Journalize the following transactions for Cox Company using

Journalize the following transactions for Cox Company using the gross method of accounting for sales discounts. Assume a perpetual inventory system. Also, assume a constant gross profit ratio for all items sold. Make sure to enter the day for each separate transaction. April 7 Sold goods costing $6,000 to Lopez Company on account, $10,000, terms 4/10, n/30. April 13 Lopez Company was granted an allowance of $1,700 for returned merchandise that was previously purchased on account. The returned goods are in perfect condition. April 18 Received the amount due from Lopez Company.

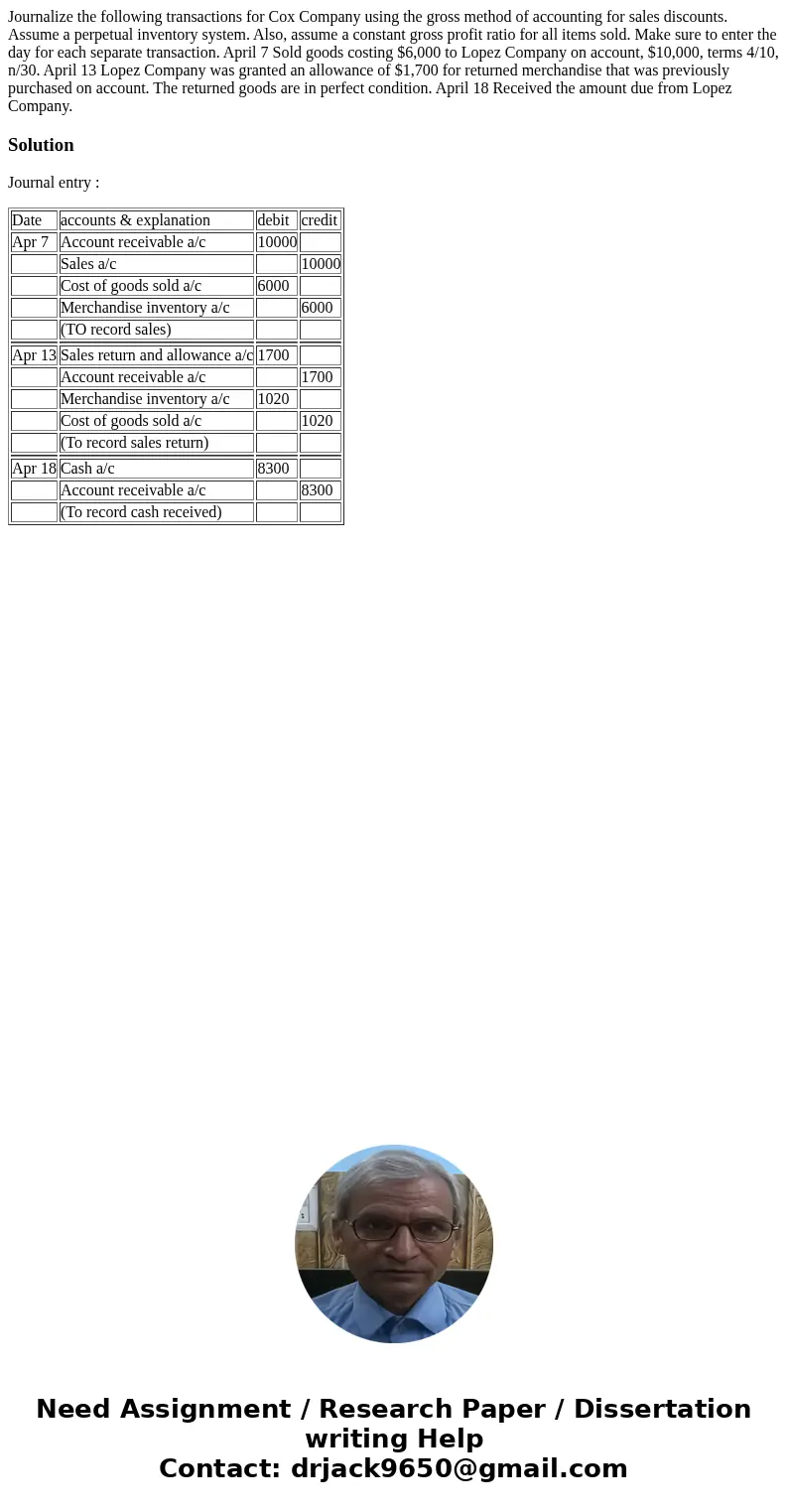

Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| Apr 7 | Account receivable a/c | 10000 | |

| Sales a/c | 10000 | ||

| Cost of goods sold a/c | 6000 | ||

| Merchandise inventory a/c | 6000 | ||

| (TO record sales) | |||

| Apr 13 | Sales return and allowance a/c | 1700 | |

| Account receivable a/c | 1700 | ||

| Merchandise inventory a/c | 1020 | ||

| Cost of goods sold a/c | 1020 | ||

| (To record sales return) | |||

| Apr 18 | Cash a/c | 8300 | |

| Account receivable a/c | 8300 | ||

| (To record cash received) |

Homework Sourse

Homework Sourse