History Bookmarks Window Help nbox 6847 messages 1794 uneead

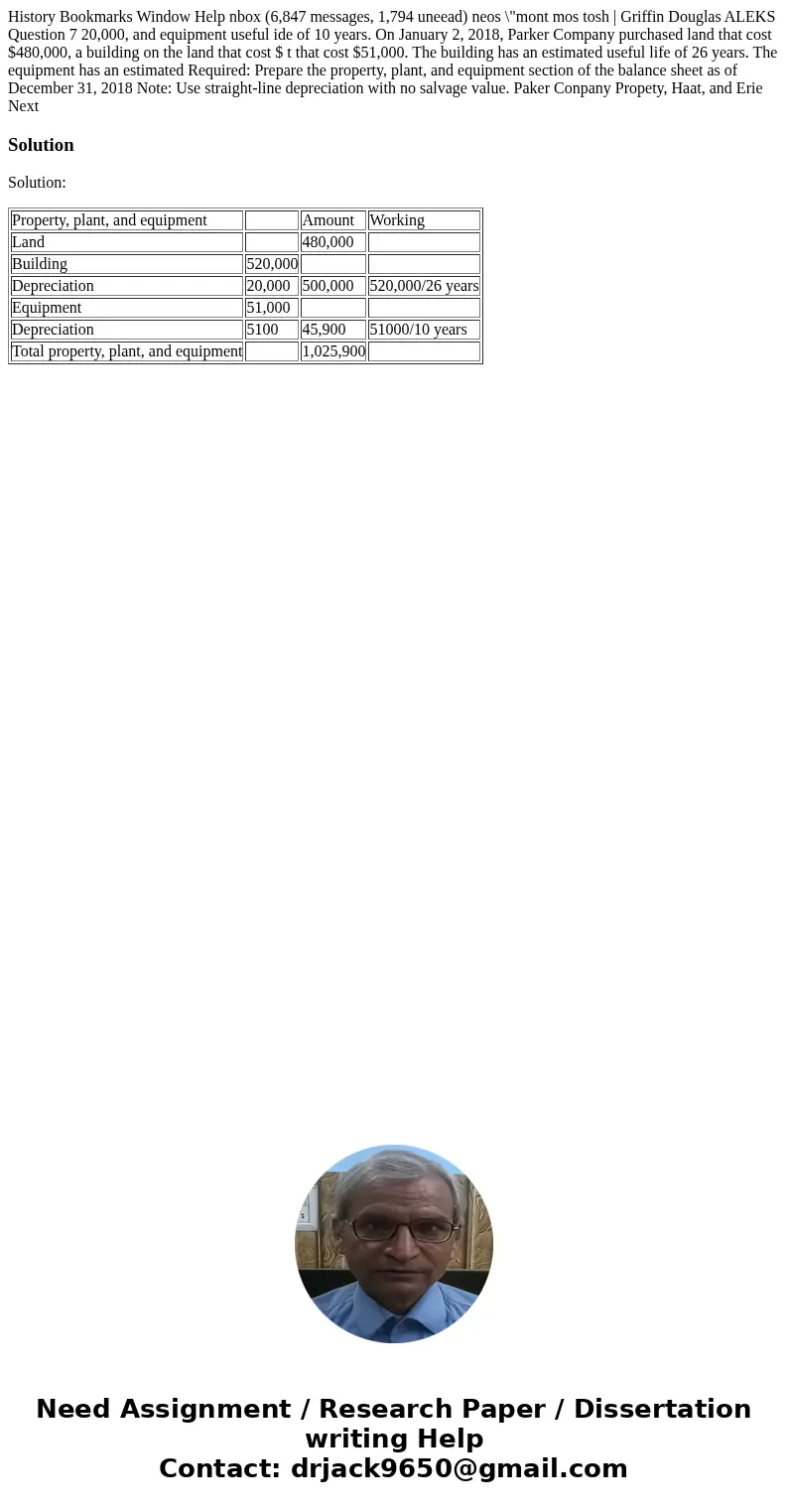

History Bookmarks Window Help nbox (6,847 messages, 1,794 uneead) neos \"mont mos tosh | Griffin Douglas ALEKS Question 7 20,000, and equipment useful ide of 10 years. On January 2, 2018, Parker Company purchased land that cost $480,000, a building on the land that cost $ t that cost $51,000. The building has an estimated useful life of 26 years. The equipment has an estimated Required: Prepare the property, plant, and equipment section of the balance sheet as of December 31, 2018 Note: Use straight-line depreciation with no salvage value. Paker Conpany Propety, Haat, and Erie Next

Solution

Solution:

| Property, plant, and equipment | Amount | Working | |

| Land | 480,000 | ||

| Building | 520,000 | ||

| Depreciation | 20,000 | 500,000 | 520,000/26 years |

| Equipment | 51,000 | ||

| Depreciation | 5100 | 45,900 | 51000/10 years |

| Total property, plant, and equipment | 1,025,900 |

Homework Sourse

Homework Sourse