The answers for Net short term capital gain and Net Long ter

The answers for Net short term capital gain and Net Long term capital loss are not correct. Please help me.

During 2015, George receives a $60,000 salary and has no deductions for AGI. In 2014, George had a $5,500

STCL available and no other capital losses or capital gains. Consider the following sales.

An automobile purchased in 2010 for $11,200 and held for personal use is sold for $9,000.

On April 10, 2015, stock held for investment is sold for $30,000. The stock was acquired on November 20, 2014, for $16,000

Requirement

Determine George\'s AGI for 2015. (Assume that the 2014 STCL of $5,500 is before George has taken any capital loss deduction in 2014. Complete all answer boxes. Enter a \"0\" for any zero-balances.)

2015

Salary ?

Net short-term capital gain (loss) ?

Net long-term capital gain (loss) ?

Total AGI ?

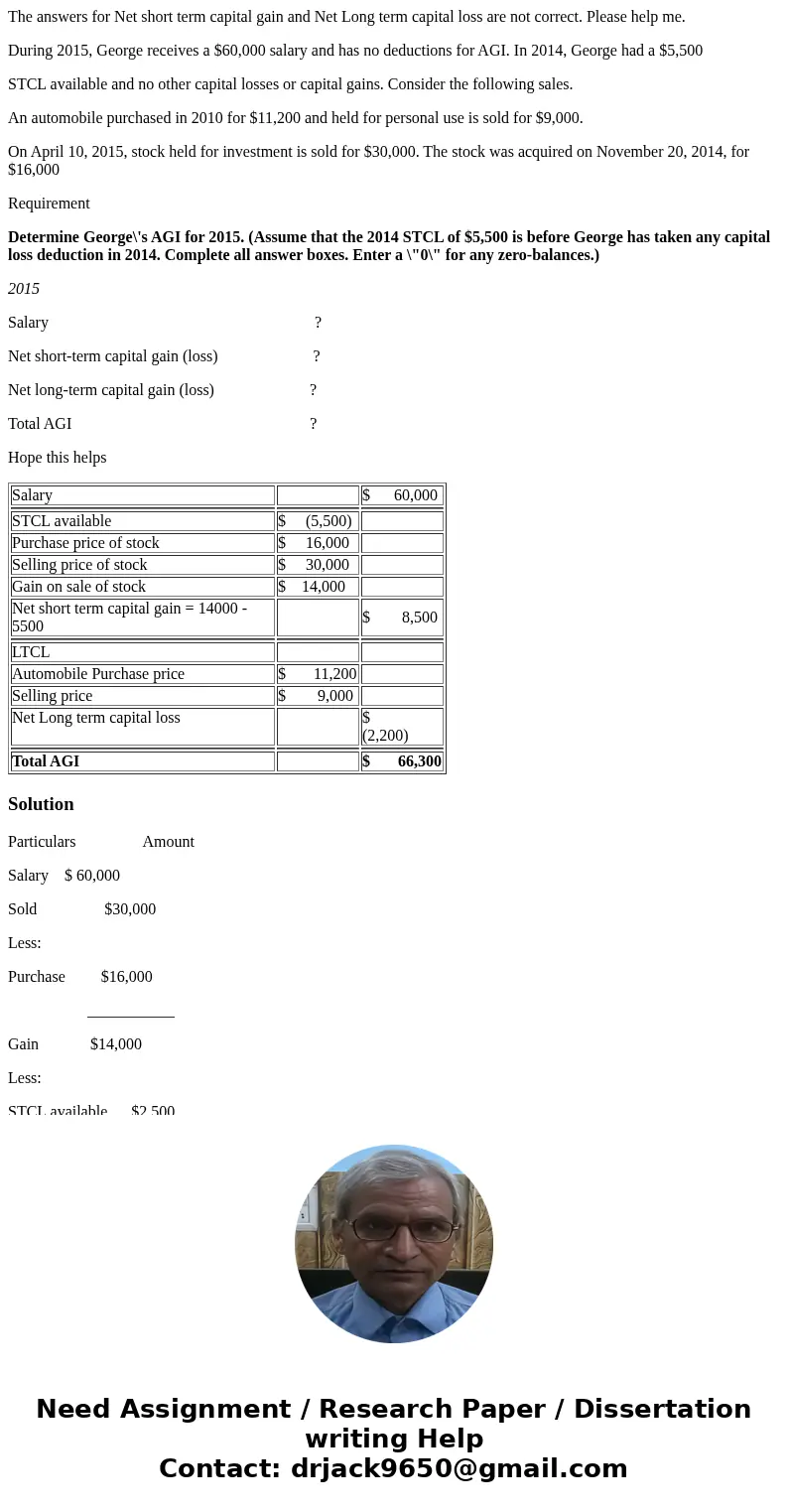

Hope this helps

| Salary | $ 60,000 | |

| STCL available | $ (5,500) | |

| Purchase price of stock | $ 16,000 | |

