he iser Import favorites Ogivy Company manutachures and sell

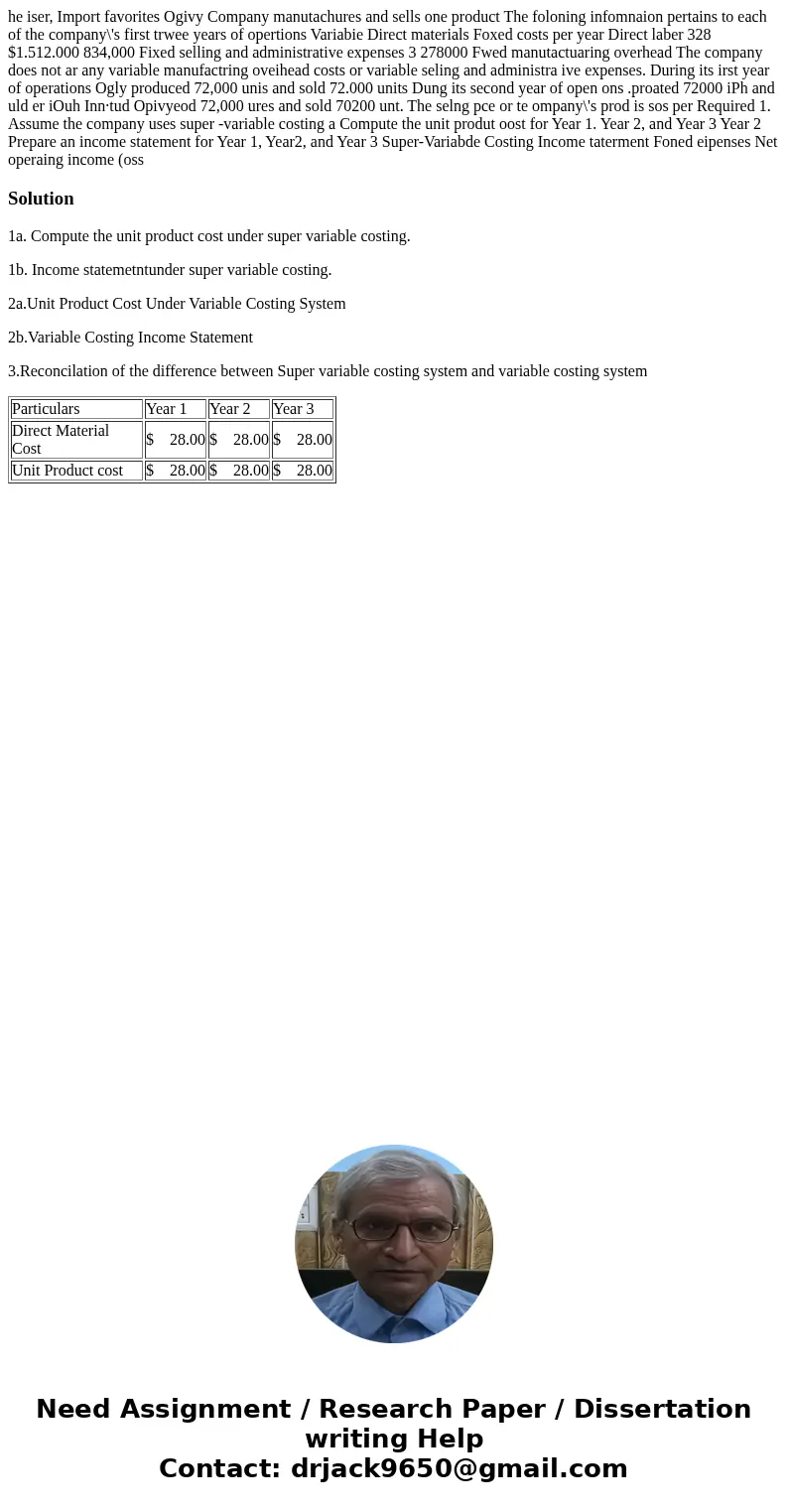

he iser, Import favorites Ogivy Company manutachures and sells one product The foloning infomnaion pertains to each of the company\'s first trwee years of opertions Variabie Direct materials Foxed costs per year Direct laber 328 $1.512.000 834,000 Fixed selling and administrative expenses 3 278000 Fwed manutactuaring overhead The company does not ar any variable manufactring oveihead costs or variable seling and administra ive expenses. During its irst year of operations Ogly produced 72,000 unis and sold 72.000 units Dung its second year of open ons .proated 72000 iPh and uld er iOuh Inn·tud Opivyeod 72,000 ures and sold 70200 unt. The selng pce or te ompany\'s prod is sos per Required 1. Assume the company uses super -variable costing a Compute the unit produt oost for Year 1. Year 2, and Year 3 Year 2 Prepare an income statement for Year 1, Year2, and Year 3 Super-Variabde Costing Income taterment Foned eipenses Net operaing income (oss

Solution

1a. Compute the unit product cost under super variable costing.

1b. Income statemetntunder super variable costing.

2a.Unit Product Cost Under Variable Costing System

2b.Variable Costing Income Statement

3.Reconcilation of the difference between Super variable costing system and variable costing system

| Particulars | Year 1 | Year 2 | Year 3 |

| Direct Material Cost | $ 28.00 | $ 28.00 | $ 28.00 |

| Unit Product cost | $ 28.00 | $ 28.00 | $ 28.00 |

Homework Sourse

Homework Sourse