Mendez Corporation has 10000 shares of its 100 par value 7 p

Mendez Corporation has 10,000 shares of its $100 par value, 7 percent cumulative

preferred stock outstanding and 50,000 shares of its $1 par value common stock outstanding.

In Mendez’s first four years of operation, its board of directors paid the following

cash dividends: 2011, none; 2012, $120,000; 2013, $140,000; 2014, $140,000.

Determine the dividends per share and total cash dividends paid to the preferred and

common stockholders during each of the four years.

Solution

The dividends per year on preferred stock = 10,000 x $ 100 x 7 %

= $ 10,000 x $ 100 x 0.07 = $ 70,000

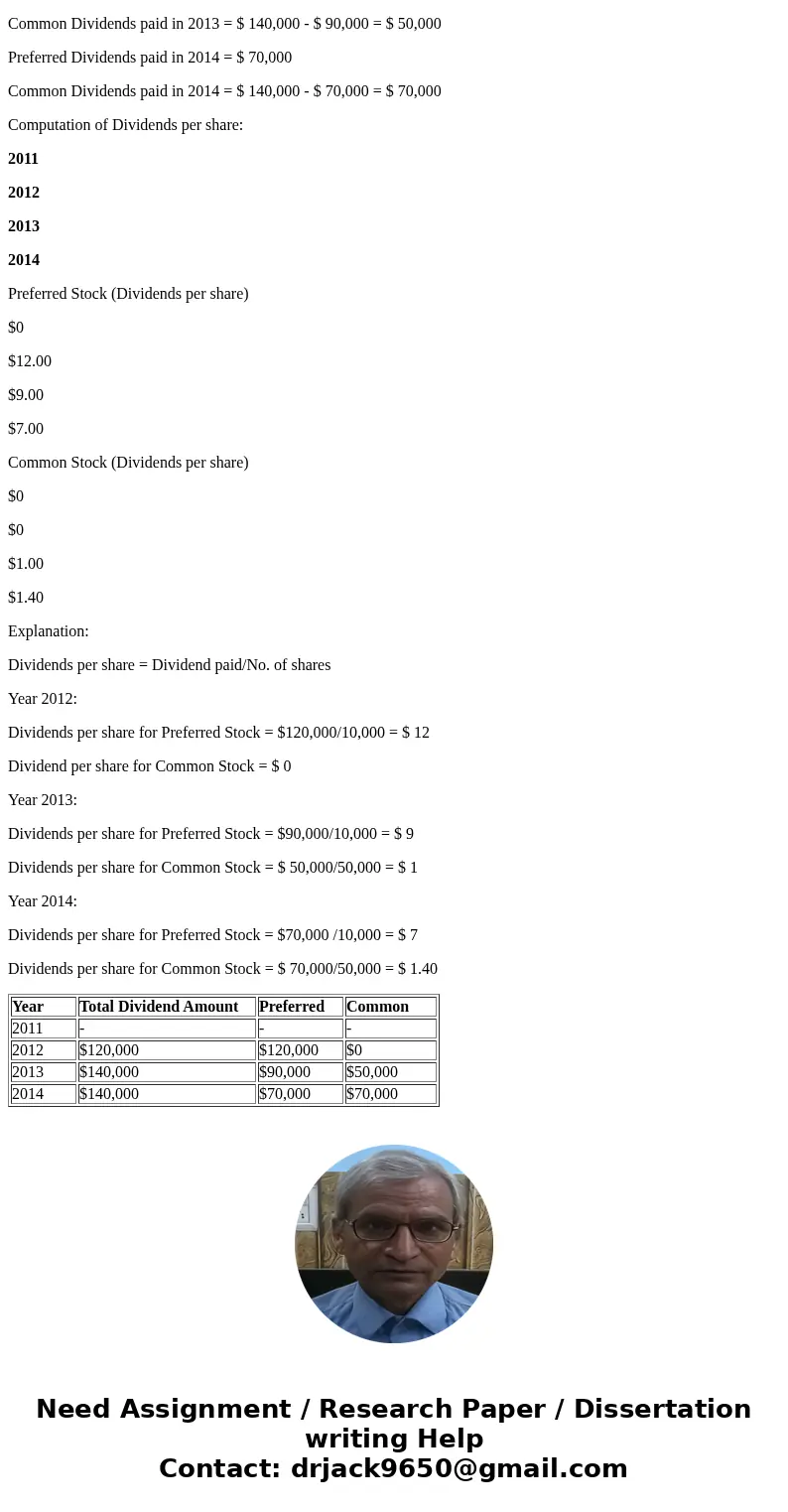

Dividend distribution:

Year

Total Dividend Amount

Preferred

Common

2011

-

-

-

2012

$120,000

$120,000

$0

2013

$140,000

$90,000

$50,000

2014

$140,000

$70,000

$70,000

Explanation:

First dividend is paid to Preferred stock and then excess amount goes to common share holder. For cumulative preferred stock, any deficiency in dividend, not paid carries over to subsequent years and is added to that year\'s dividend.

Preferred Dividends unpaid in 2011 = $70,000

Preferred Dividends on 2012 = $70,000 + $ 70,000 = $ 140,000

Preferred Dividends paid in 2012 = $ 120,000

Preferred Dividends shortage on 2012 = $ 20,000

As the Dividend was insufficient for preferred stocks, common stocks holder was not paid any dividend during 2011 & 2012.

Preferred Dividends paid in 2013 = $ 70,000 + $ 20,000 = $ 90,000

Common Dividends paid in 2013 = $ 140,000 - $ 90,000 = $ 50,000

Preferred Dividends paid in 2014 = $ 70,000

Common Dividends paid in 2014 = $ 140,000 - $ 70,000 = $ 70,000

Computation of Dividends per share:

2011

2012

2013

2014

Preferred Stock (Dividends per share)

$0

$12.00

$9.00

$7.00

Common Stock (Dividends per share)

$0

$0

$1.00

$1.40

Explanation:

Dividends per share = Dividend paid/No. of shares

Year 2012:

Dividends per share for Preferred Stock = $120,000/10,000 = $ 12

Dividend per share for Common Stock = $ 0

Year 2013:

Dividends per share for Preferred Stock = $90,000/10,000 = $ 9

Dividends per share for Common Stock = $ 50,000/50,000 = $ 1

Year 2014:

Dividends per share for Preferred Stock = $70,000 /10,000 = $ 7

Dividends per share for Common Stock = $ 70,000/50,000 = $ 1.40

| Year | Total Dividend Amount | Preferred | Common |

| 2011 | - | - | - |

| 2012 | $120,000 | $120,000 | $0 |

| 2013 | $140,000 | $90,000 | $50,000 |

| 2014 | $140,000 | $70,000 | $70,000 |

Homework Sourse

Homework Sourse