RESOURCES CAL CULATO Do It Review 151 During the curr ent mo

RESOURCES CAL CULATO Do It! Review 15-1 During the curr ent month, Wacholz Company incurs the following manufacturing costs (a) (b) (c) Purchased raw materials of $18,800 on account. Incurred factory labor of $41,300. of that Factory utilities of ise 15-3 ise 154 ise 15-5 ise 15-6 amount, $30,800 relates to wages payable and $10,500 relates to payroll taxes payable. paid 93.700 are payable, pre factory property taxes of $2,650 have expired, and depreciation on the factory building is $8,700. acturing cost. (Credit account titles are automatically indented when amount is entered. Do not indent manually) No. Account Titles and Explanation Debit Credit (Purchases of raw materials on account) 52A (To record factory labor costs) ctive (To record overhead costs) Click if you would like to Show Work for this question: Open Show work LIST OF ACCOUNTS

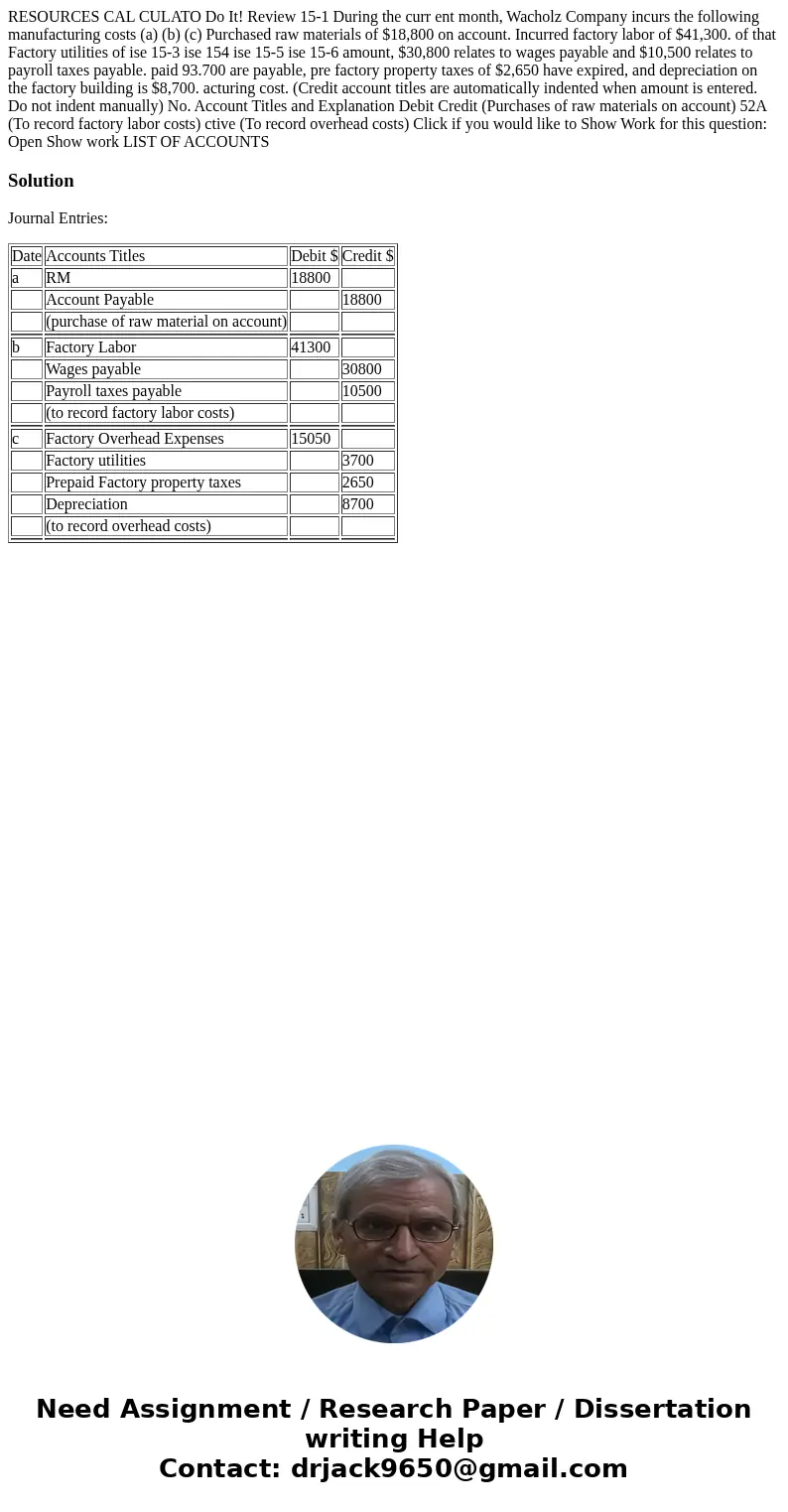

Solution

Journal Entries:

| Date | Accounts Titles | Debit $ | Credit $ |

| a | RM | 18800 | |

| Account Payable | 18800 | ||

| (purchase of raw material on account) | |||

| b | Factory Labor | 41300 | |

| Wages payable | 30800 | ||

| Payroll taxes payable | 10500 | ||

| (to record factory labor costs) | |||

| c | Factory Overhead Expenses | 15050 | |

| Factory utilities | 3700 | ||

| Prepaid Factory property taxes | 2650 | ||

| Depreciation | 8700 | ||

| (to record overhead costs) | |||

Homework Sourse

Homework Sourse