XYZ Companys target capital structure is 40 debt and 60 comm

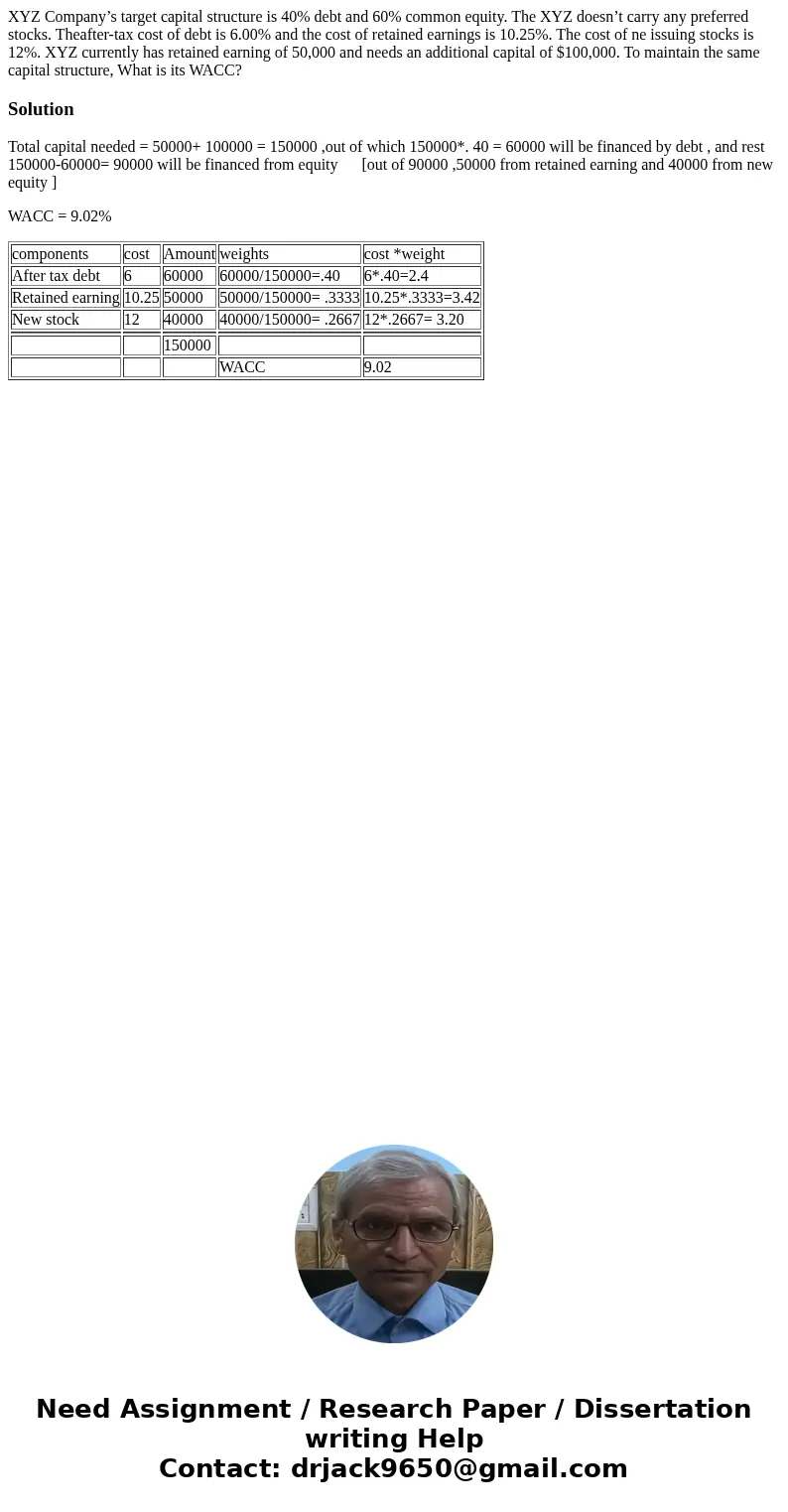

XYZ Company’s target capital structure is 40% debt and 60% common equity. The XYZ doesn’t carry any preferred stocks. Theafter-tax cost of debt is 6.00% and the cost of retained earnings is 10.25%. The cost of ne issuing stocks is 12%. XYZ currently has retained earning of 50,000 and needs an additional capital of $100,000. To maintain the same capital structure, What is its WACC?

Solution

Total capital needed = 50000+ 100000 = 150000 ,out of which 150000*. 40 = 60000 will be financed by debt , and rest 150000-60000= 90000 will be financed from equity [out of 90000 ,50000 from retained earning and 40000 from new equity ]

WACC = 9.02%

| components | cost | Amount | weights | cost *weight |

| After tax debt | 6 | 60000 | 60000/150000=.40 | 6*.40=2.4 |

| Retained earning | 10.25 | 50000 | 50000/150000= .3333 | 10.25*.3333=3.42 |

| New stock | 12 | 40000 | 40000/150000= .2667 | 12*.2667= 3.20 |

| 150000 | ||||

| WACC | 9.02 |

Homework Sourse

Homework Sourse