Exercise 151 During its first year of operations Swifty Corp

Exercise 15-1 During its first year of operations, Swifty Corporation had the following transactions pertaining to its common stock Issued 80,900 shares for cash at 57 per share. ssued 5,000 shares to attorneys in payment of a bill for37,400 for services rendered in helping the company to incorporate. Issued 32,300 shares for cash at S9 per share. Issued 64,100 shares for cash at s11 per share. Sept. (a) Prepare the journal entries for these transactions, assurming that the common stock has a par value of $5 per share (b) Prepare the journal entries for these transactions, assuming that the common stock is no-par with a stated value of $2 per share. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account tities and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit

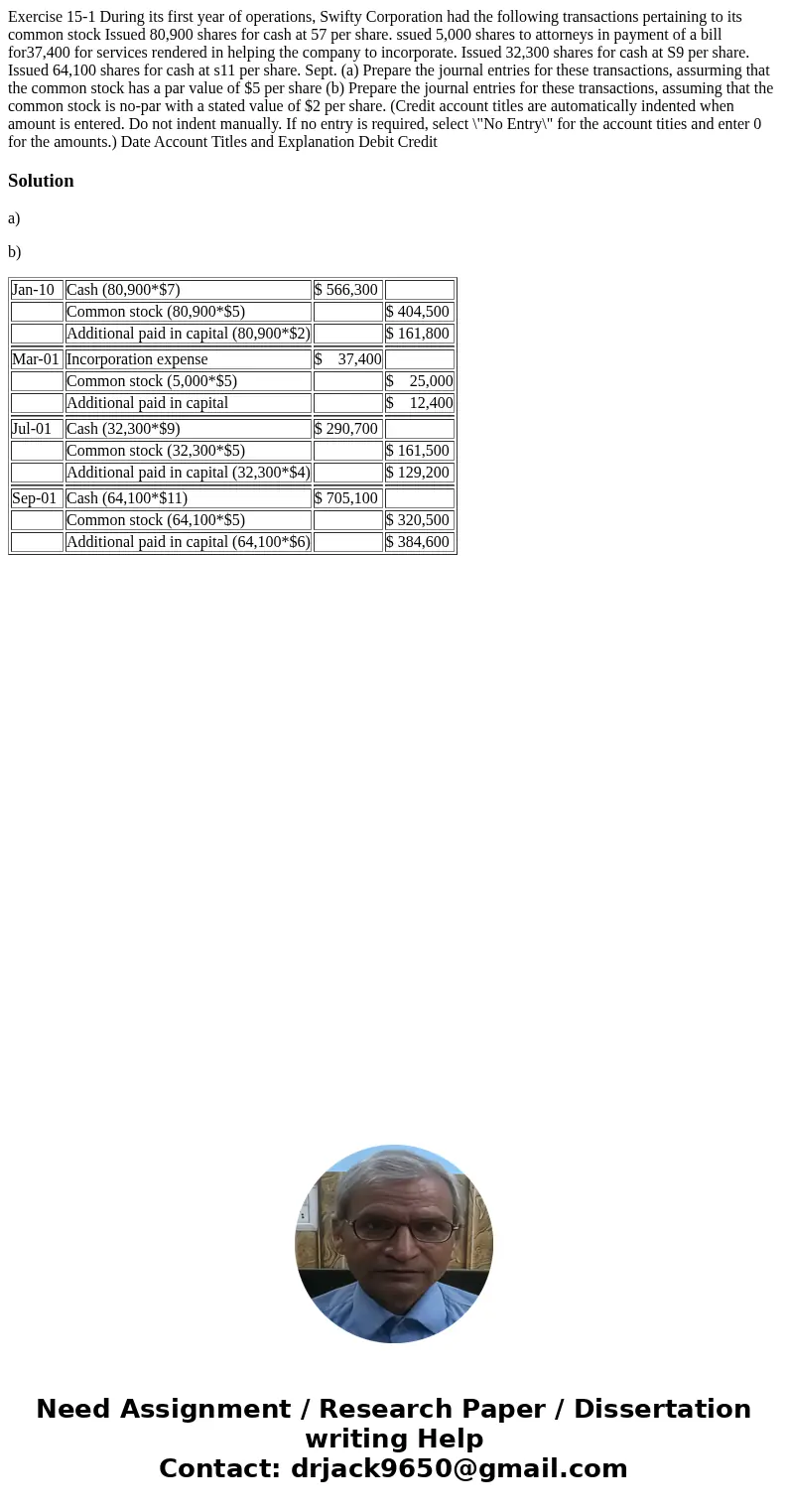

Solution

a)

b)

| Jan-10 | Cash (80,900*$7) | $ 566,300 | |

| Common stock (80,900*$5) | $ 404,500 | ||

| Additional paid in capital (80,900*$2) | $ 161,800 | ||

| Mar-01 | Incorporation expense | $ 37,400 | |

| Common stock (5,000*$5) | $ 25,000 | ||

| Additional paid in capital | $ 12,400 | ||

| Jul-01 | Cash (32,300*$9) | $ 290,700 | |

| Common stock (32,300*$5) | $ 161,500 | ||

| Additional paid in capital (32,300*$4) | $ 129,200 | ||

| Sep-01 | Cash (64,100*$11) | $ 705,100 | |

| Common stock (64,100*$5) | $ 320,500 | ||

| Additional paid in capital (64,100*$6) | $ 384,600 |

Homework Sourse

Homework Sourse