P147B L0345 Entries for Life Cycle of Bonds On June 1 2017 R

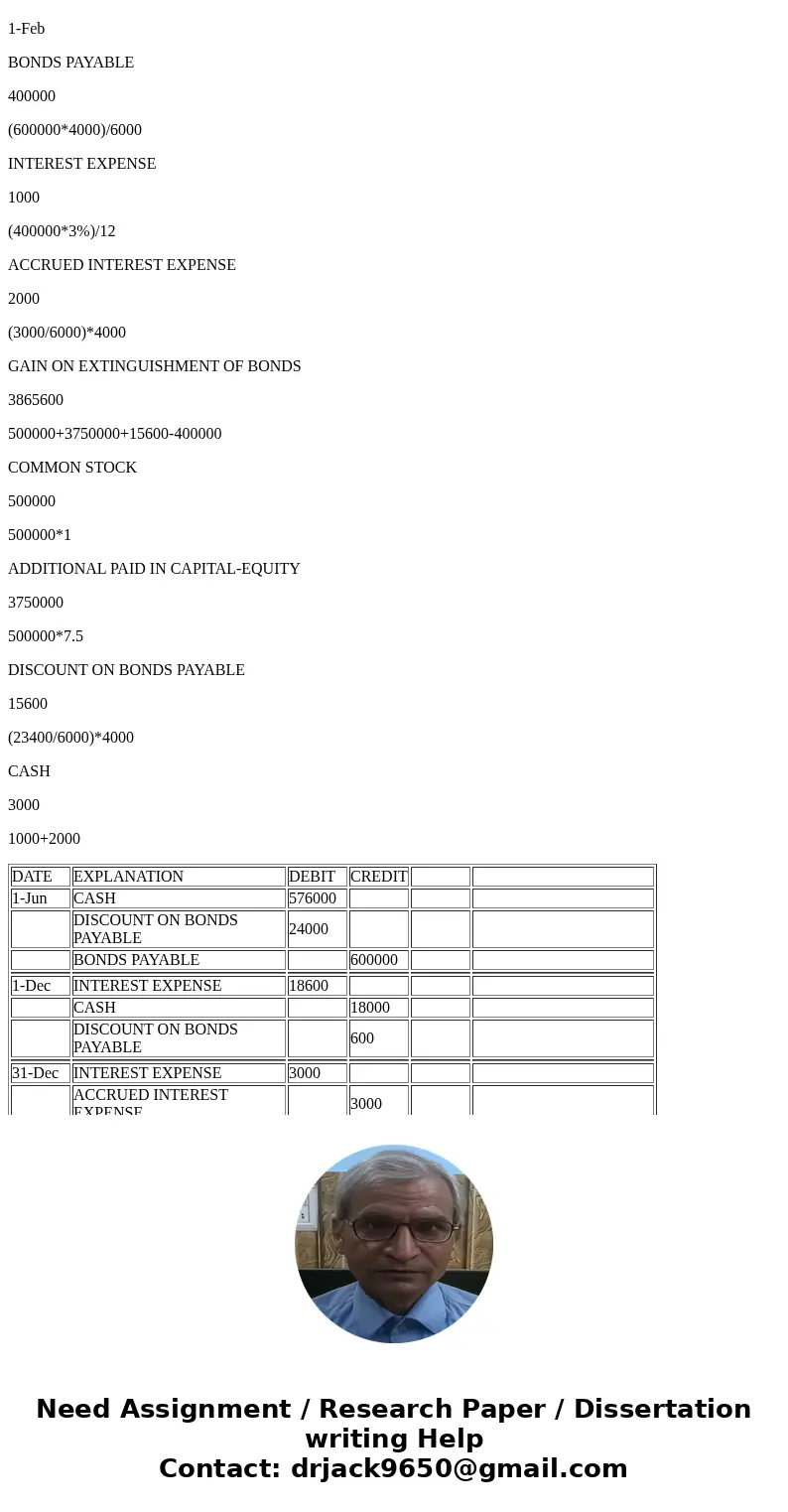

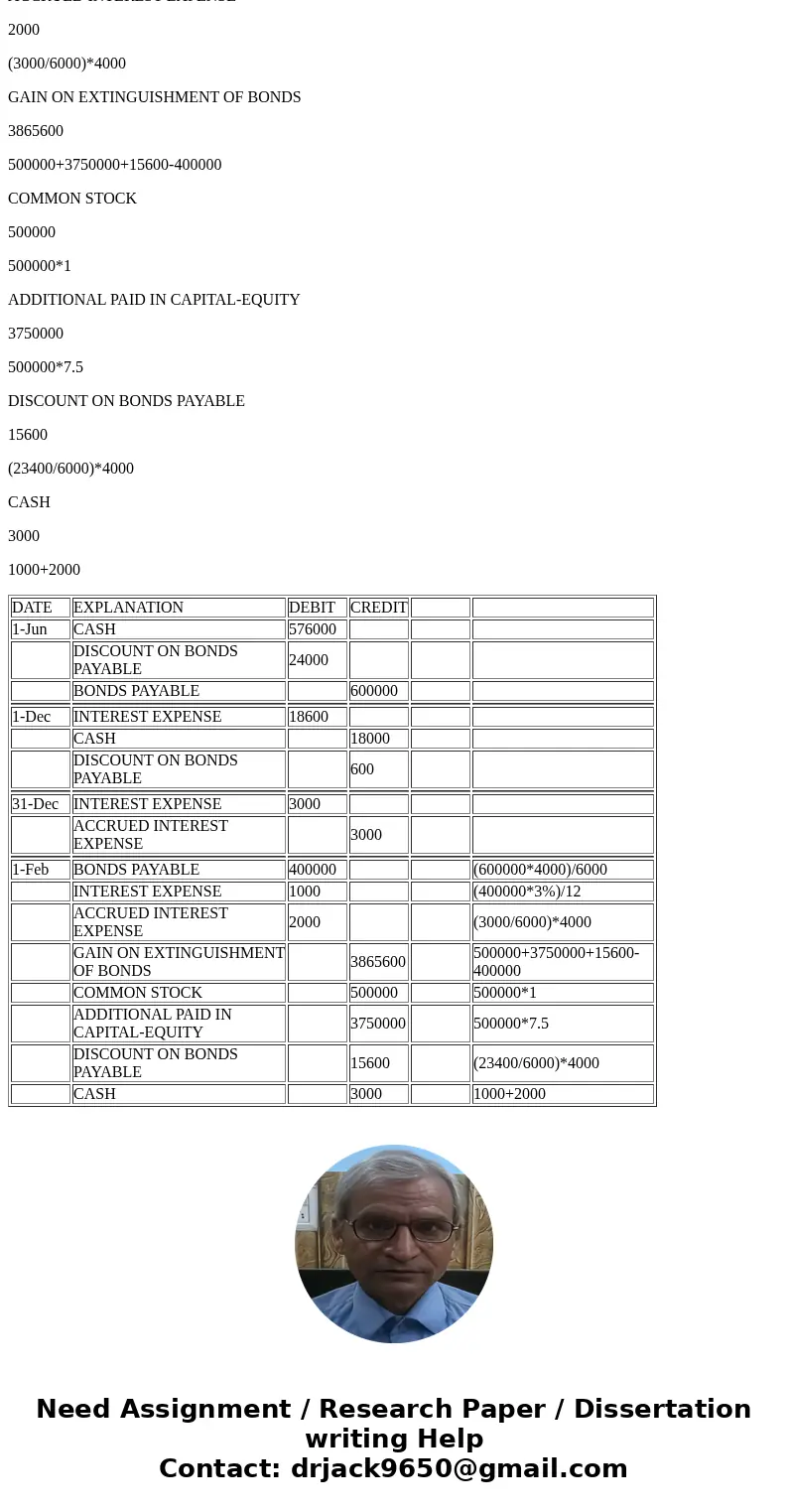

P14-7B (L03,4,5) (Entries for Life Cycle of Bonds) On June 1, 2017, Royal Palm Company sold 6,000 of its 6%, 20-year, $1,000 face value bonds at 96. Interest payment dates are December 1 and June 1, and the company uses the straight-line method of bond discount amortization. On February 1, 2018, Royal Palm took advantage of favorable prices of its stock to extinguish 4,000 of the bonds by issuing 500,000 shares of its $1 par value common stock. At this time, the accrued interest was paid in cash. The company’s stock was selling for $8.50 per share on February 1, 2018.

Instructions

Prepare the journal entries needed on the books of Royal Palm Company to record the following.

(a) June 1, 2017: issuance of the bonds.

(b) December 1, 2017: payment of semiannual interest.

(c) December 31, 2017: accrual of interest expense.

(d) February 1, 2018: extinguishment of 4,000 bonds. (No reversing entries made.)

Solution

DATE

EXPLANATION

DEBIT

CREDIT

1-Jun

CASH

576000

DISCOUNT ON BONDS PAYABLE

24000

BONDS PAYABLE

600000

1-Dec

INTEREST EXPENSE

18600

CASH

18000

DISCOUNT ON BONDS PAYABLE

600

