You are evaluating a project for The Ultimate recreational t

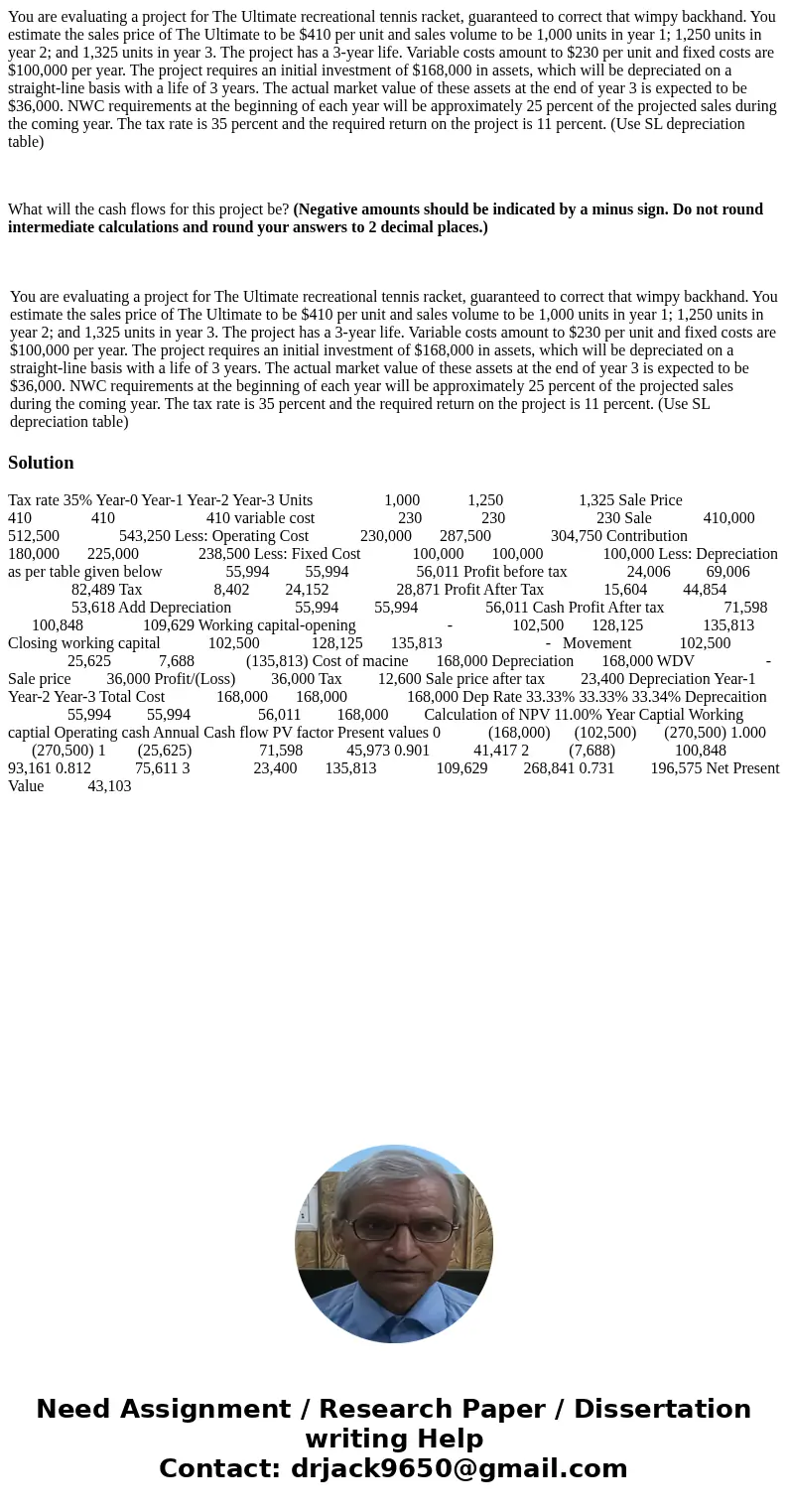

You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $410 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $230 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $168,000 in assets, which will be depreciated on a straight-line basis with a life of 3 years. The actual market value of these assets at the end of year 3 is expected to be $36,000. NWC requirements at the beginning of each year will be approximately 25 percent of the projected sales during the coming year. The tax rate is 35 percent and the required return on the project is 11 percent. (Use SL depreciation table)

What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places.)

| You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $410 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $230 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $168,000 in assets, which will be depreciated on a straight-line basis with a life of 3 years. The actual market value of these assets at the end of year 3 is expected to be $36,000. NWC requirements at the beginning of each year will be approximately 25 percent of the projected sales during the coming year. The tax rate is 35 percent and the required return on the project is 11 percent. (Use SL depreciation table) |

Solution

Tax rate 35% Year-0 Year-1 Year-2 Year-3 Units 1,000 1,250 1,325 Sale Price 410 410 410 variable cost 230 230 230 Sale 410,000 512,500 543,250 Less: Operating Cost 230,000 287,500 304,750 Contribution 180,000 225,000 238,500 Less: Fixed Cost 100,000 100,000 100,000 Less: Depreciation as per table given below 55,994 55,994 56,011 Profit before tax 24,006 69,006 82,489 Tax 8,402 24,152 28,871 Profit After Tax 15,604 44,854 53,618 Add Depreciation 55,994 55,994 56,011 Cash Profit After tax 71,598 100,848 109,629 Working capital-opening - 102,500 128,125 135,813 Closing working capital 102,500 128,125 135,813 - Movement 102,500 25,625 7,688 (135,813) Cost of macine 168,000 Depreciation 168,000 WDV - Sale price 36,000 Profit/(Loss) 36,000 Tax 12,600 Sale price after tax 23,400 Depreciation Year-1 Year-2 Year-3 Total Cost 168,000 168,000 168,000 Dep Rate 33.33% 33.33% 33.34% Deprecaition 55,994 55,994 56,011 168,000 Calculation of NPV 11.00% Year Captial Working captial Operating cash Annual Cash flow PV factor Present values 0 (168,000) (102,500) (270,500) 1.000 (270,500) 1 (25,625) 71,598 45,973 0.901 41,417 2 (7,688) 100,848 93,161 0.812 75,611 3 23,400 135,813 109,629 268,841 0.731 196,575 Net Present Value 43,103

Homework Sourse

Homework Sourse