one job in process Job 120 as of June 30 at thet time its jo

one job in process (Job 120) as of June 30, at thet time. its job cost sheet reports direct materials of $6.200 and applied overhead of $2520. Custom Cabinetry applies overhead at the rate of 9d% of direct labor Custom C During July. Job 120 is sold (on account for $26,000. Job 121 is started and completed, and Job 122 is started and suill in process et the end of the month Custom Cabinetry incurs the following costs during July Direct materials Direct labo Overheed applied $1,1a8 58,600 $2.600 $12,388 3,600 4,a0 2,280 1a,608 1. Propare journal entries for the following in Juh . Direct materials used in production b. Direct iabor used in production c. Overheatd app ed d The sale of Job 120 Cost of goode sold for job t20 2. Campute the July 31 aiences of the Work.ir Process inyentoly end the Finished Goods Inventory genere edger accounts Ase mere erg ro jobs n Finished Goods inventory e, o,une 301 ete this question by entering your answers in the tabs below e hry 31 bsences of the work process theentory and th4 Frisned Goods Inventory general iedaer accounts: Asure there arens jobs in Finished Goods Inventory aF of Jue 30.) Process Finished Goods

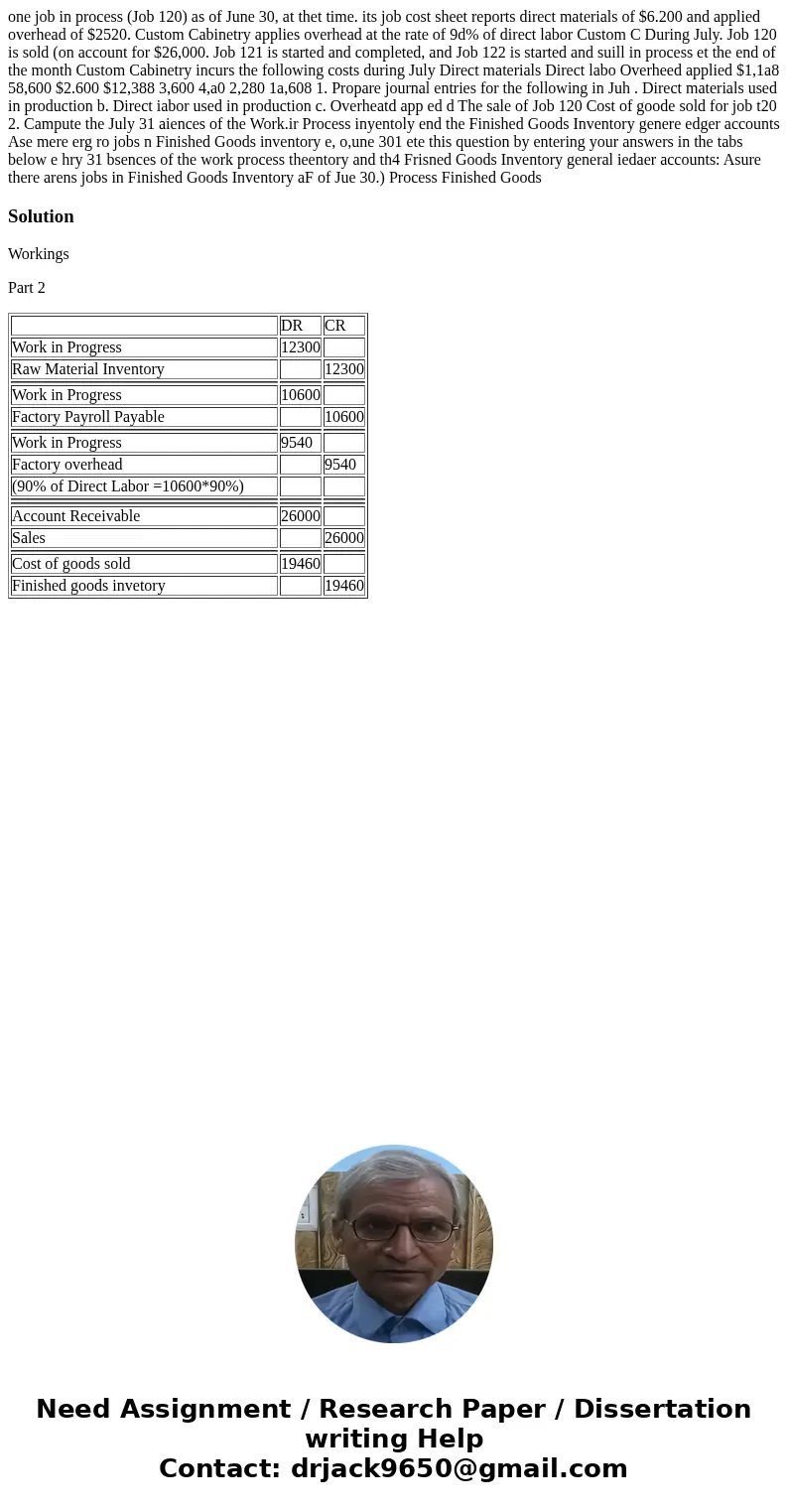

Solution

Workings

Part 2

| DR | CR | |

| Work in Progress | 12300 | |

| Raw Material Inventory | 12300 | |

| Work in Progress | 10600 | |

| Factory Payroll Payable | 10600 | |

| Work in Progress | 9540 | |

| Factory overhead | 9540 | |

| (90% of Direct Labor =10600*90%) | ||

| Account Receivable | 26000 | |

| Sales | 26000 | |

| Cost of goods sold | 19460 | |

| Finished goods invetory | 19460 |

Homework Sourse

Homework Sourse