The transactions of Spade Company appear below a Kacy Spade

The transactions of Spade Company appear below a. Kacy Spade, owner, invested $100,750 cash in the company in exchange for common stock b. The company purchased office supplies for $1,250 cash c. The company purchased $10,050 of office equipment on credit d. The company received $15,500 cash as fees for services provided to a customer e. The company paid $10,050 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $2,700 as fees for services provided R The company poilecde@ 3, 25 Cast a pontalpayment for he account recervable created in transacion h. The company collected $1,125 cash as partial payment for the account receivable created in transaction f i. The company paid $10,000 cash in dividends to the owner (sole shareholder) Check Cash ending balance, $94,850 Prepare the Trial Balance SPADE COMPANY Trial Balance May 31, 2016 Debit Credit S 94850 1.250 10,050 2.700 Cash Office supplies Office equipment Fees earned Accounts payable Common stock Rent expense Accounts receivable Dividends 10.050 1.225 16,625 10,000

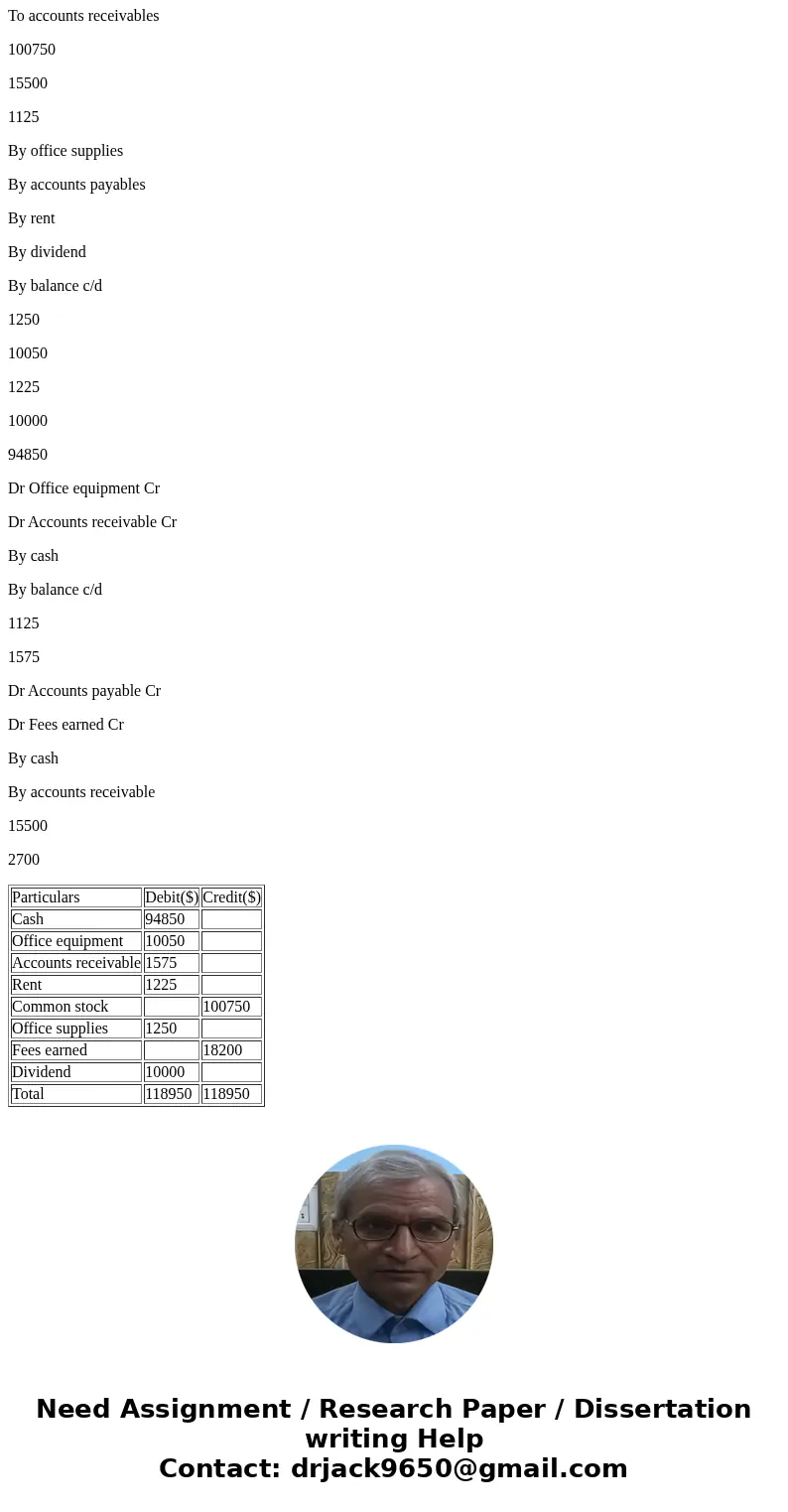

Solution

SPADE COMPANY

Trial balance as on May 31 2016

Dr Cash Cr

To common stock

To fees earned

To accounts receivables

100750

15500

1125

By office supplies

By accounts payables

By rent

By dividend

By balance c/d

1250

10050

1225

10000

94850

Dr Office equipment Cr

Dr Accounts receivable Cr

By cash

By balance c/d

1125

1575

Dr Accounts payable Cr

Dr Fees earned Cr

By cash

By accounts receivable

15500

2700

| Particulars | Debit($) | Credit($) |

| Cash | 94850 | |

| Office equipment | 10050 | |

| Accounts receivable | 1575 | |

| Rent | 1225 | |

| Common stock | 100750 | |

| Office supplies | 1250 | |

| Fees earned | 18200 | |

| Dividend | 10000 | |

| Total | 118950 | 118950 |

Homework Sourse

Homework Sourse