Madison Company has the following information available Amou

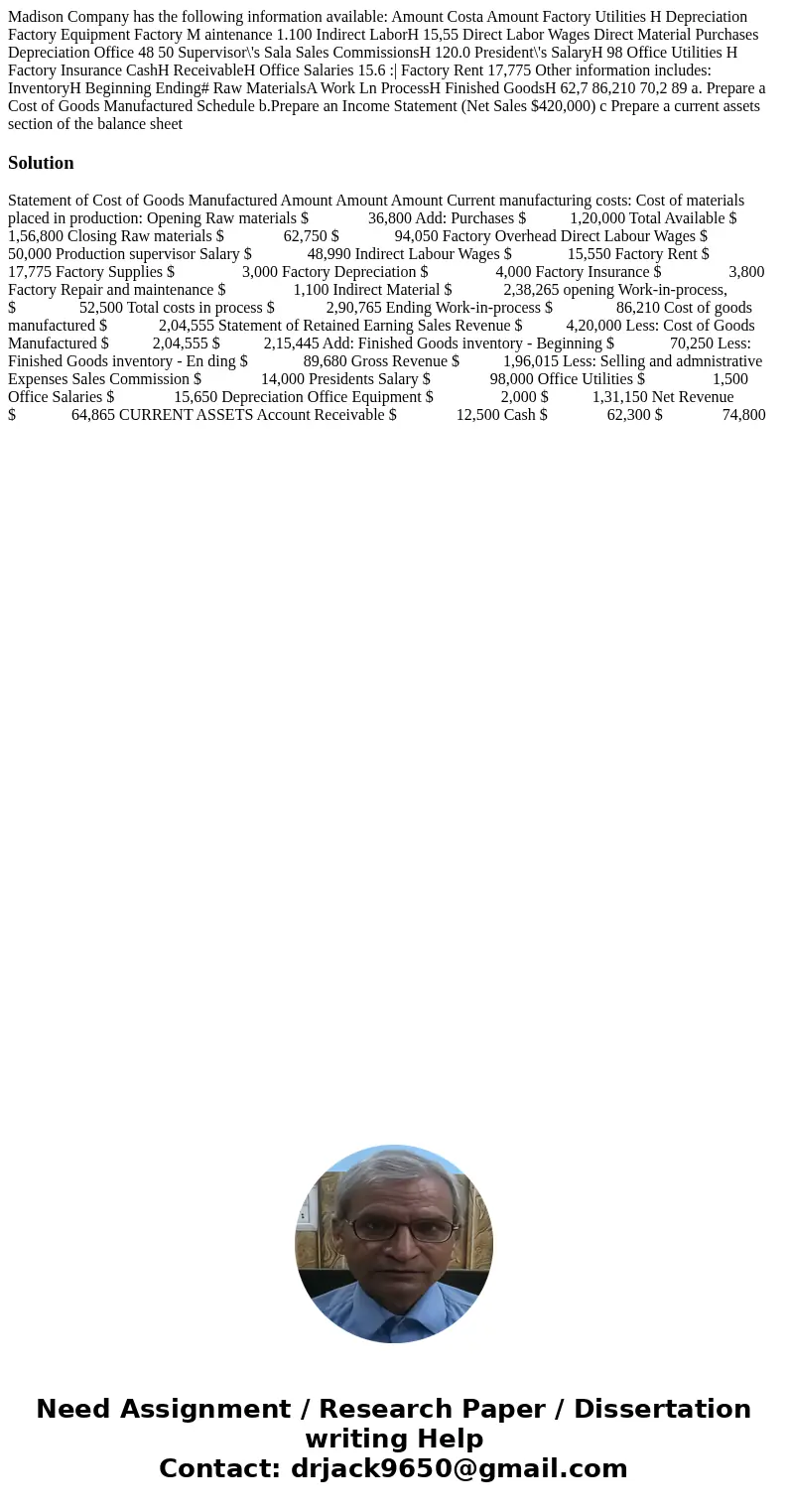

Madison Company has the following information available: Amount Costa Amount Factory Utilities H Depreciation Factory Equipment Factory M aintenance 1.100 Indirect LaborH 15,55 Direct Labor Wages Direct Material Purchases Depreciation Office 48 50 Supervisor\'s Sala Sales CommissionsH 120.0 President\'s SalaryH 98 Office Utilities H Factory Insurance CashH ReceivableH Office Salaries 15.6 :| Factory Rent 17,775 Other information includes: InventoryH Beginning Ending# Raw MaterialsA Work Ln ProcessH Finished GoodsH 62,7 86,210 70,2 89 a. Prepare a Cost of Goods Manufactured Schedule b.Prepare an Income Statement (Net Sales $420,000) c Prepare a current assets section of the balance sheet

Solution

Statement of Cost of Goods Manufactured Amount Amount Amount Current manufacturing costs: Cost of materials placed in production: Opening Raw materials $ 36,800 Add: Purchases $ 1,20,000 Total Available $ 1,56,800 Closing Raw materials $ 62,750 $ 94,050 Factory Overhead Direct Labour Wages $ 50,000 Production supervisor Salary $ 48,990 Indirect Labour Wages $ 15,550 Factory Rent $ 17,775 Factory Supplies $ 3,000 Factory Depreciation $ 4,000 Factory Insurance $ 3,800 Factory Repair and maintenance $ 1,100 Indirect Material $ 2,38,265 opening Work-in-process, $ 52,500 Total costs in process $ 2,90,765 Ending Work-in-process $ 86,210 Cost of goods manufactured $ 2,04,555 Statement of Retained Earning Sales Revenue $ 4,20,000 Less: Cost of Goods Manufactured $ 2,04,555 $ 2,15,445 Add: Finished Goods inventory - Beginning $ 70,250 Less: Finished Goods inventory - En ding $ 89,680 Gross Revenue $ 1,96,015 Less: Selling and admnistrative Expenses Sales Commission $ 14,000 Presidents Salary $ 98,000 Office Utilities $ 1,500 Office Salaries $ 15,650 Depreciation Office Equipment $ 2,000 $ 1,31,150 Net Revenue $ 64,865 CURRENT ASSETS Account Receivable $ 12,500 Cash $ 62,300 $ 74,800

Homework Sourse

Homework Sourse