a Direct materials prices in 2015 are expected to increase b

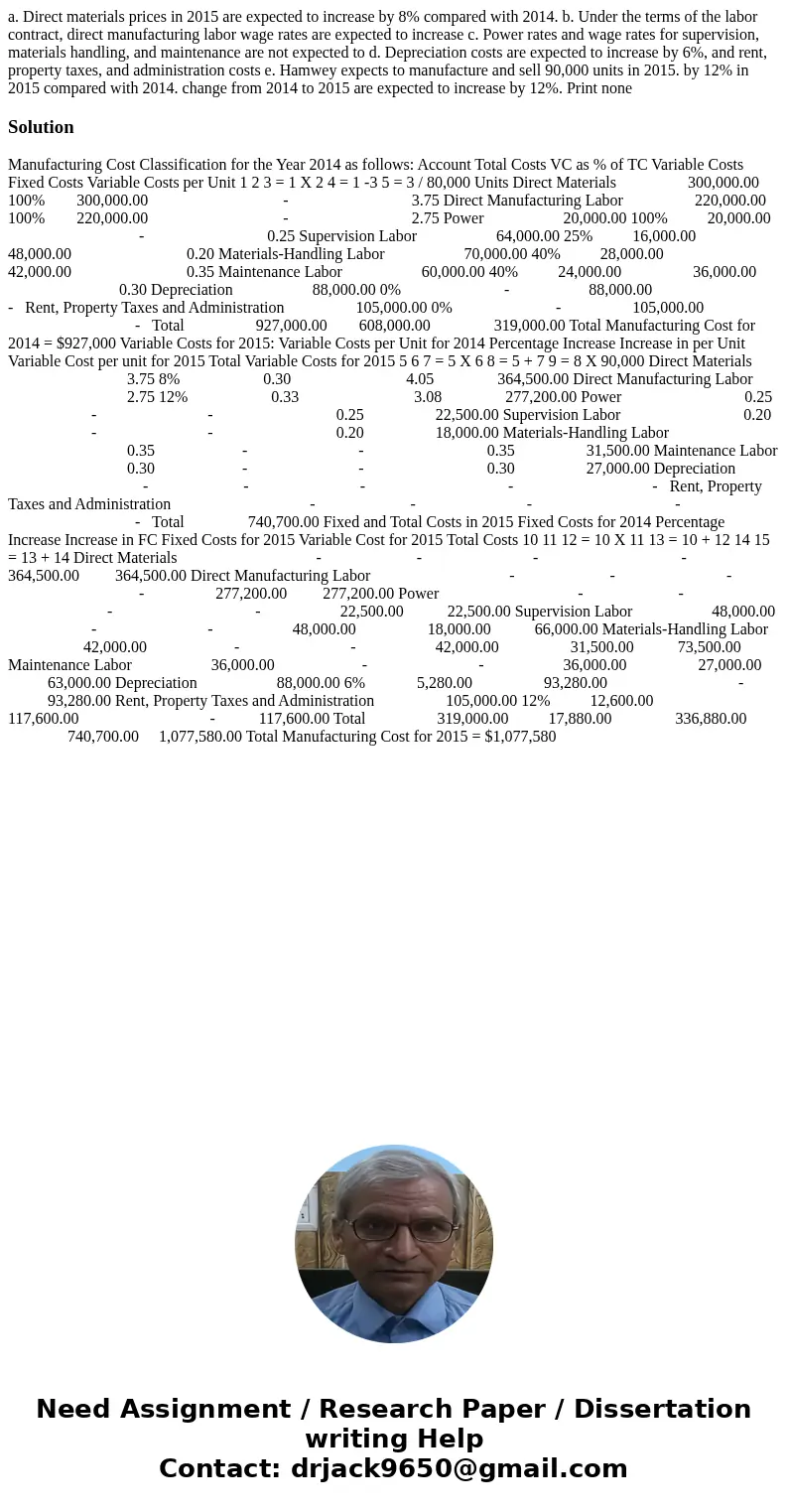

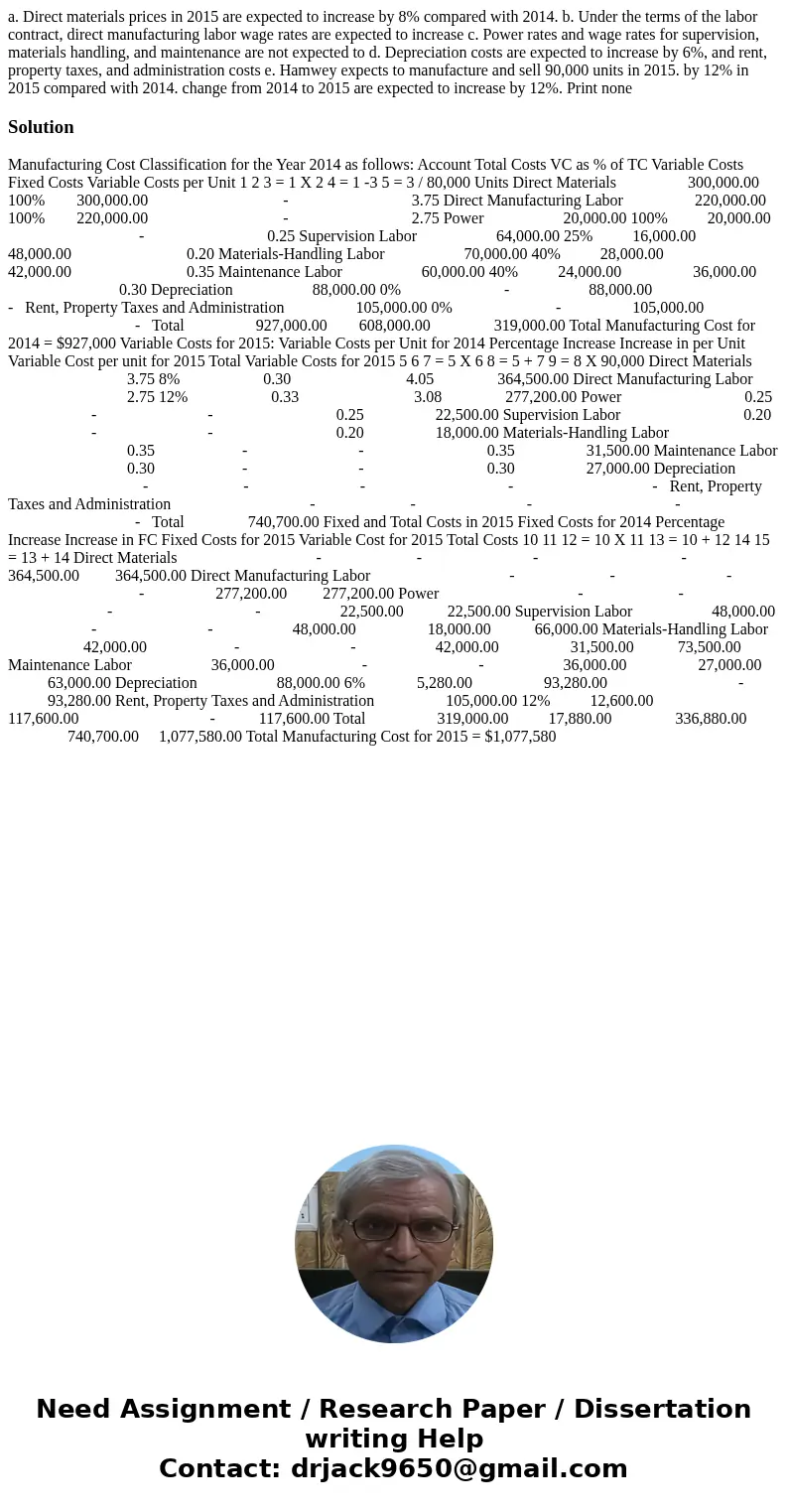

a. Direct materials prices in 2015 are expected to increase by 8% compared with 2014. b. Under the terms of the labor contract, direct manufacturing labor wage rates are expected to increase c. Power rates and wage rates for supervision, materials handling, and maintenance are not expected to d. Depreciation costs are expected to increase by 6%, and rent, property taxes, and administration costs e. Hamwey expects to manufacture and sell 90,000 units in 2015. by 12% in 2015 compared with 2014. change from 2014 to 2015 are expected to increase by 12%. Print none

Solution

Manufacturing Cost Classification for the Year 2014 as follows: Account Total Costs VC as % of TC Variable Costs Fixed Costs Variable Costs per Unit 1 2 3 = 1 X 2 4 = 1 -3 5 = 3 / 80,000 Units Direct Materials 300,000.00 100% 300,000.00 - 3.75 Direct Manufacturing Labor 220,000.00 100% 220,000.00 - 2.75 Power 20,000.00 100% 20,000.00 - 0.25 Supervision Labor 64,000.00 25% 16,000.00 48,000.00 0.20 Materials-Handling Labor 70,000.00 40% 28,000.00 42,000.00 0.35 Maintenance Labor 60,000.00 40% 24,000.00 36,000.00 0.30 Depreciation 88,000.00 0% - 88,000.00 - Rent, Property Taxes and Administration 105,000.00 0% - 105,000.00 - Total 927,000.00 608,000.00 319,000.00 Total