Woodwick Company issues 9 fiveyear bonds on December 31 2014

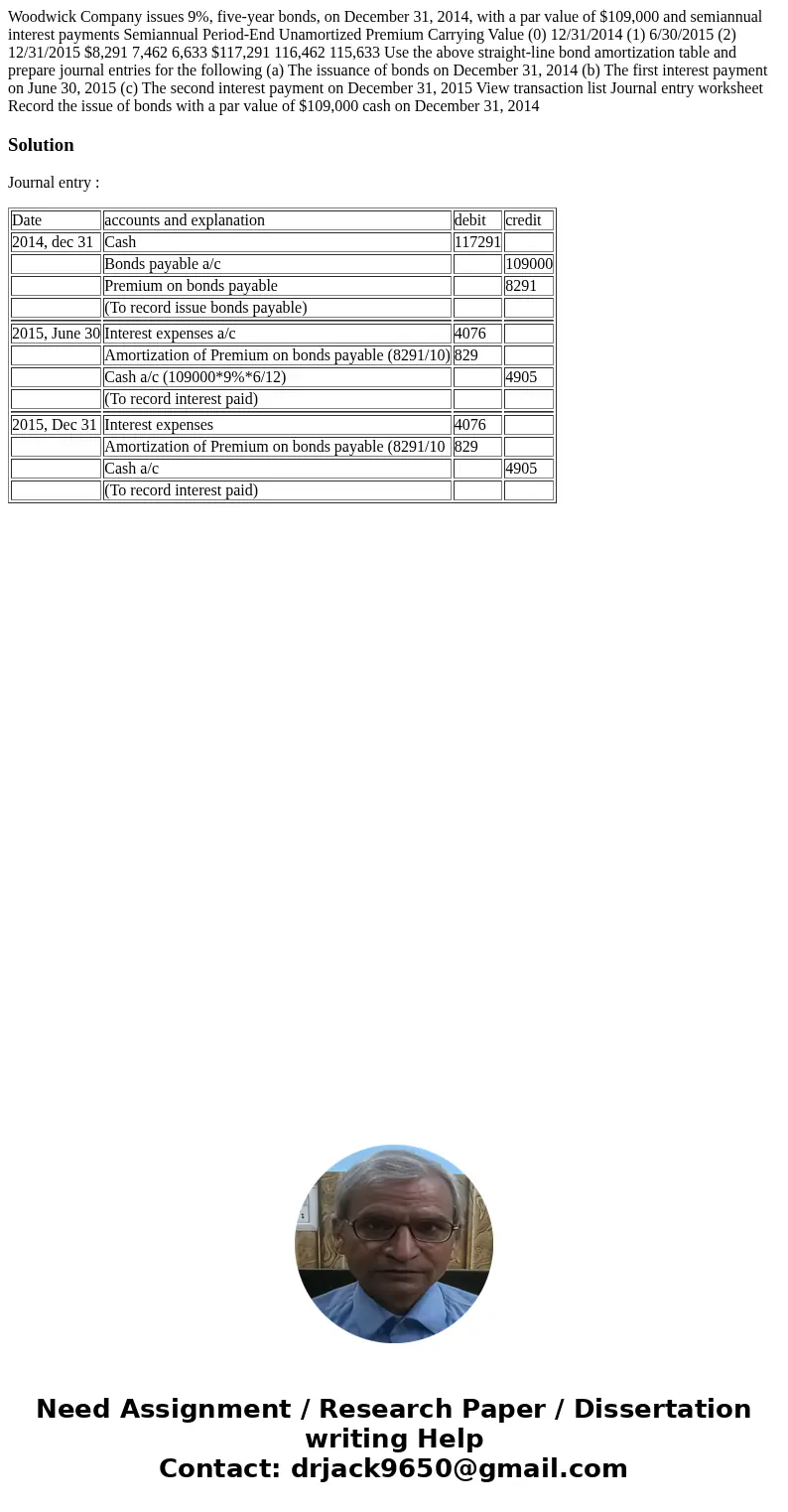

Woodwick Company issues 9%, five-year bonds, on December 31, 2014, with a par value of $109,000 and semiannual interest payments Semiannual Period-End Unamortized Premium Carrying Value (0) 12/31/2014 (1) 6/30/2015 (2) 12/31/2015 $8,291 7,462 6,633 $117,291 116,462 115,633 Use the above straight-line bond amortization table and prepare journal entries for the following (a) The issuance of bonds on December 31, 2014 (b) The first interest payment on June 30, 2015 (c) The second interest payment on December 31, 2015 View transaction list Journal entry worksheet Record the issue of bonds with a par value of $109,000 cash on December 31, 2014

Solution

Journal entry :

| Date | accounts and explanation | debit | credit |

| 2014, dec 31 | Cash | 117291 | |

| Bonds payable a/c | 109000 | ||

| Premium on bonds payable | 8291 | ||

| (To record issue bonds payable) | |||

| 2015, June 30 | Interest expenses a/c | 4076 | |

| Amortization of Premium on bonds payable (8291/10) | 829 | ||

| Cash a/c (109000*9%*6/12) | 4905 | ||

| (To record interest paid) | |||

| 2015, Dec 31 | Interest expenses | 4076 | |

| Amortization of Premium on bonds payable (8291/10 | 829 | ||

| Cash a/c | 4905 | ||

| (To record interest paid) |

Homework Sourse

Homework Sourse