Value Vintage Corp is a secondhand thrift store During the D

Value Vintage Corp. is a second-hand thrift store. During the December 31, 2018 fiscal year end, the following accounts appeared in two of its trial balances:

Unadjusted

Adjusted

Accounts payable

$ 79,300

$ 79,300

Accounts receivable

95,300

95,300

Accumulated depreciation—building

42,100

52,500

Accumulated depreciation—equipment

29,600

42,900

Buildings

190,000

190,000

Cash

68,000

68,000

Common shares

160,000

160,000

Cost of goods sold

412,700

412,700

Depreciation expense

0

23,700

Dividends

28,000

28,000

Equipment

110,000

110,000

Insurance expense

0

7,200

Interest expense

3,000

11,000

Interest income

4,000

4,000

Interest payable

0

8,000

Inventory

75,000

75,000

Mortgage payable

80,000

80,000

Prepaid insurance

9,600

2,400

Property tax expense

0

4,800

Property tax payable

0

4,800

Retained earnings

16,600

16,600

Salaries and wages expense

108,000

108,000

Sales commission expense

11,000

14,500

Sales commission payable

0

3,500

Sales returns and allowances

8,000

8,000

Sales revenue

718,000

718,000

Utilities expense

11,000

11,000

Analysis information pertaining to the accounts are as follows:

- Insurance expense and utilities expense are 60% selling and 40% administrative.

- In the next year, $20,000 of the mortgage payable will be due for payment.

- Property tax expense and depreciation on the building are administrative expenses; depreciation on the equipment is a selling expense; and $32,000 of the salaries and wages expense related to office salaries and the remainder related to sales salaries. Depreciation expense includes $10,400 relating to the building and $13,300 relating to equipment.

