Listed below are several transactions that took place during

Solution

Answer 1:

Year 1:

Cash Inflow = $159,000

Cash Outflow = Salaries paid + Utilities + Purchase of Insurance Policy

Cash Outflow = $89,000 + $29,500 + $59,700

Cash outflow =$178,200

Net Operating Cash Flow = Cash Inflow – Cash Outflow

Net Operating Cash Flow = $159,000 - $178,200

Net Operating Cash Flow = -$19,200

Year 2:

Cash Inflow = $189,000

Cash Outflow = Salaries paid + Utilities

Cash Outflow = $99,000 +$39,000

Cash Outflow = $138,000

Net Operating Cash flow = Cash Inflow – Cash Outflow

Net Operating cash flow = $189,000 – $138,000

Net Operating Cash Flow = $51,000

Answer 2:

Year 1

Year 2

Revenues

172,000

222,000

Less Expenses:

Salaries

Utilities

Insurance

89,000

34,500

19,900

99,000

34,000

19,900

Net Income

28,600

69,100

Explanation :

Utilities Expense for Year 2 = Utilities Paid of 2year – Utilities Outstanding for Year 1

Utilities Expense for Year 2 = $39,000 - $5,000

Utilities Expense for Year 2 = $34,000

Answer 3:

Year 1:

Account Receivable, Year 1 = Amount billed to customer – Cash collected from customer

Account Receivable, Year 1 = $172,000 - $159,000

Account Receivable, Year 1 = $13,000

Year 2:

Ending Accounts Receivable, Year 2 = Beginning Accounts Receivable + Amount Billed to customer during the year – Cash Collected during the year

Ending Accounts Receivable, Year 2 = $13,000 + $222,000 - $189,000

Ending Accounts Receivable, Year 2 = $46,000

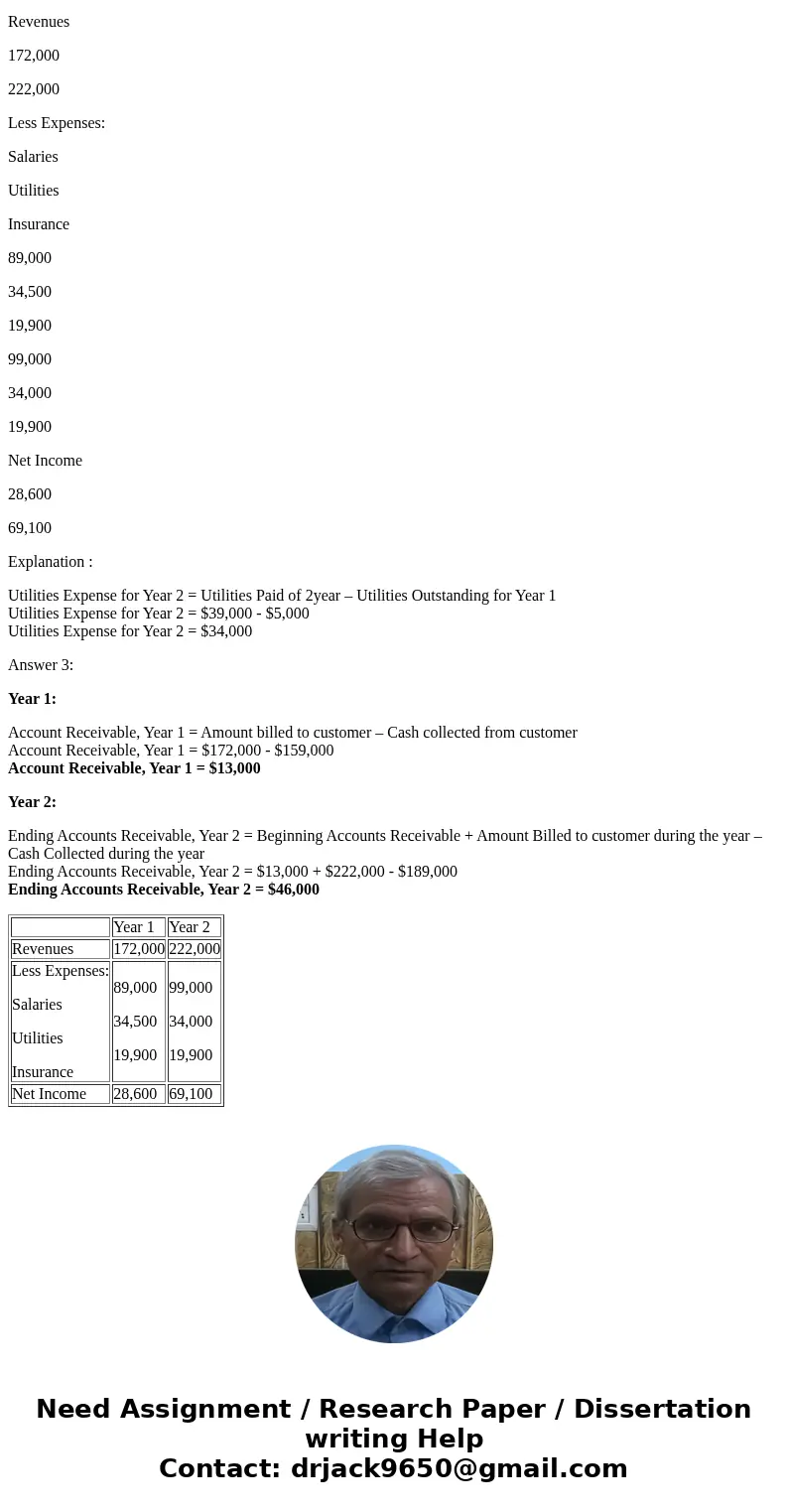

| Year 1 | Year 2 | |

| Revenues | 172,000 | 222,000 |

| Less Expenses: Salaries Utilities Insurance | 89,000 34,500 19,900 | 99,000 34,000 19,900 |

| Net Income | 28,600 | 69,100 |

Homework Sourse

Homework Sourse