Machine A has 3year life with no salvage value Assume that t

Machine A has 3-year life with no salvage value. Assume that there were told that the service provided by these machines would be needed for only 5 years. Alternative A would have to be repurchased and kept for only 2 years. What would its salvage value have to be after the 2 years in order to make its annual worth the same as it is for its 3-year life cycle at an interest rate of 10% per year?

Year Alternative A, $ Alternative B, $

0 -10,000 -20,000

1 -7,000 -5,000

2 -7,000 -5,000

3 -7,000 -5,000

4 -5,000

5 -5,000

Solution

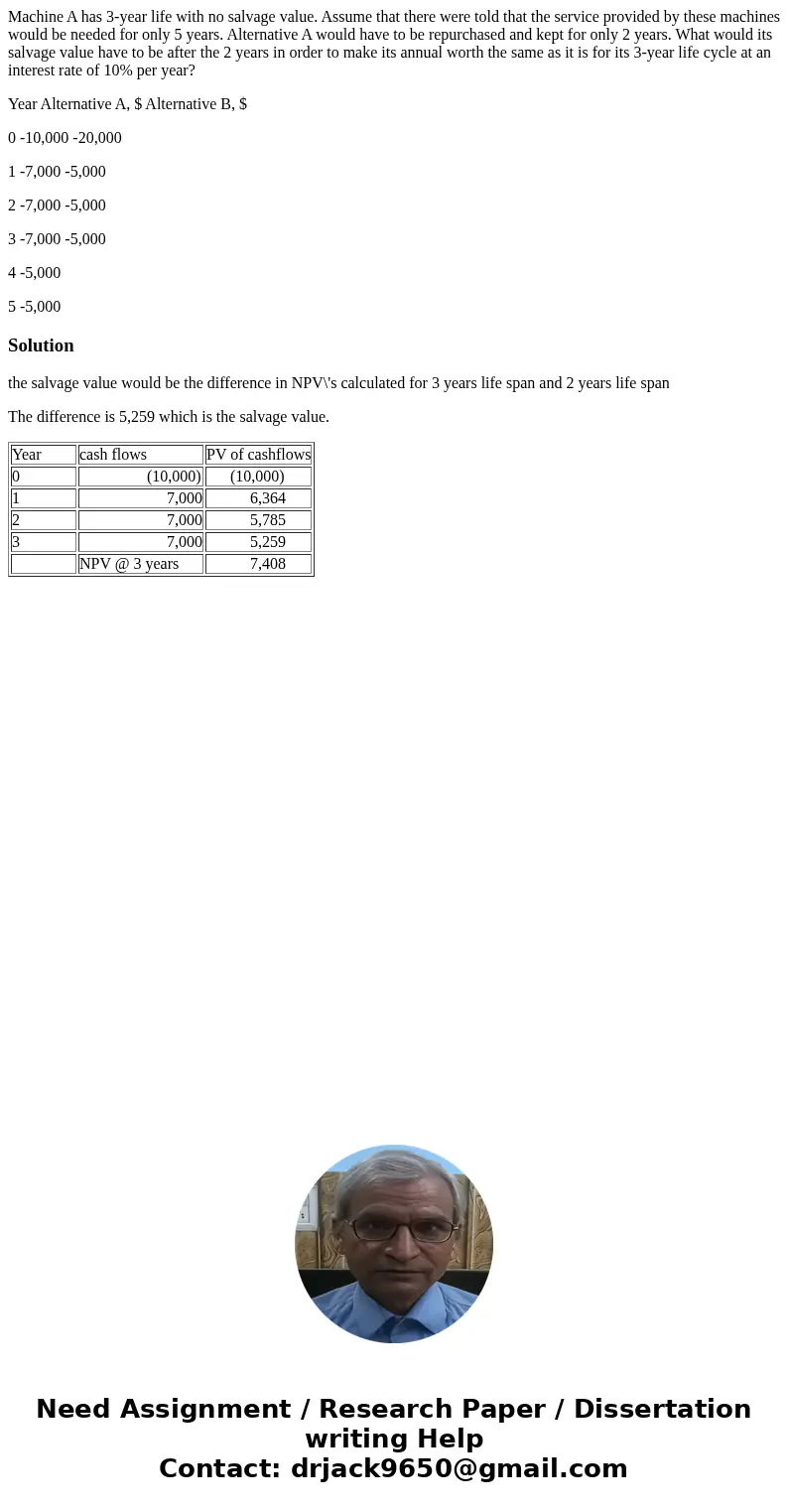

the salvage value would be the difference in NPV\'s calculated for 3 years life span and 2 years life span

The difference is 5,259 which is the salvage value.

| Year | cash flows | PV of cashflows |

| 0 | (10,000) | (10,000) |

| 1 | 7,000 | 6,364 |

| 2 | 7,000 | 5,785 |

| 3 | 7,000 | 5,259 |

| NPV @ 3 years | 7,408 |

Homework Sourse

Homework Sourse