Suppose a company will issue new 20 year debt with a par val

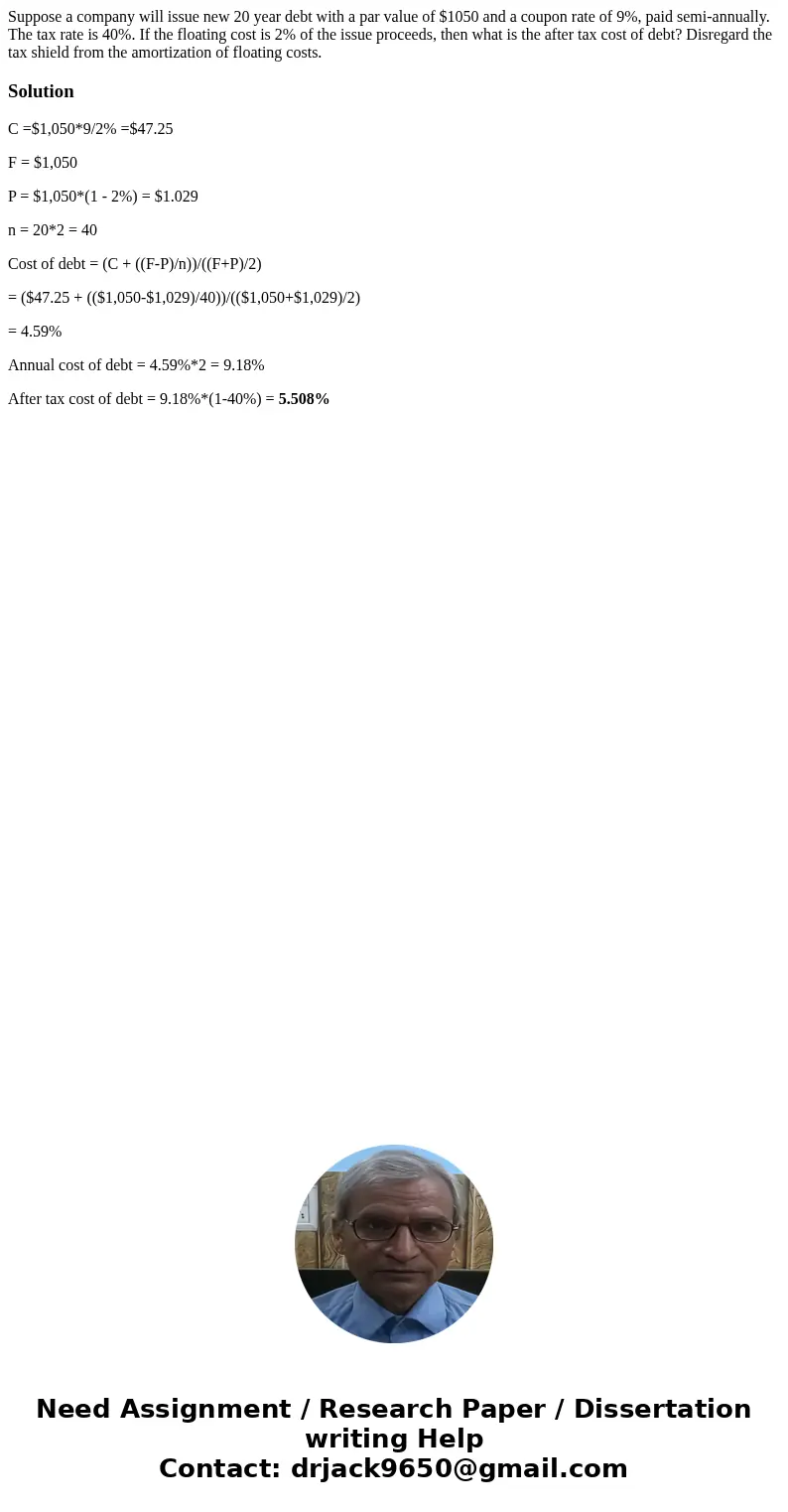

Suppose a company will issue new 20 year debt with a par value of $1050 and a coupon rate of 9%, paid semi-annually. The tax rate is 40%. If the floating cost is 2% of the issue proceeds, then what is the after tax cost of debt? Disregard the tax shield from the amortization of floating costs.

Solution

C =$1,050*9/2% =$47.25

F = $1,050

P = $1,050*(1 - 2%) = $1.029

n = 20*2 = 40

Cost of debt = (C + ((F-P)/n))/((F+P)/2)

= ($47.25 + (($1,050-$1,029)/40))/(($1,050+$1,029)/2)

= 4.59%

Annual cost of debt = 4.59%*2 = 9.18%

After tax cost of debt = 9.18%*(1-40%) = 5.508%

Homework Sourse

Homework Sourse