Gem E Fallon LLP GEF is currently evaluating an investment i

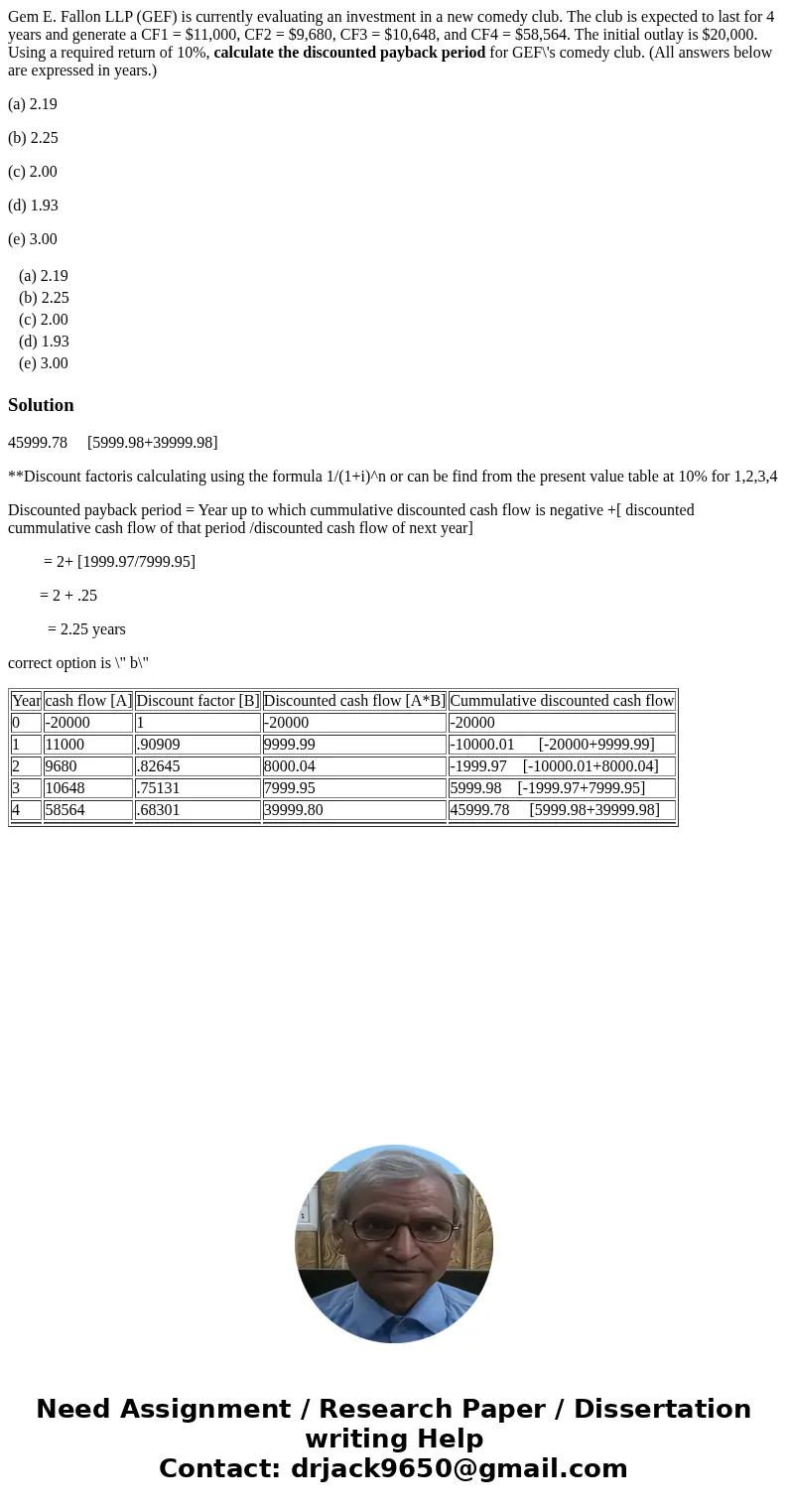

Gem E. Fallon LLP (GEF) is currently evaluating an investment in a new comedy club. The club is expected to last for 4 years and generate a CF1 = $11,000, CF2 = $9,680, CF3 = $10,648, and CF4 = $58,564. The initial outlay is $20,000. Using a required return of 10%, calculate the discounted payback period for GEF\'s comedy club. (All answers below are expressed in years.)

(a) 2.19

(b) 2.25

(c) 2.00

(d) 1.93

(e) 3.00

| (a) 2.19 | ||

| (b) 2.25 | ||

| (c) 2.00 | ||

| (d) 1.93 | ||

| (e) 3.00 |

Solution

45999.78 [5999.98+39999.98]

**Discount factoris calculating using the formula 1/(1+i)^n or can be find from the present value table at 10% for 1,2,3,4

Discounted payback period = Year up to which cummulative discounted cash flow is negative +[ discounted cummulative cash flow of that period /discounted cash flow of next year]

= 2+ [1999.97/7999.95]

= 2 + .25

= 2.25 years

correct option is \" b\"

| Year | cash flow [A] | Discount factor [B] | Discounted cash flow [A*B] | Cummulative discounted cash flow |

| 0 | -20000 | 1 | -20000 | -20000 |

| 1 | 11000 | .90909 | 9999.99 | -10000.01 [-20000+9999.99] |

| 2 | 9680 | .82645 | 8000.04 | -1999.97 [-10000.01+8000.04] |

| 3 | 10648 | .75131 | 7999.95 | 5999.98 [-1999.97+7999.95] |

| 4 | 58564 | .68301 | 39999.80 | 45999.78 [5999.98+39999.98] |

Homework Sourse

Homework Sourse