Required

1. Journalize the adjusting entries. (2 marks/entry x 6=12)

2. Journalize the closing entries. (8 marks [-2 per entry error])

3. Prepare a classified balance sheet. (20 marks [-2 per error])

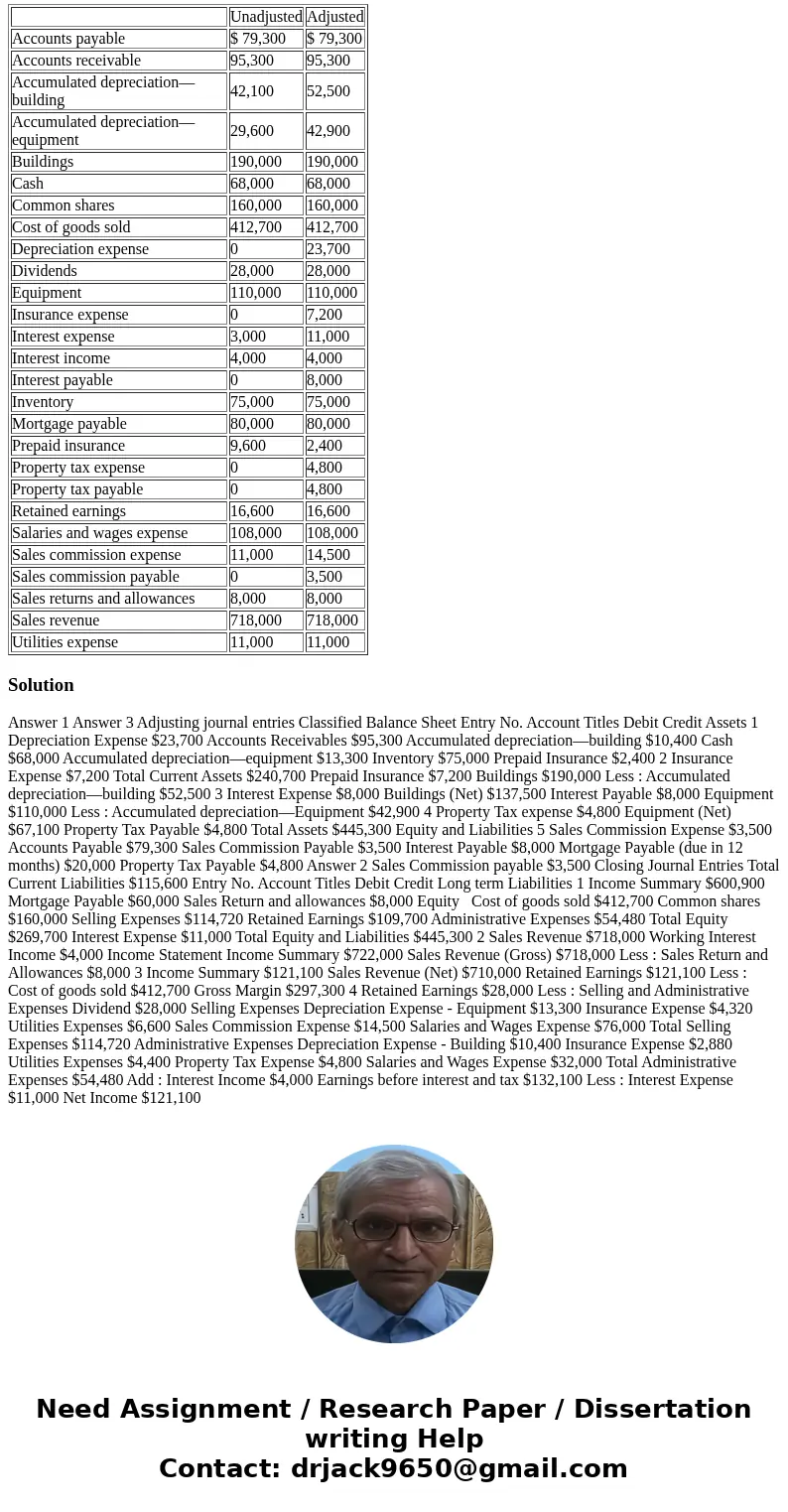

| Unadjusted | Adjusted | |

| Accounts payable | $ 79,300 | $ 79,300 |

| Accounts receivable | 95,300 | 95,300 |

| Accumulated depreciation—building | 42,100 | 52,500 |

| Accumulated depreciation—equipment | 29,600 | 42,900 |

| Buildings | 190,000 | 190,000 |

| Cash | 68,000 | 68,000 |

| Common shares | 160,000 | 160,000 |

| Cost of goods sold | 412,700 | 412,700 |

| Depreciation expense | 0 | 23,700 |

| Dividends | 28,000 | 28,000 |

| Equipment | 110,000 | 110,000 |

| Insurance expense | 0 | 7,200 |

| Interest expense | 3,000 | 11,000 |

| Interest income | 4,000 | 4,000 |

| Interest payable | 0 | 8,000 |

| Inventory | 75,000 | 75,000 |

| Mortgage payable | 80,000 | 80,000 |

| Prepaid insurance | 9,600 | 2,400 |

| Property tax expense | 0 | 4,800 |

| Property tax payable | 0 | 4,800 |

| Retained earnings | 16,600 | 16,600 |

| Salaries and wages expense | 108,000 | 108,000 |

| Sales commission expense | 11,000 | 14,500 |

| Sales commission payable | 0 | 3,500 |

| Sales returns and allowances | 8,000 | 8,000 |

| Sales revenue | 718,000 | 718,000 |

| Utilities expense | 11,000 | 11,000 |

Solution

Answer 1 Answer 3 Adjusting journal entries Classified Balance Sheet Entry No. Account Titles Debit Credit Assets 1 Depreciation Expense $23,700 Accounts Receivables $95,300 Accumulated depreciation—building $10,400 Cash $68,000 Accumulated depreciation—equipment $13,300 Inventory $75,000 Prepaid Insurance $2,400 2 Insurance Expense $7,200 Total Current Assets $240,700 Prepaid Insurance $7,200 Buildings $190,000 Less : Accumulated depreciation—building $52,500 3 Interest Expense $8,000 Buildings (Net) $137,500 Interest Payable $8,000 Equipment $110,000 Less : Accumulated depreciation—Equipment $42,900 4 Property Tax expense $4,800 Equipment (Net) $67,100 Property Tax Payable $4,800 Total Assets $445,300 Equity and Liabilities 5 Sales Commission Expense $3,500 Accounts Payable $79,300 Sales Commission Payable $3,500 Interest Payable $8,000 Mortgage Payable (due in 12 months) $20,000 Property Tax Payable $4,800 Answer 2 Sales Commission payable $3,500 Closing Journal Entries Total Current Liabilities $115,600 Entry No. Account Titles Debit Credit Long term Liabilities 1 Income Summary $600,900 Mortgage Payable $60,000 Sales Return and allowances $8,000 Equity Cost of goods sold $412,700 Common shares $160,000 Selling Expenses $114,720 Retained Earnings $109,700 Administrative Expenses $54,480 Total Equity $269,700 Interest Expense $11,000 Total Equity and Liabilities $445,300 2 Sales Revenue $718,000 Working Interest Income $4,000 Income Statement Income Summary $722,000 Sales Revenue (Gross) $718,000 Less : Sales Return and Allowances $8,000 3 Income Summary $121,100 Sales Revenue (Net) $710,000 Retained Earnings $121,100 Less : Cost of goods sold $412,700 Gross Margin $297,300 4 Retained Earnings $28,000 Less : Selling and Administrative Expenses Dividend $28,000 Selling Expenses Depreciation Expense - Equipment $13,300 Insurance Expense $4,320 Utilities Expenses $6,600 Sales Commission Expense $14,500 Salaries and Wages Expense $76,000 Total Selling Expenses $114,720 Administrative Expenses Depreciation Expense - Building $10,400 Insurance Expense $2,880 Utilities Expenses $4,400 Property Tax Expense $4,800 Salaries and Wages Expense $32,000 Total Administrative Expenses $54,480 Add : Interest Income $4,000 Earnings before interest and tax $132,100 Less : Interest Expense $11,000 Net Income $121,100

Homework Sourse

Homework Sourse