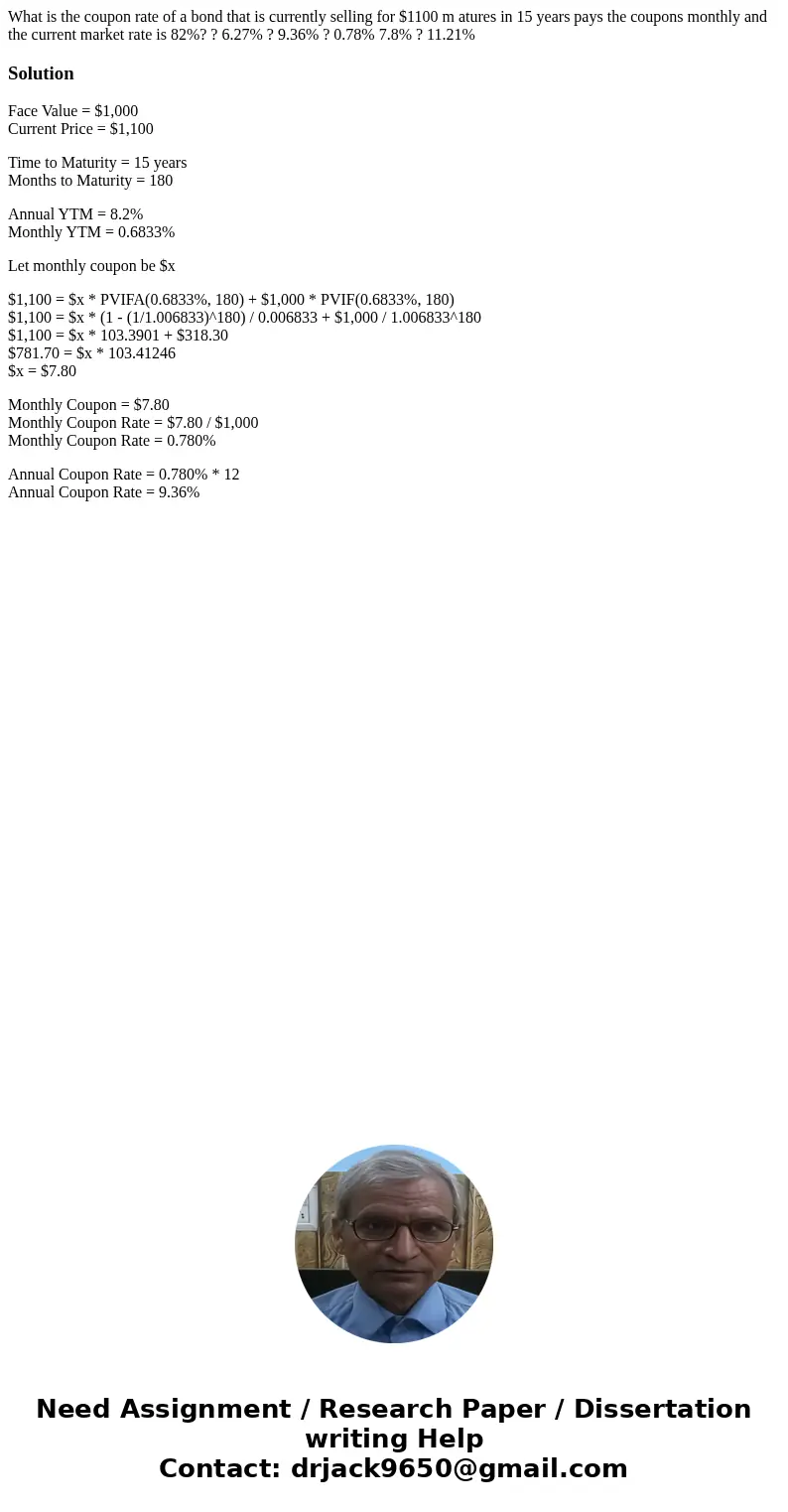

What is the coupon rate of a bond that is currently selling

What is the coupon rate of a bond that is currently selling for $1100 m atures in 15 years pays the coupons monthly and the current market rate is 82%? ? 6.27% ? 9.36% ? 0.78% 7.8% ? 11.21%

Solution

Face Value = $1,000

Current Price = $1,100

Time to Maturity = 15 years

Months to Maturity = 180

Annual YTM = 8.2%

Monthly YTM = 0.6833%

Let monthly coupon be $x

$1,100 = $x * PVIFA(0.6833%, 180) + $1,000 * PVIF(0.6833%, 180)

$1,100 = $x * (1 - (1/1.006833)^180) / 0.006833 + $1,000 / 1.006833^180

$1,100 = $x * 103.3901 + $318.30

$781.70 = $x * 103.41246

$x = $7.80

Monthly Coupon = $7.80

Monthly Coupon Rate = $7.80 / $1,000

Monthly Coupon Rate = 0.780%

Annual Coupon Rate = 0.780% * 12

Annual Coupon Rate = 9.36%

Homework Sourse

Homework Sourse