On January 1 2017 Leahy Corp paid 600000 to acquire Fischer

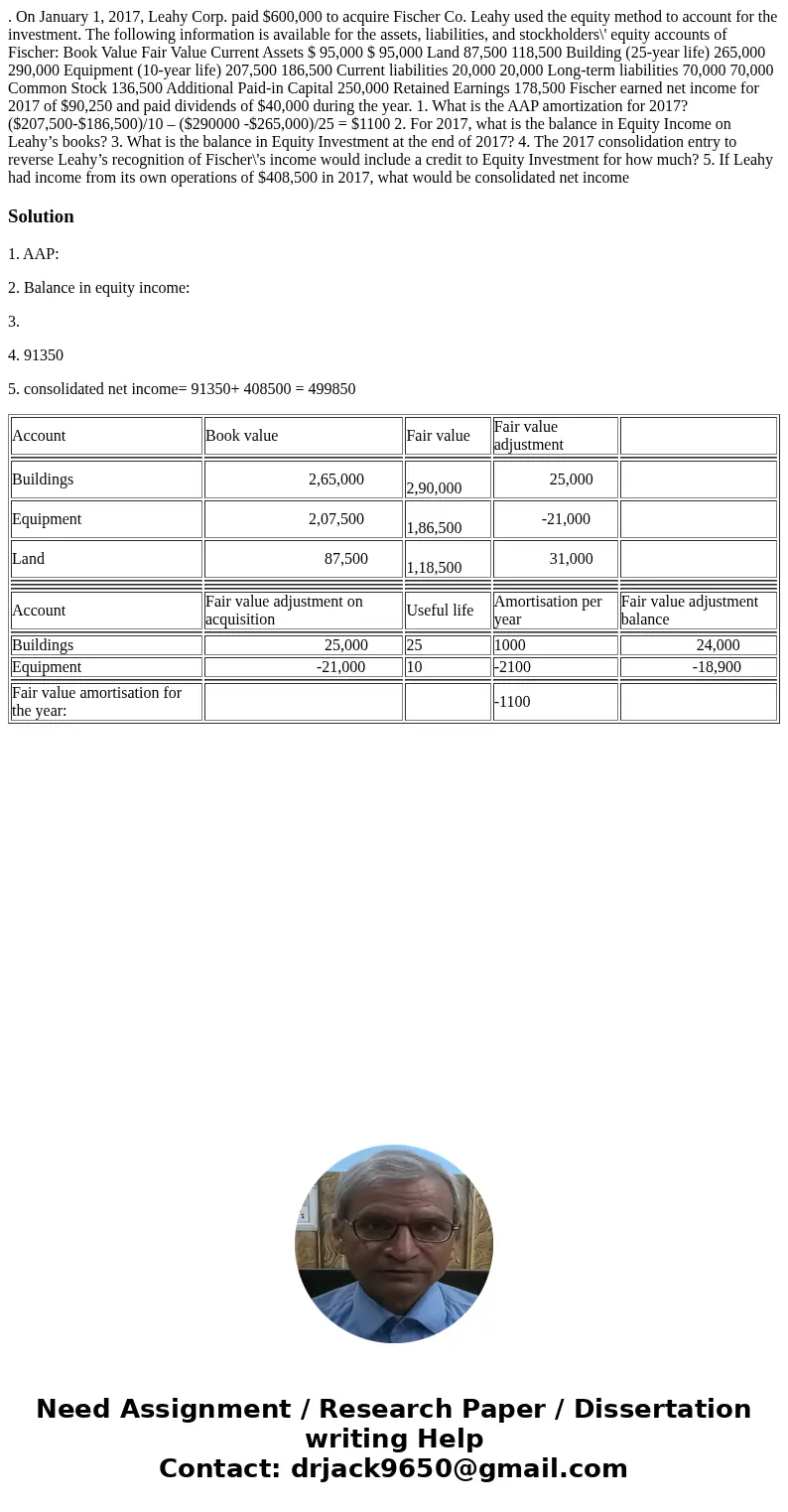

. On January 1, 2017, Leahy Corp. paid $600,000 to acquire Fischer Co. Leahy used the equity method to account for the investment. The following information is available for the assets, liabilities, and stockholders\' equity accounts of Fischer: Book Value Fair Value Current Assets $ 95,000 $ 95,000 Land 87,500 118,500 Building (25-year life) 265,000 290,000 Equipment (10-year life) 207,500 186,500 Current liabilities 20,000 20,000 Long-term liabilities 70,000 70,000 Common Stock 136,500 Additional Paid-in Capital 250,000 Retained Earnings 178,500 Fischer earned net income for 2017 of $90,250 and paid dividends of $40,000 during the year. 1. What is the AAP amortization for 2017? ($207,500-$186,500)/10 – ($290000 -$265,000)/25 = $1100 2. For 2017, what is the balance in Equity Income on Leahy’s books? 3. What is the balance in Equity Investment at the end of 2017? 4. The 2017 consolidation entry to reverse Leahy’s recognition of Fischer\'s income would include a credit to Equity Investment for how much? 5. If Leahy had income from its own operations of $408,500 in 2017, what would be consolidated net income

Solution

1. AAP:

2. Balance in equity income:

3.

4. 91350

5. consolidated net income= 91350+ 408500 = 499850

| Account | Book value | Fair value | Fair value adjustment | |

| Buildings | 2,65,000 | 2,90,000 | 25,000 | |

| Equipment | 2,07,500 | 1,86,500 | -21,000 | |

| Land | 87,500 | 1,18,500 | 31,000 | |

| Account | Fair value adjustment on acquisition | Useful life | Amortisation per year | Fair value adjustment balance |

| Buildings | 25,000 | 25 | 1000 | 24,000 |

| Equipment | -21,000 | 10 | -2100 | -18,900 |

| Fair value amortisation for the year: | -1100 |

Homework Sourse

Homework Sourse