Calculate two sets of returns 300 and 500 for BOTH the a eng

Solution

1.

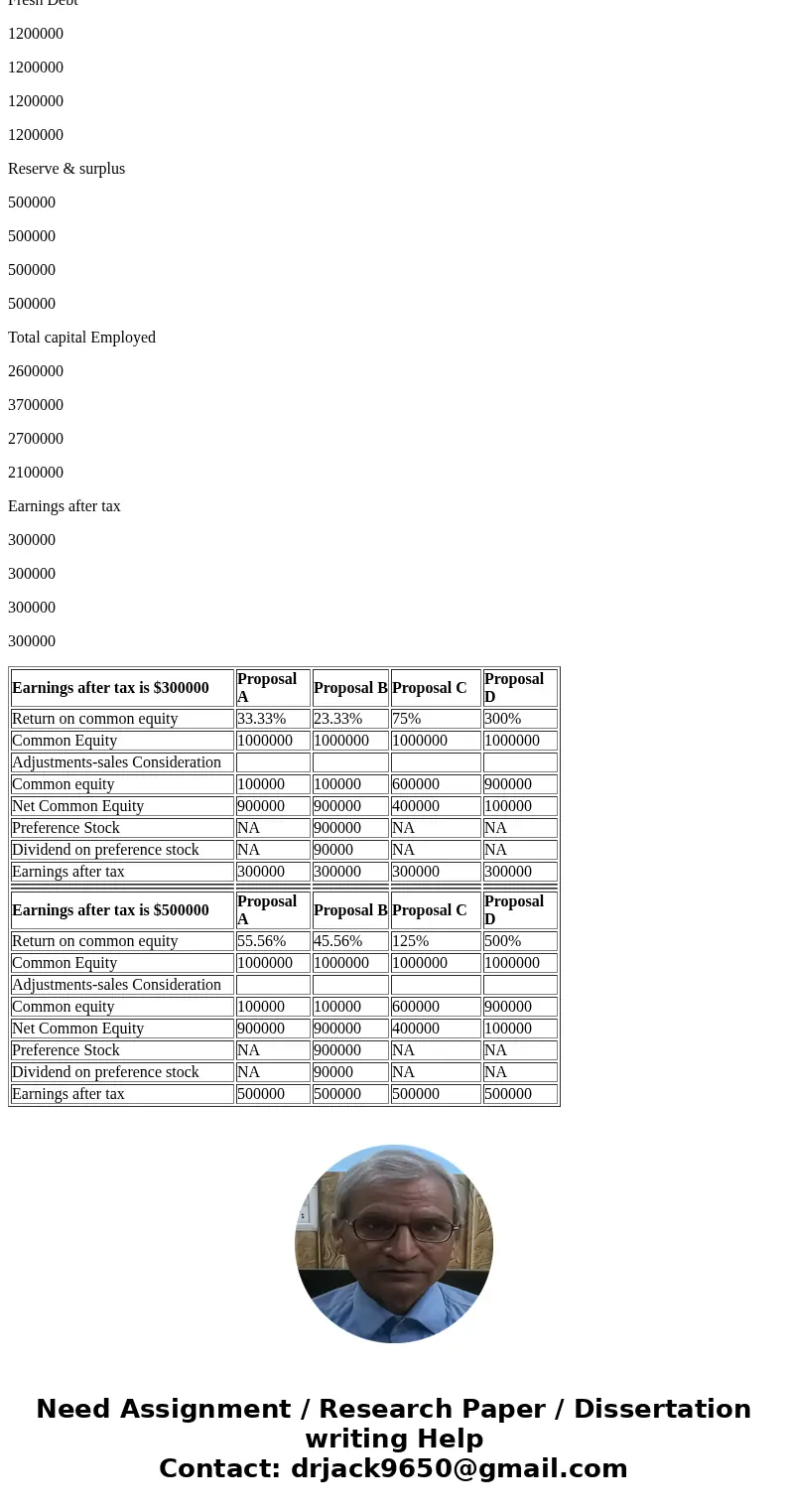

Return on equity is given by earnings after tax-prefrence dividend/common equity.

