You are given the following information for Sookies Cookies

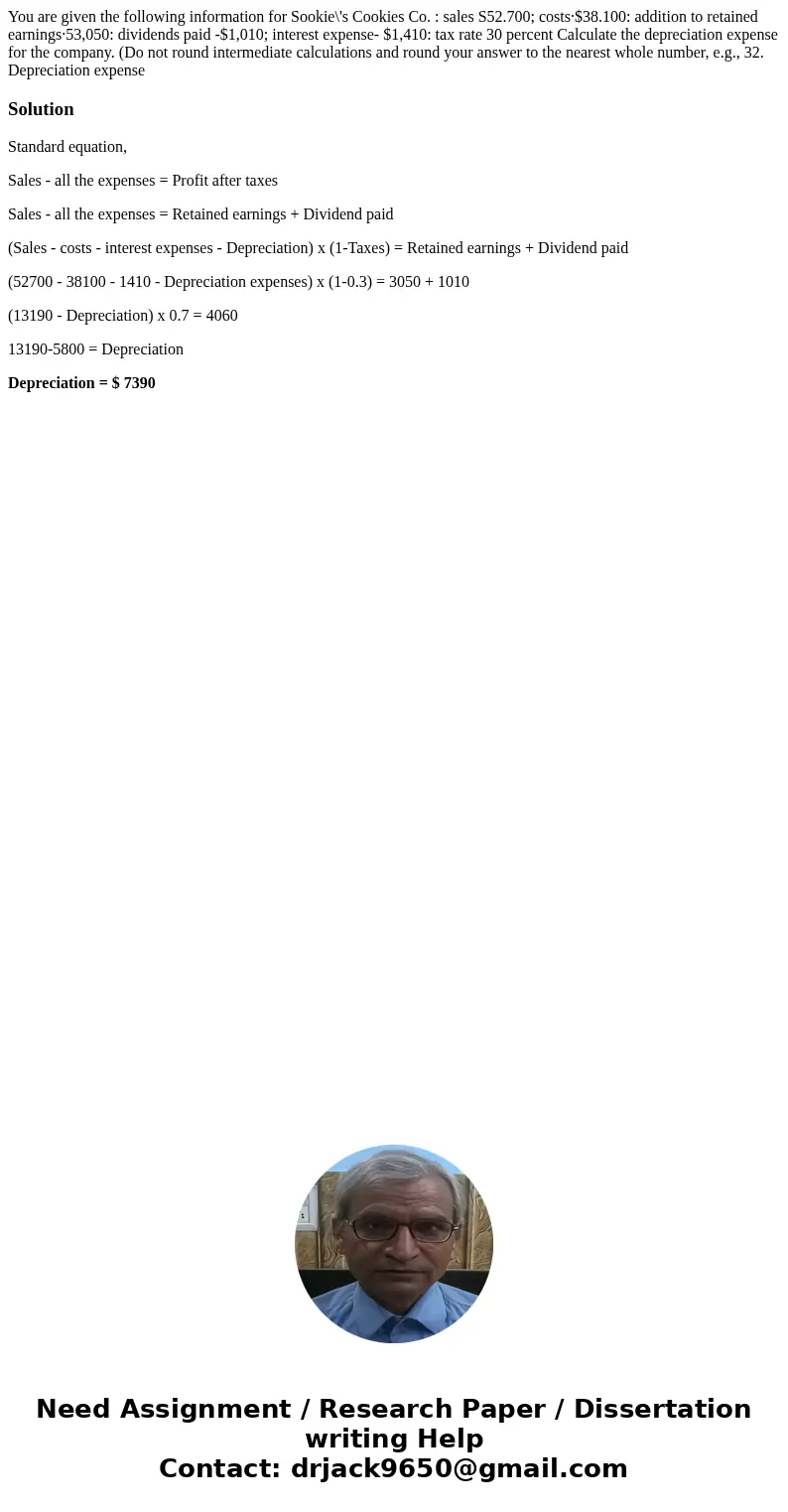

You are given the following information for Sookie\'s Cookies Co. : sales S52.700; costs·$38.100: addition to retained earnings·53,050: dividends paid -$1,010; interest expense- $1,410: tax rate 30 percent Calculate the depreciation expense for the company. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Depreciation expense

Solution

Standard equation,

Sales - all the expenses = Profit after taxes

Sales - all the expenses = Retained earnings + Dividend paid

(Sales - costs - interest expenses - Depreciation) x (1-Taxes) = Retained earnings + Dividend paid

(52700 - 38100 - 1410 - Depreciation expenses) x (1-0.3) = 3050 + 1010

(13190 - Depreciation) x 0.7 = 4060

13190-5800 = Depreciation

Depreciation = $ 7390

Homework Sourse

Homework Sourse