Sandpiper Company has 15000 shares of cumulative preferred 2

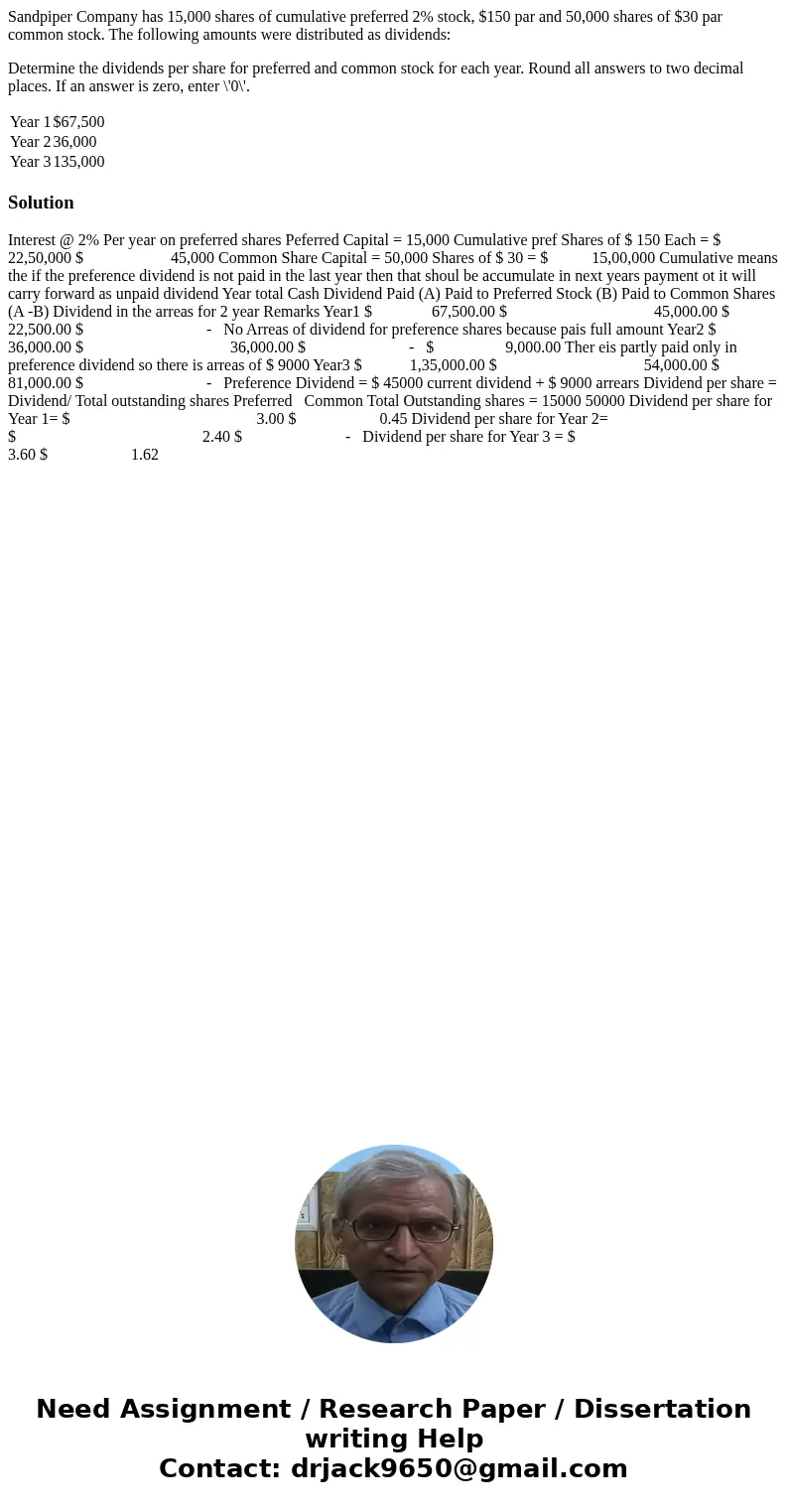

Sandpiper Company has 15,000 shares of cumulative preferred 2% stock, $150 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter \'0\'.

| Year 1 | $67,500 |

| Year 2 | 36,000 |

| Year 3 | 135,000 |

Solution

Interest @ 2% Per year on preferred shares Peferred Capital = 15,000 Cumulative pref Shares of $ 150 Each = $ 22,50,000 $ 45,000 Common Share Capital = 50,000 Shares of $ 30 = $ 15,00,000 Cumulative means the if the preference dividend is not paid in the last year then that shoul be accumulate in next years payment ot it will carry forward as unpaid dividend Year total Cash Dividend Paid (A) Paid to Preferred Stock (B) Paid to Common Shares (A -B) Dividend in the arreas for 2 year Remarks Year1 $ 67,500.00 $ 45,000.00 $ 22,500.00 $ - No Arreas of dividend for preference shares because pais full amount Year2 $ 36,000.00 $ 36,000.00 $ - $ 9,000.00 Ther eis partly paid only in preference dividend so there is arreas of $ 9000 Year3 $ 1,35,000.00 $ 54,000.00 $ 81,000.00 $ - Preference Dividend = $ 45000 current dividend + $ 9000 arrears Dividend per share = Dividend/ Total outstanding shares Preferred Common Total Outstanding shares = 15000 50000 Dividend per share for Year 1= $ 3.00 $ 0.45 Dividend per share for Year 2= $ 2.40 $ - Dividend per share for Year 3 = $ 3.60 $ 1.62

Homework Sourse

Homework Sourse