The return on common equity for Innovative Engineering is presented below:

Earnings after tax is $300000

Proposal A

Proposal B

Proposal C

Proposal D

Return on common equity

33.33%

23.33%

75%

300%

Common Equity

1000000

1000000

1000000

1000000

Adjustments-sales Consideration

Common equity

100000

100000

600000

900000

Net Common Equity

900000

900000

400000

100000

Preference Stock

NA

900000

NA

NA

Dividend on preference stock

NA

90000

NA

NA

Earnings after tax

300000

300000

300000

300000

Earnings after tax is $500000

Proposal A

Proposal B

Proposal C

Proposal D

Return on common equity

55.56%

45.56%

125%

500%

Common Equity

1000000

1000000

1000000

1000000

Adjustments-sales Consideration

Common equity

100000

100000

600000

900000

Net Common Equity

900000

900000

400000

100000

Preference Stock

NA

900000

NA

NA

Dividend on preference stock

NA

90000

NA

NA

Earnings after tax

500000

500000

500000

500000

2.

Return of investment has been presented for Innovative Engineering below for all 4 proposals for raising of $1.2million loan from Albor Capital Corporation:

Return on Investment has been calculated as earnings after tax /total capital employed

Total capital employed in shareholders’ fund + debt fund

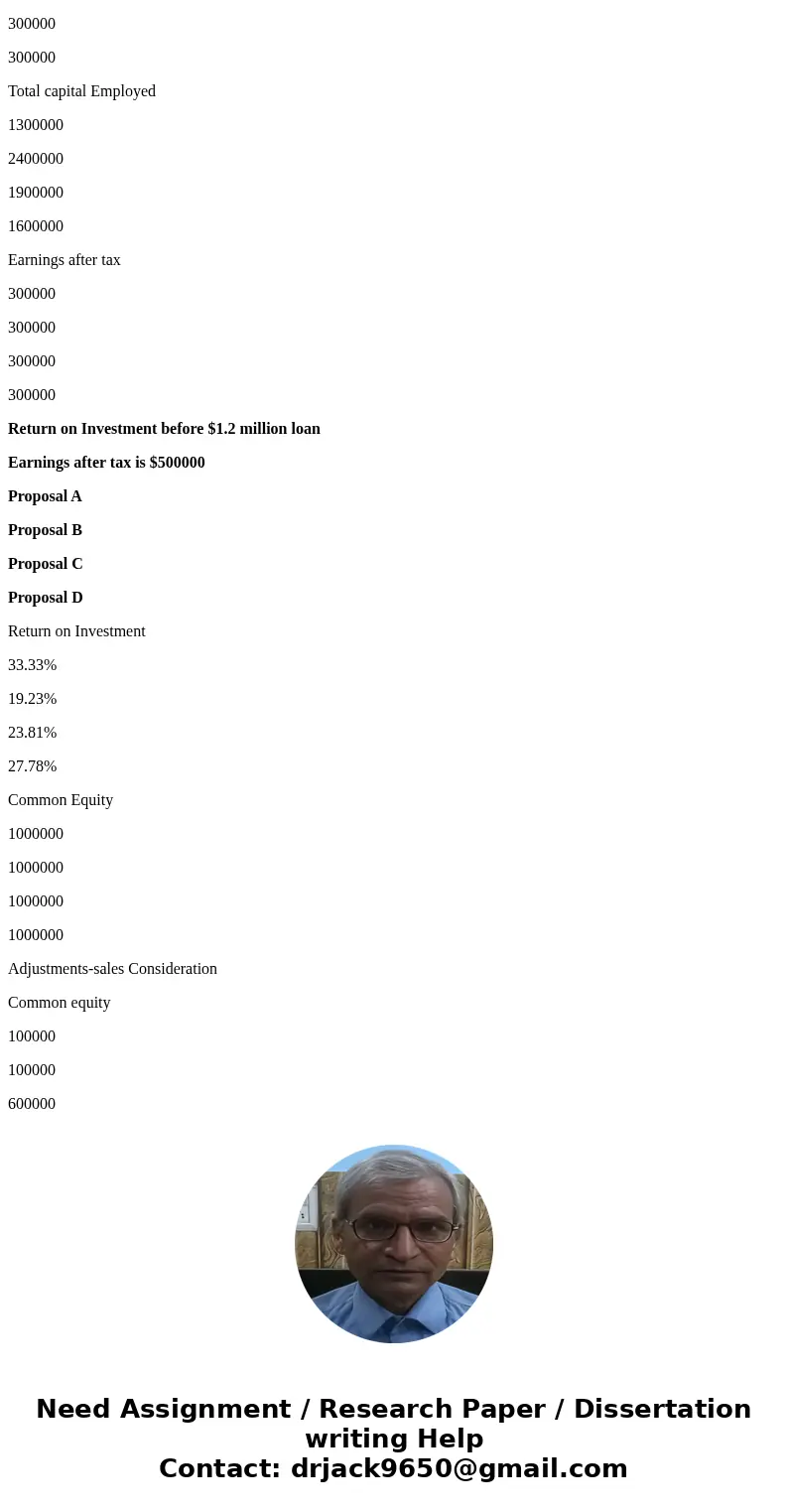

Return on Investment before $1.2 million loan

Earnings after tax is $300000

Proposal A

Proposal B

Proposal C

Proposal D

Return on Investment

23.08%

12.50%

15.79%

18.75%

Common Equity

1000000

1000000

1000000

1000000

Adjustments-sales Consideration

Common equity

100000

100000

600000

900000

Net Common Equity

900000

900000

400000

100000

Preference Stock

NA

900000

NA

NA

Debt

NA

200000

600000

300000

Reserve & Surplus

300000

300000

300000

300000

Total capital Employed

1300000

2400000

1900000

1600000

Earnings after tax

300000

300000

300000

300000

Return on Investment before $1.2 million loan

Earnings after tax is $500000

Proposal A

Proposal B

Proposal C

Proposal D

Return on Investment

33.33%

19.23%

23.81%

27.78%

Common Equity

1000000

1000000

1000000

1000000

Adjustments-sales Consideration

Common equity

100000

100000

600000

900000

Net Common Equity

900000

900000

400000

100000

Preference Stock

NA

900000

NA

NA

Debt

NA

200000

600000

300000

Reserve & Surplus

500000

500000

500000

500000

Total capital Employed

1500000

2600000

2100000

1800000

Earnings after tax