Manufacturing Cost for 2014 = $927,000 Variable Costs for 2015: Variable Costs per Unit for 2014 Percentage Increase Increase in per Unit Variable Cost per unit for 2015 Total Variable Costs for 2015 5 6 7 = 5 X 6 8 = 5 + 7 9 = 8 X 90,000 Direct Materials 3.75 8% 0.30 4.05 364,500.00 Direct Manufacturing Labor 2.75 12% 0.33 3.08 277,200.00 Power 0.25 - - 0.25 22,500.00 Supervision Labor 0.20 - - 0.20 18,000.00 Materials-Handling Labor 0.35 - - 0.35 31,500.00 Maintenance Labor 0.30 - - 0.30 27,000.00 Depreciation - - - - - Rent, Property Taxes and Administration - - - - - Total 740,700.00 Fixed and Total Costs in 2015 Fixed Costs for 2014 Percentage Increase Increase in FC Fixed Costs for 2015 Variable Cost for 2015 Total Costs 10 11 12 = 10 X 11 13 = 10 + 12 14 15 = 13 + 14 Direct Materials - - - - 364,500.00 364,500.00 Direct Manufacturing Labor - - - - 277,200.00 277,200.00 Power - - - - 22,500.00 22,500.00 Supervision Labor 48,000.00 - - 48,000.00 18,000.00 66,000.00 Materials-Handling Labor 42,000.00 - - 42,000.00 31,500.00 73,500.00 Maintenance Labor 36,000.00 - - 36,000.00 27,000.00 63,000.00 Depreciation 88,000.00 6% 5,280.00 93,280.00 - 93,280.00 Rent, Property Taxes and Administration 105,000.00 12% 12,600.00 117,600.00 - 117,600.00 Total 319,000.00 17,880.00 336,880.00 740,700.00 1,077,580.00 Total Manufacturing Cost for 2015 = $1,077,580

Homework Sourse

Homework Sourse