Cengage CengageNowy2 Onlir e Chegg Study Guided Solut v LT

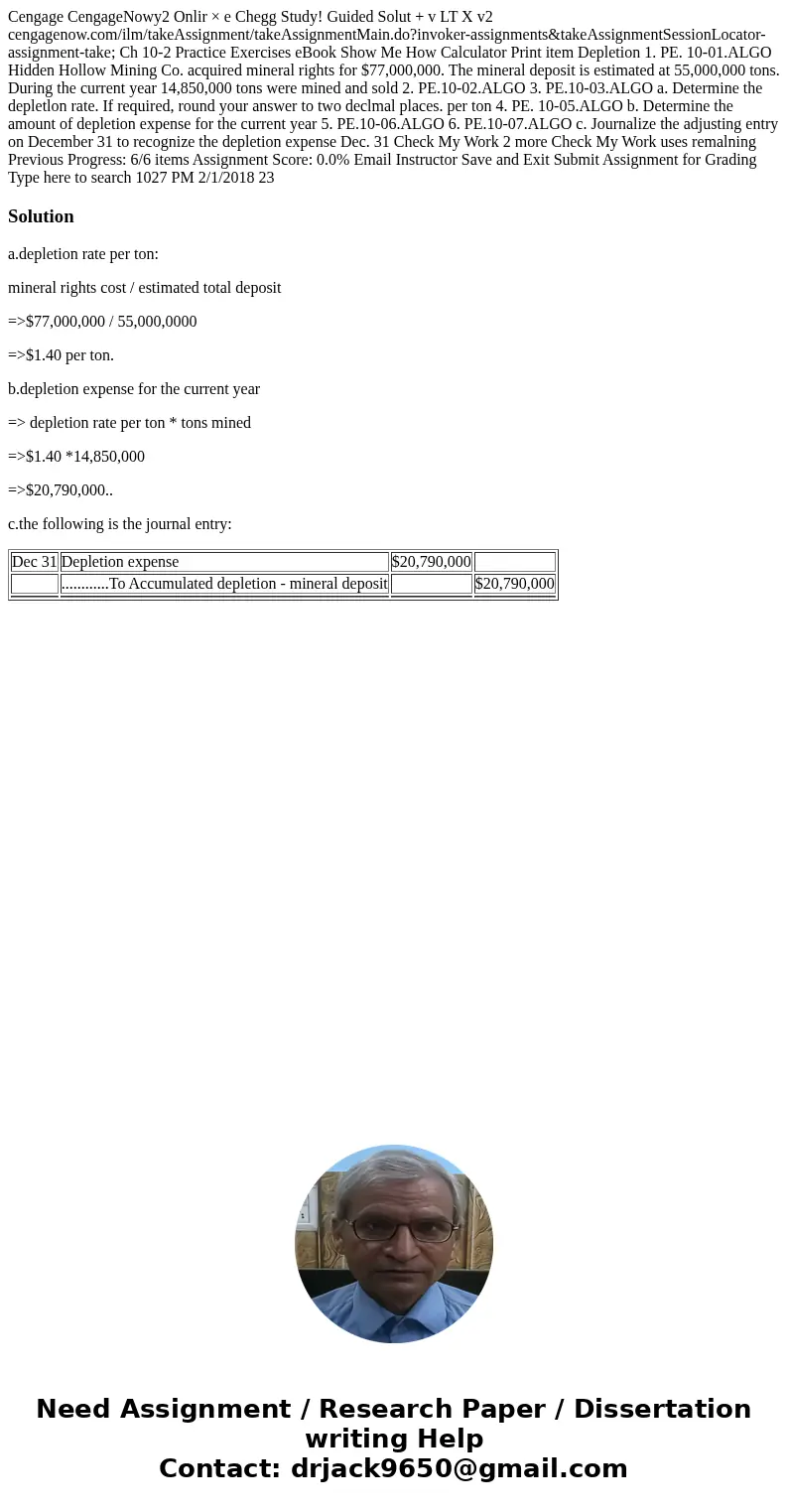

Cengage CengageNowy2 Onlir × e Chegg Study! Guided Solut + v LT X v2 cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator-assignment-take; Ch 10-2 Practice Exercises eBook Show Me How Calculator Print item Depletion 1. PE. 10-01.ALGO Hidden Hollow Mining Co. acquired mineral rights for $77,000,000. The mineral deposit is estimated at 55,000,000 tons. During the current year 14,850,000 tons were mined and sold 2. PE.10-02.ALGO 3. PE.10-03.ALGO a. Determine the depletlon rate. If required, round your answer to two declmal places. per ton 4. PE. 10-05.ALGO b. Determine the amount of depletion expense for the current year 5. PE.10-06.ALGO 6. PE.10-07.ALGO c. Journalize the adjusting entry on December 31 to recognize the depletion expense Dec. 31 Check My Work 2 more Check My Work uses remalning Previous Progress: 6/6 items Assignment Score: 0.0% Email Instructor Save and Exit Submit Assignment for Grading Type here to search 1027 PM 2/1/2018 23

Solution

a.depletion rate per ton:

mineral rights cost / estimated total deposit

=>$77,000,000 / 55,000,0000

=>$1.40 per ton.

b.depletion expense for the current year

=> depletion rate per ton * tons mined

=>$1.40 *14,850,000

=>$20,790,000..

c.the following is the journal entry:

| Dec 31 | Depletion expense | $20,790,000 | |

| ............To Accumulated depletion - mineral deposit | $20,790,000 | ||

Homework Sourse

Homework Sourse