Problem 610AB Gross profit method P4 Wayward Company wants t

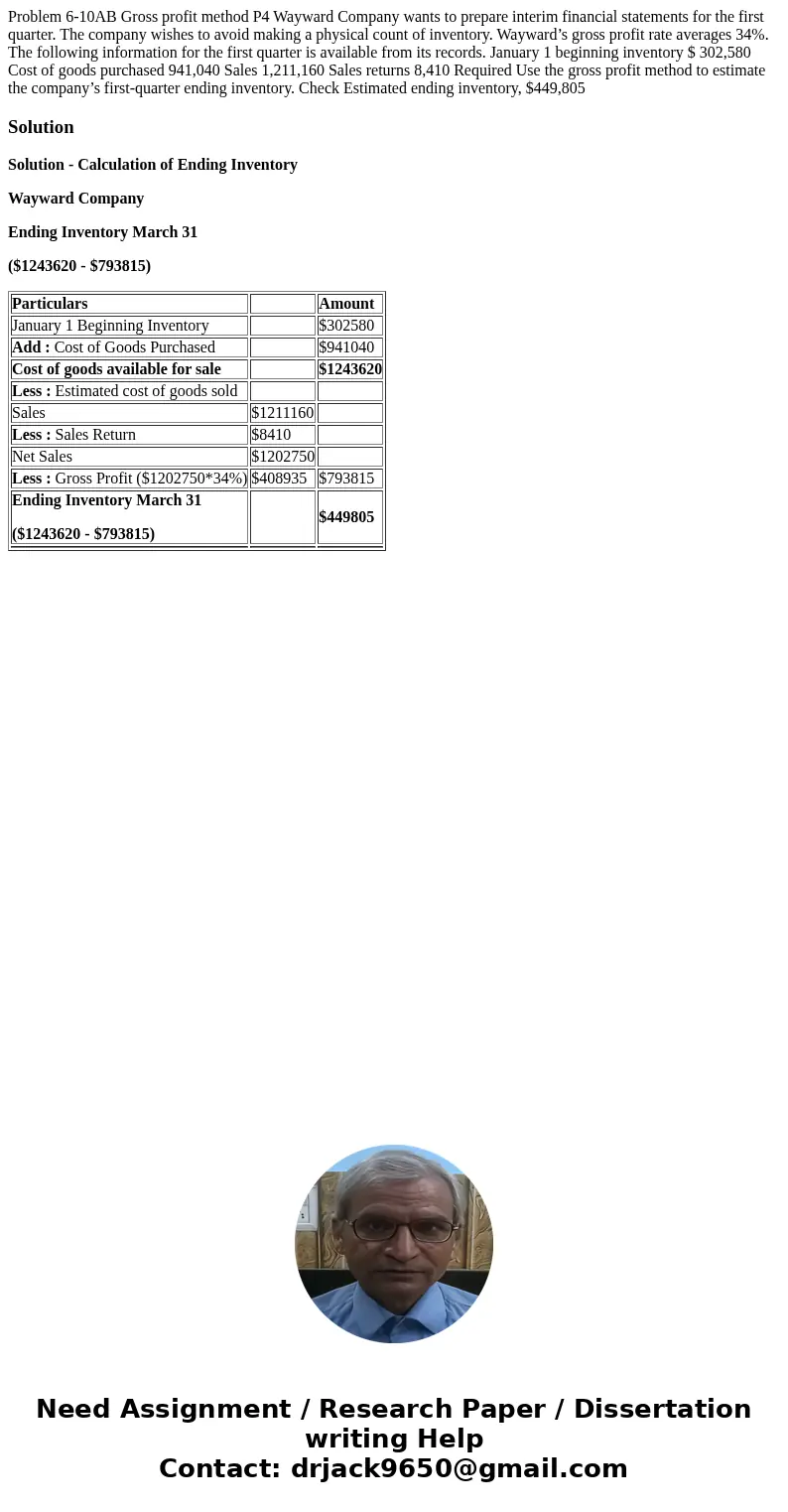

Problem 6-10AB Gross profit method P4 Wayward Company wants to prepare interim financial statements for the first quarter. The company wishes to avoid making a physical count of inventory. Wayward’s gross profit rate averages 34%. The following information for the first quarter is available from its records. January 1 beginning inventory $ 302,580 Cost of goods purchased 941,040 Sales 1,211,160 Sales returns 8,410 Required Use the gross profit method to estimate the company’s first-quarter ending inventory. Check Estimated ending inventory, $449,805

Solution

Solution - Calculation of Ending Inventory

Wayward Company

Ending Inventory March 31

($1243620 - $793815)

| Particulars | Amount | |

| January 1 Beginning Inventory | $302580 | |

| Add : Cost of Goods Purchased | $941040 | |

| Cost of goods available for sale | $1243620 | |

| Less : Estimated cost of goods sold | ||

| Sales | $1211160 | |

| Less : Sales Return | $8410 | |

| Net Sales | $1202750 | |

| Less : Gross Profit ($1202750*34%) | $408935 | $793815 |

| Ending Inventory March 31 ($1243620 - $793815) | $449805 | |

Homework Sourse

Homework Sourse