500000

500000

500000

500000

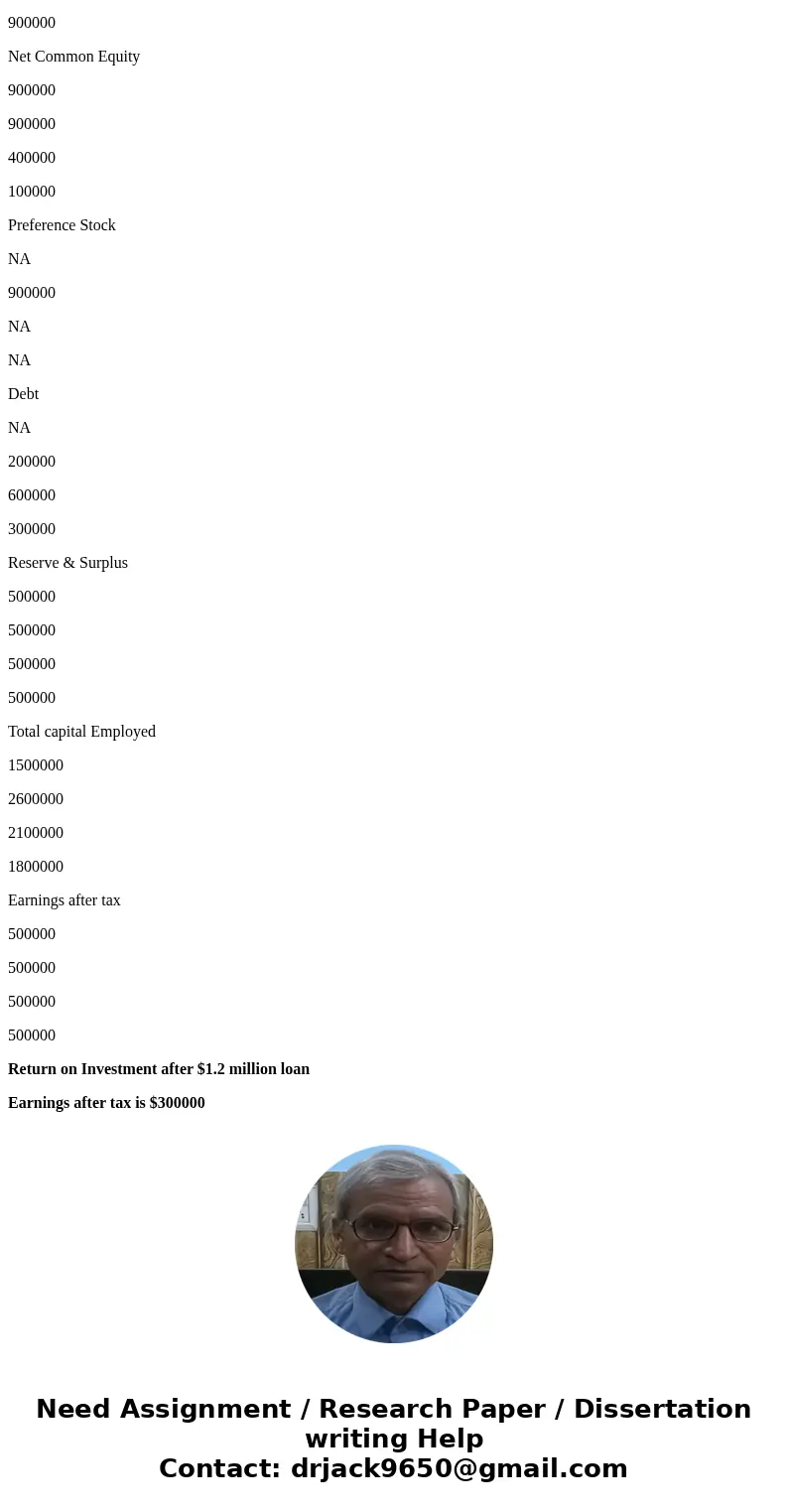

Return on Investment after $1.2 million loan

Earnings after tax is $300000

Proposal A

Proposal B

Proposal C

Proposal D

Return on Investment

12.50%

8.57%

12.00%

15.79%

Common Equity

1000000

1000000

1000000

1000000

Adjustments-sales Consideration

Common equity

100000

100000

600000

900000

Net Common Equity

900000

900000

400000

100000

Preference Stock

NA

900000

NA

NA

Debt

NA

200000

600000

300000

Fresh Debt

1200000

1200000

1200000

1200000

Reserve & surplus

300000

300000

300000

300000

Total capital Employed

2400000

3500000

2500000

1900000

Earnings after tax

300000

300000

300000

300000

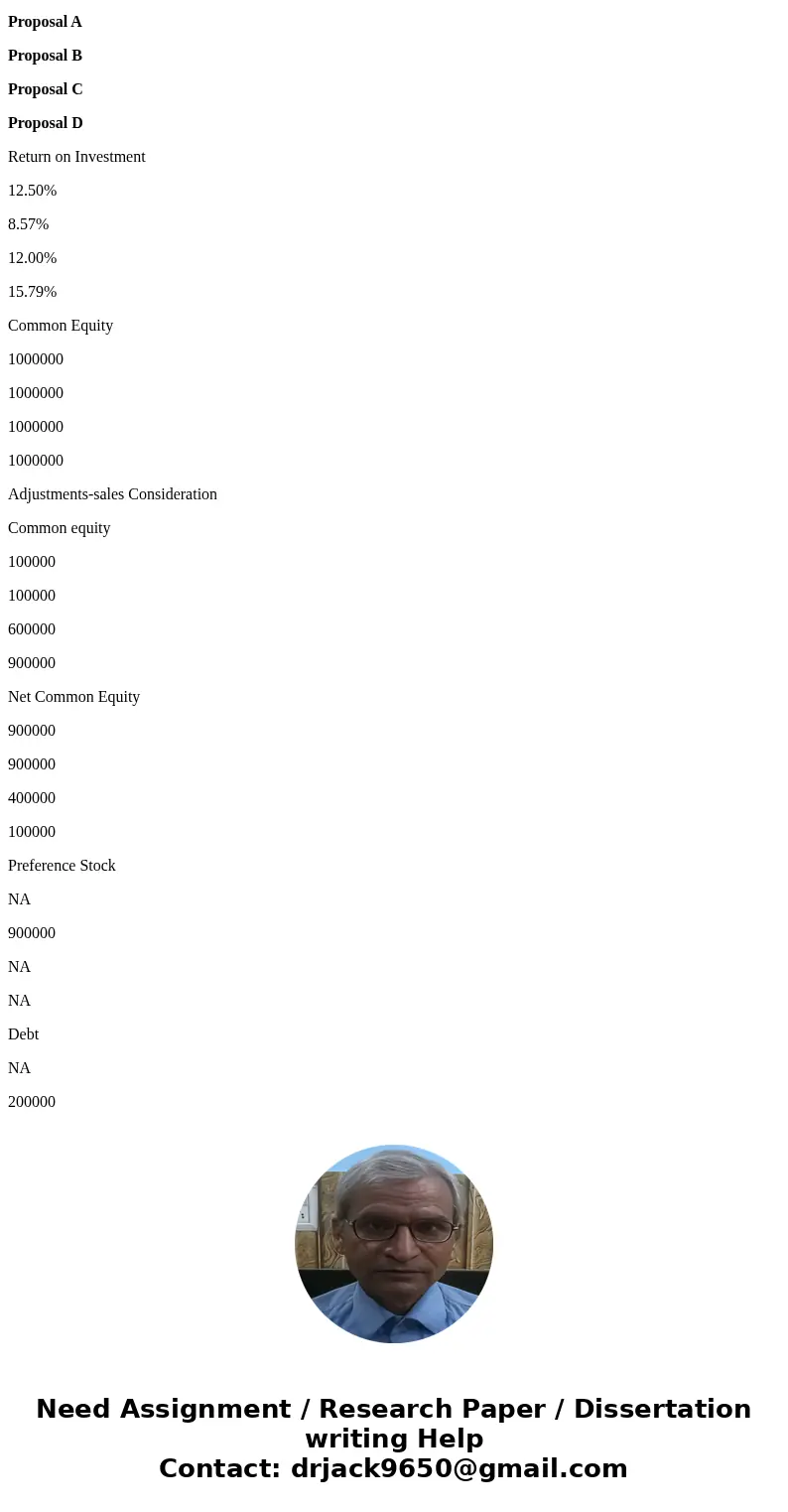

Return on Investment after $1.2 million loan

Earnings after tax is $500000

Proposal A

Proposal B

Proposal C

Proposal D

Return on Investment

11.54%

8.11%

11.11%

14.29%

Common Equity

1000000

1000000

1000000

1000000

Adjustments-sales Consideration

Common equity

100000

100000

600000

900000

Net Common Equity

900000

900000

400000

100000

Preference Stock

NA

900000

NA

NA

Debt

NA

200000

600000

300000

Fresh Debt

1200000

1200000

1200000

1200000