31-Dec

INTEREST EXPENSE

3000

ACCRUED INTEREST EXPENSE

3000

1-Feb

BONDS PAYABLE

400000

(600000*4000)/6000

INTEREST EXPENSE

1000

(400000*3%)/12

ACCRUED INTEREST EXPENSE

2000

(3000/6000)*4000

GAIN ON EXTINGUISHMENT OF BONDS

3865600

500000+3750000+15600-400000

COMMON STOCK

500000

500000*1

ADDITIONAL PAID IN CAPITAL-EQUITY

3750000

500000*7.5

DISCOUNT ON BONDS PAYABLE

15600

(23400/6000)*4000

CASH

3000

1000+2000

| DATE | EXPLANATION | DEBIT | CREDIT | ||

| 1-Jun | CASH | 576000 | |||

| DISCOUNT ON BONDS PAYABLE | 24000 | ||||

| BONDS PAYABLE | 600000 | ||||

| 1-Dec | INTEREST EXPENSE | 18600 | |||

| CASH | 18000 | ||||

| DISCOUNT ON BONDS PAYABLE | 600 | ||||

| 31-Dec | INTEREST EXPENSE | 3000 | |||

| ACCRUED INTEREST EXPENSE | 3000 | ||||

| 1-Feb | BONDS PAYABLE | 400000 | (600000*4000)/6000 | ||

| INTEREST EXPENSE | 1000 | (400000*3%)/12 | |||

| ACCRUED INTEREST EXPENSE | 2000 | (3000/6000)*4000 | |||

| GAIN ON EXTINGUISHMENT OF BONDS | 3865600 | 500000+3750000+15600-400000 | |||

| COMMON STOCK | 500000 | 500000*1 | |||

| ADDITIONAL PAID IN CAPITAL-EQUITY | 3750000 | 500000*7.5 | |||

| DISCOUNT ON BONDS PAYABLE | 15600 | (23400/6000)*4000 | |||

| CASH | 3000 | 1000+2000 |

Homework Sourse

Homework Sourse