XYZ Co has 2350 bonds with a price of 925 15000 shares of pr

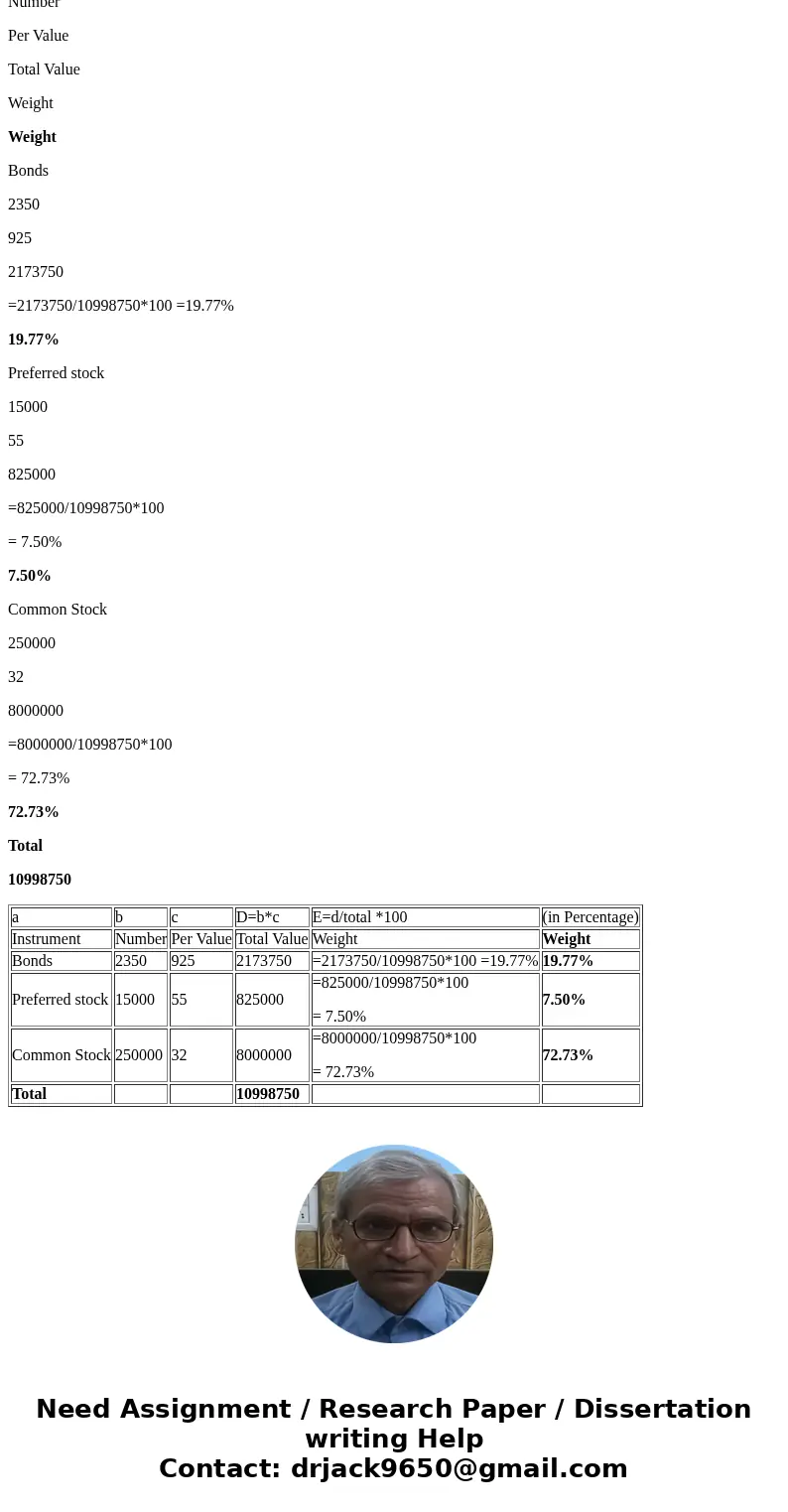

XYZ Co. has 2,350 bonds with a price of $925, 15,000 shares of preferred stock with a price of $55, and 250,000 share of common stock with a selling price of $32. Calculate the capital structure weights of bonds, preferred stock, and common stock, respectively.

Solution

a

b

c

D=b*c

E=d/total *100

(in Percentage)

Instrument

Number

Per Value

Total Value

Weight

Weight

Bonds

2350

925

2173750

=2173750/10998750*100 =19.77%

19.77%

Preferred stock

15000

55

825000

=825000/10998750*100

= 7.50%

7.50%

Common Stock

250000

32

8000000

=8000000/10998750*100

= 72.73%

72.73%

Total

10998750

| a | b | c | D=b*c | E=d/total *100 | (in Percentage) |

| Instrument | Number | Per Value | Total Value | Weight | Weight |

| Bonds | 2350 | 925 | 2173750 | =2173750/10998750*100 =19.77% | 19.77% |

| Preferred stock | 15000 | 55 | 825000 | =825000/10998750*100 = 7.50% | 7.50% |

| Common Stock | 250000 | 32 | 8000000 | =8000000/10998750*100 = 72.73% | 72.73% |

| Total | 10998750 |

Homework Sourse

Homework Sourse