Using the appropriate present value table and assuming a 12

Using the appropriate present value table and assuming a 12% annual interest rate, determine the present value on December 31, 2016, of a five period annual annuity of $5,000 under each of the following situations: 1. The first payment is received on December 31, 2017, and interest is compounded annually. compounded annually compounded quarterly 2. The first payment is received on December 31, 2016, and interest is 3. The first payment is received on December 31, 2017, and interest is

Solution

1) Solution: $18,024

Working: PVA = $5,000 * 3.60478 = $18,024

2) Solution: $20,187

Working: PVAD = $5,000 * 4.03735 = $20,187

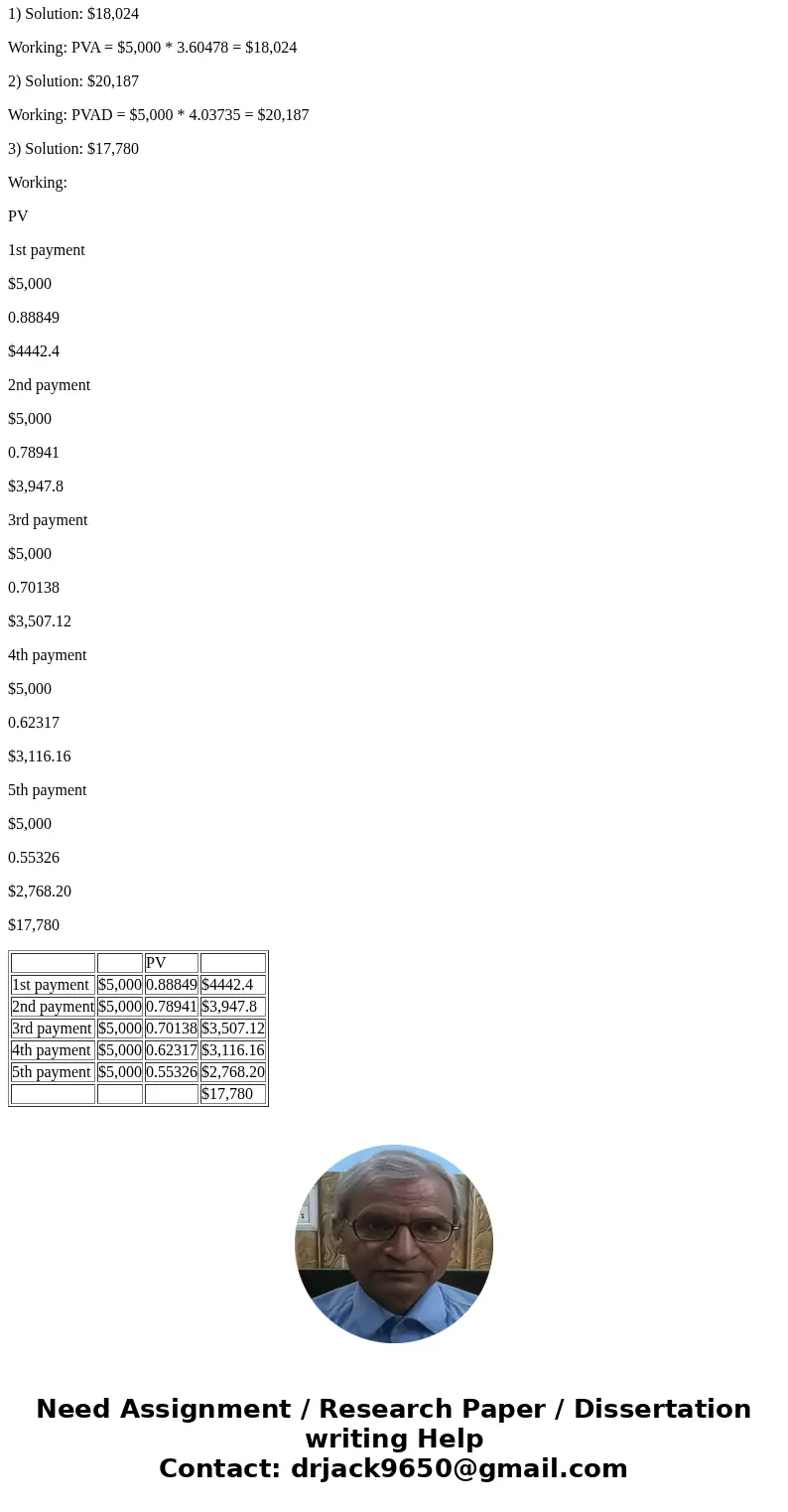

3) Solution: $17,780

Working:

PV

1st payment

$5,000

0.88849

$4442.4

2nd payment

$5,000

0.78941

$3,947.8

3rd payment

$5,000

0.70138

$3,507.12

4th payment

$5,000

0.62317

$3,116.16

5th payment

$5,000

0.55326

$2,768.20

$17,780

| PV | |||

| 1st payment | $5,000 | 0.88849 | $4442.4 |

| 2nd payment | $5,000 | 0.78941 | $3,947.8 |

| 3rd payment | $5,000 | 0.70138 | $3,507.12 |

| 4th payment | $5,000 | 0.62317 | $3,116.16 |

| 5th payment | $5,000 | 0.55326 | $2,768.20 |

| $17,780 |

Homework Sourse

Homework Sourse