per Sat 115 AM a D akeAssignmentMaindoinvokerassignme a

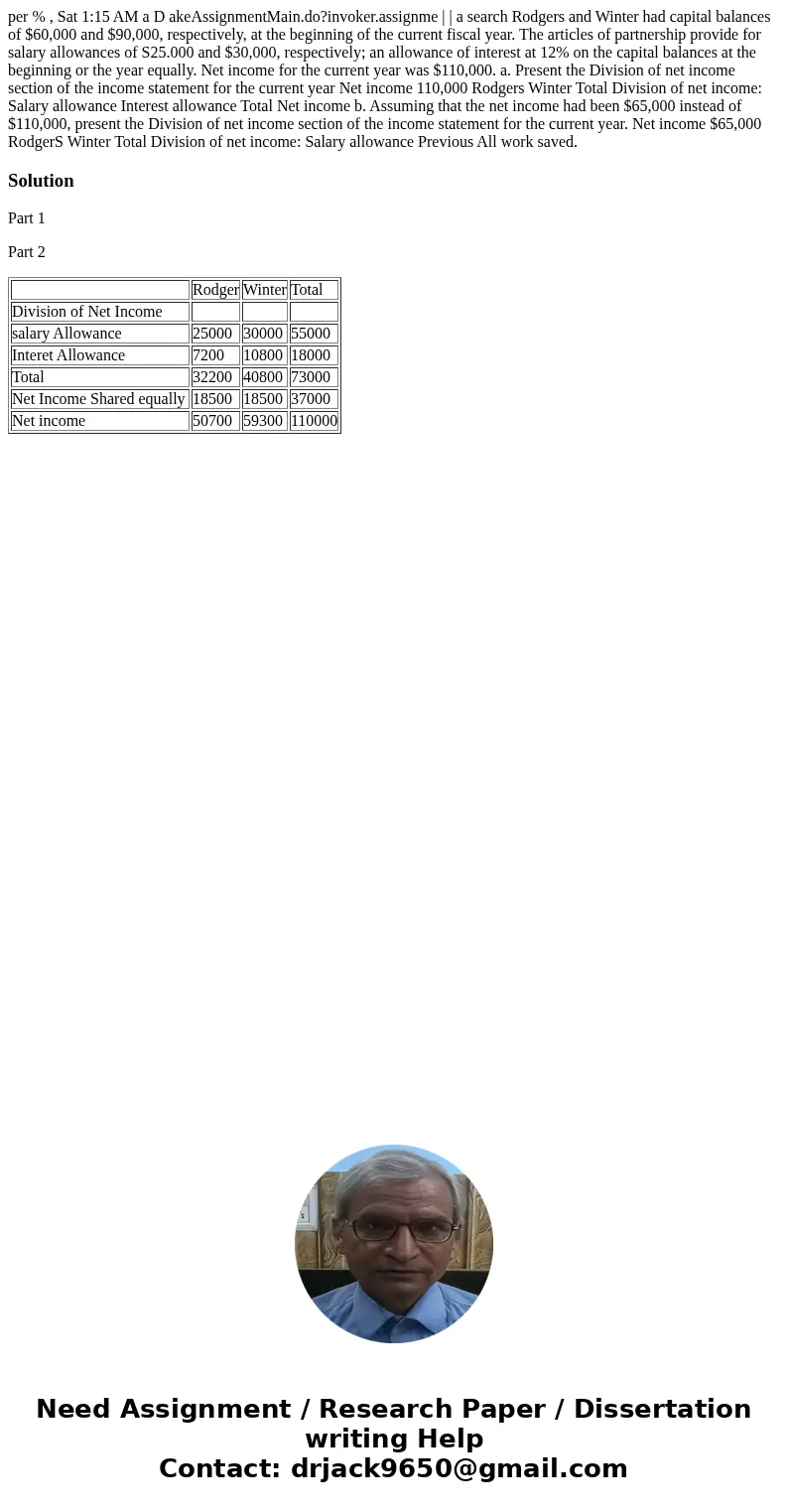

per % , Sat 1:15 AM a D akeAssignmentMain.do?invoker.assignme | | a search Rodgers and Winter had capital balances of $60,000 and $90,000, respectively, at the beginning of the current fiscal year. The articles of partnership provide for salary allowances of S25.000 and $30,000, respectively; an allowance of interest at 12% on the capital balances at the beginning or the year equally. Net income for the current year was $110,000. a. Present the Division of net income section of the income statement for the current year Net income 110,000 Rodgers Winter Total Division of net income: Salary allowance Interest allowance Total Net income b. Assuming that the net income had been $65,000 instead of $110,000, present the Division of net income section of the income statement for the current year. Net income $65,000 RodgerS Winter Total Division of net income: Salary allowance Previous All work saved.

Solution

Part 1

Part 2

| Rodger | Winter | Total | |

| Division of Net Income | |||

| salary Allowance | 25000 | 30000 | 55000 |

| Interet Allowance | 7200 | 10800 | 18000 |

| Total | 32200 | 40800 | 73000 |

| Net Income Shared equally | 18500 | 18500 | 37000 |

| Net income | 50700 | 59300 | 110000 |

Homework Sourse

Homework Sourse