How much do you have to deposit today in order to allow 9 an

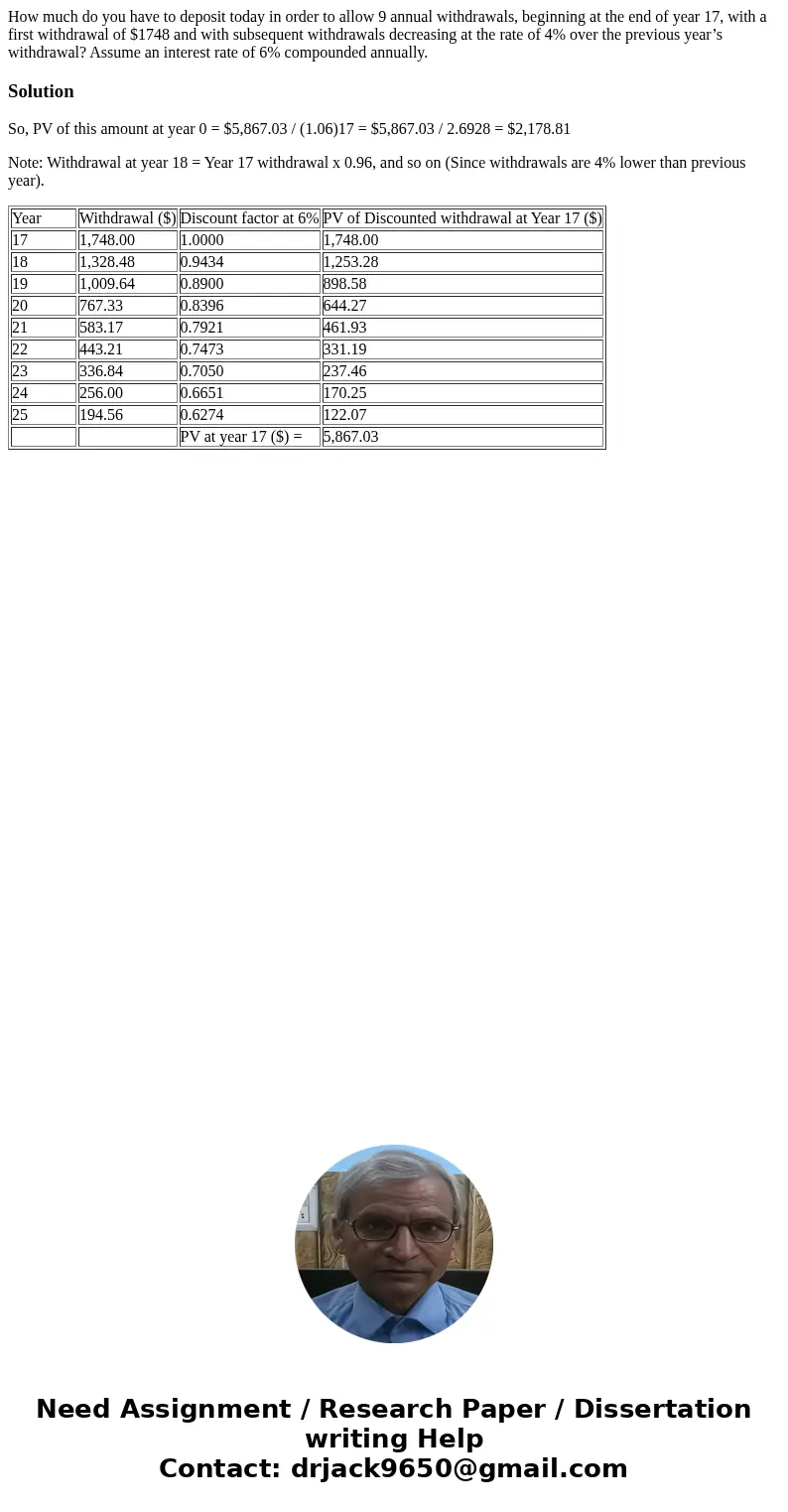

How much do you have to deposit today in order to allow 9 annual withdrawals, beginning at the end of year 17, with a first withdrawal of $1748 and with subsequent withdrawals decreasing at the rate of 4% over the previous year’s withdrawal? Assume an interest rate of 6% compounded annually.

Solution

So, PV of this amount at year 0 = $5,867.03 / (1.06)17 = $5,867.03 / 2.6928 = $2,178.81

Note: Withdrawal at year 18 = Year 17 withdrawal x 0.96, and so on (Since withdrawals are 4% lower than previous year).

| Year | Withdrawal ($) | Discount factor at 6% | PV of Discounted withdrawal at Year 17 ($) |

| 17 | 1,748.00 | 1.0000 | 1,748.00 |

| 18 | 1,328.48 | 0.9434 | 1,253.28 |

| 19 | 1,009.64 | 0.8900 | 898.58 |

| 20 | 767.33 | 0.8396 | 644.27 |

| 21 | 583.17 | 0.7921 | 461.93 |

| 22 | 443.21 | 0.7473 | 331.19 |

| 23 | 336.84 | 0.7050 | 237.46 |

| 24 | 256.00 | 0.6651 | 170.25 |

| 25 | 194.56 | 0.6274 | 122.07 |

| PV at year 17 ($) = | 5,867.03 |

Homework Sourse

Homework Sourse