Reserve & surplus

500000

500000

500000

500000

Total capital Employed

2600000

3700000

2700000

2100000

Earnings after tax

300000

300000

300000

300000

| Earnings after tax is $300000 | Proposal A | Proposal B | Proposal C | Proposal D |

| Return on common equity | 33.33% | 23.33% | 75% | 300% |

| Common Equity | 1000000 | 1000000 | 1000000 | 1000000 |

| Adjustments-sales Consideration | ||||

| Common equity | 100000 | 100000 | 600000 | 900000 |

| Net Common Equity | 900000 | 900000 | 400000 | 100000 |

| Preference Stock | NA | 900000 | NA | NA |

| Dividend on preference stock | NA | 90000 | NA | NA |

| Earnings after tax | 300000 | 300000 | 300000 | 300000 |

| Earnings after tax is $500000 | Proposal A | Proposal B | Proposal C | Proposal D |

| Return on common equity | 55.56% | 45.56% | 125% | 500% |

| Common Equity | 1000000 | 1000000 | 1000000 | 1000000 |

| Adjustments-sales Consideration | ||||

| Common equity | 100000 | 100000 | 600000 | 900000 |

| Net Common Equity | 900000 | 900000 | 400000 | 100000 |

| Preference Stock | NA | 900000 | NA | NA |

| Dividend on preference stock | NA | 90000 | NA | NA |

| Earnings after tax | 500000 | 500000 | 500000 | 500000 |

Homework Sourse

Homework Sourse