| Selling price of stock | $ 30,000 | |

| Gain on sale of stock | $ 14,000 | |

| Net short term capital gain = 14000 - 5500 | $ 8,500 | |

| LTCL | ||

| Automobile Purchase price | $ 11,200 | |

| Selling price | $ 9,000 | |

| Net Long term capital loss | $ (2,200) | |

| Total AGI | $ 66,300 |

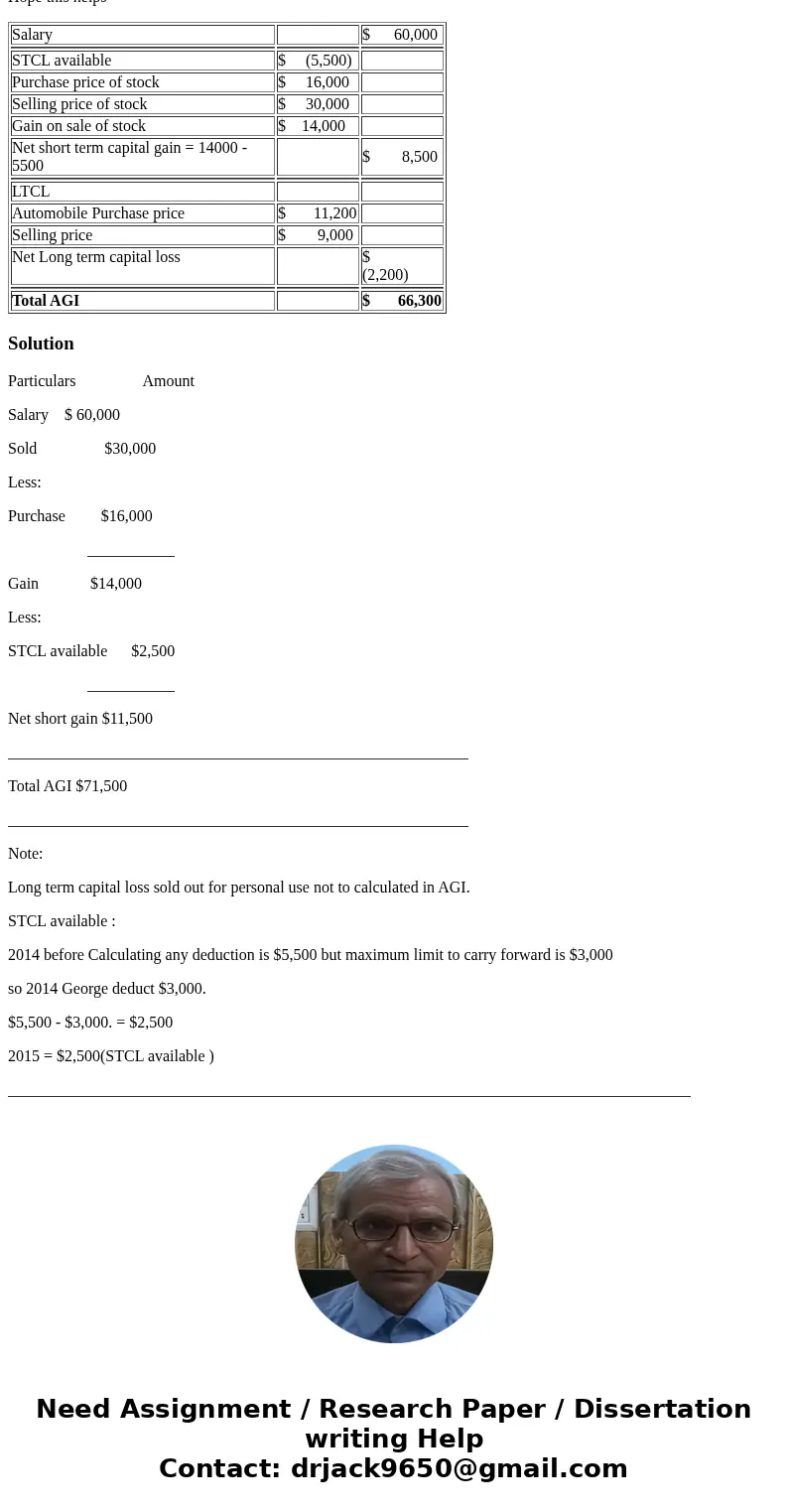

Solution

Particulars Amount

Salary $ 60,000

Sold $30,000

Less:

Purchase $16,000

___________

Gain $14,000

Less:

STCL available $2,500

___________

Net short gain $11,500

__________________________________________________________

Total AGI $71,500

__________________________________________________________

Note:

Long term capital loss sold out for personal use not to calculated in AGI.

STCL available :

2014 before Calculating any deduction is $5,500 but maximum limit to carry forward is $3,000

so 2014 George deduct $3,000.

$5,500 - $3,000. = $2,500

2015 = $2,500(STCL available )

______________________________________________________________________________________

Homework Sourse

Homework Sourse