

Check My Work

Explanation

none

X

Final Questions

2. What would be the effect on the income statement if adjustments (a) and (f) were omitted at the end of the year?

Over/Understated

Amount

Understated

Overstated

No effect

Understated

Overstated

No effect

Understated

Overstated

No effect

Points:

Feedback

Check My Work

Explanation

3. What would be the effect on the balance sheet if adjustments (a) and (f) were omitted at the end of the year?

Over/Understated

Amount

Understated

Overstated

No effect

Understated

Overstated

No effect

Understated

Overstated

No effect

Understated

Overstated

No effect

Understated

Overstated

No effect

Understated

Overstated

No effect

Points:

Feedback

Check My Work

Explanation

4. What would be the effect on the “Net increase or decrease in cash” on the statement of cash flows if adjustments (a) and (f) were omitted at the end of the year? selector 1

Understated

Overstated

No effect

Points:

Feedback

Check My Work

Explanation

| Debits | Credits | |

|---|---|---|

| Accounts Receivable | $ 75,000 | |

| Equipment | 345,700 | |

| Accumulated Depreciation—Equipment | $112,500 | |

| Prepaid Rent | 9,000 | |

| Supplies | 3,350 | |

| Wages Payable | – | |

| Unearned Fees | 12,000 | |

| Fees Earned | 660,000 | |

| Wages Expense | 325,000 | |

| Rent Expense | – | |

| Depreciation Expense | – | |

| Supplies Expense | – |

Solution

2.

3.

4. No effect

Since no cash is involved.

| 1 | Date | Description | Debit | Credit |

| a. | Jul. 31 | Accounts receivable | 11150 | |

| Fees earned | 11150 | |||

| (To record unbilled fees) | ||||

| b. | Jul. 31 | Supplies expense ($3350 - $900) | 2450 | |

| Supplies | 2450 | |||

| (To record supplies expense) | ||||

| c. | Jul. 31 | Rent expense | 6000 | |

| Prepaid rent | 6000 | |||

| (To record rent expired) | ||||

| d. | Jul. 31 | Depreciation expense | 8950 | |

| Accumulated depreciation-office equipment | 8950 | |||

| (To record depreciation expense) | ||||

| e. | Jul. 31 | Unearned fees | 10000 | |

| Fees earned ($12000 - $2000) | 10000 | |||

| (To record fees earned) | ||||

| f. | Jul. 31 | Wages expense | 4840 | |

| Wages payable | 4840 | |||

| (To record accrued wages) |

Homework Sourse

Homework Sourse