Expert QA Done 2Rural poultry farm costs 5000000 to set up a

Solution

2. Accounting rate of return

Accounting rate retun = Average return during the period/ Average Investment

= 1000000+200000+300000+400000+600000/5=320000

= 5000000/5 = 1000000

ARR = 320000/1000000

= 32%

3.( a) Payback period

Initial Investment = 105 m

Annual cash flows = 25 m

Payback period = 105/25

= 4.2 that is 4 year 2 month and 12 days

b) Intial Investment = 50

year 1 cash flow = 10

Balance = 40

Year 2 cash flow= 13

Balance = 27

Year 2 cash flow= 16

Balance = 11

19 million cash flow generated in year 3, this is 12 months total income, hence no. months needed to generate 11 million = 12/19 x 11= 6.94 that is 6 month and 28 days

Hence total payback period is 2 year, 6 month and 28 days

From the above we can conclude that Project B is better becuse it has a lesser payback perod

LIMITATIONS USING PAYBACK METHOD.

*. One of the main drawback is that this method does not considering the time value of money

*. The payback method not considering the cash fows effecting after the payback period

*. This method can be used only in preliminary evaluations. For making better comparisons we have to follow NPV method or IRR method

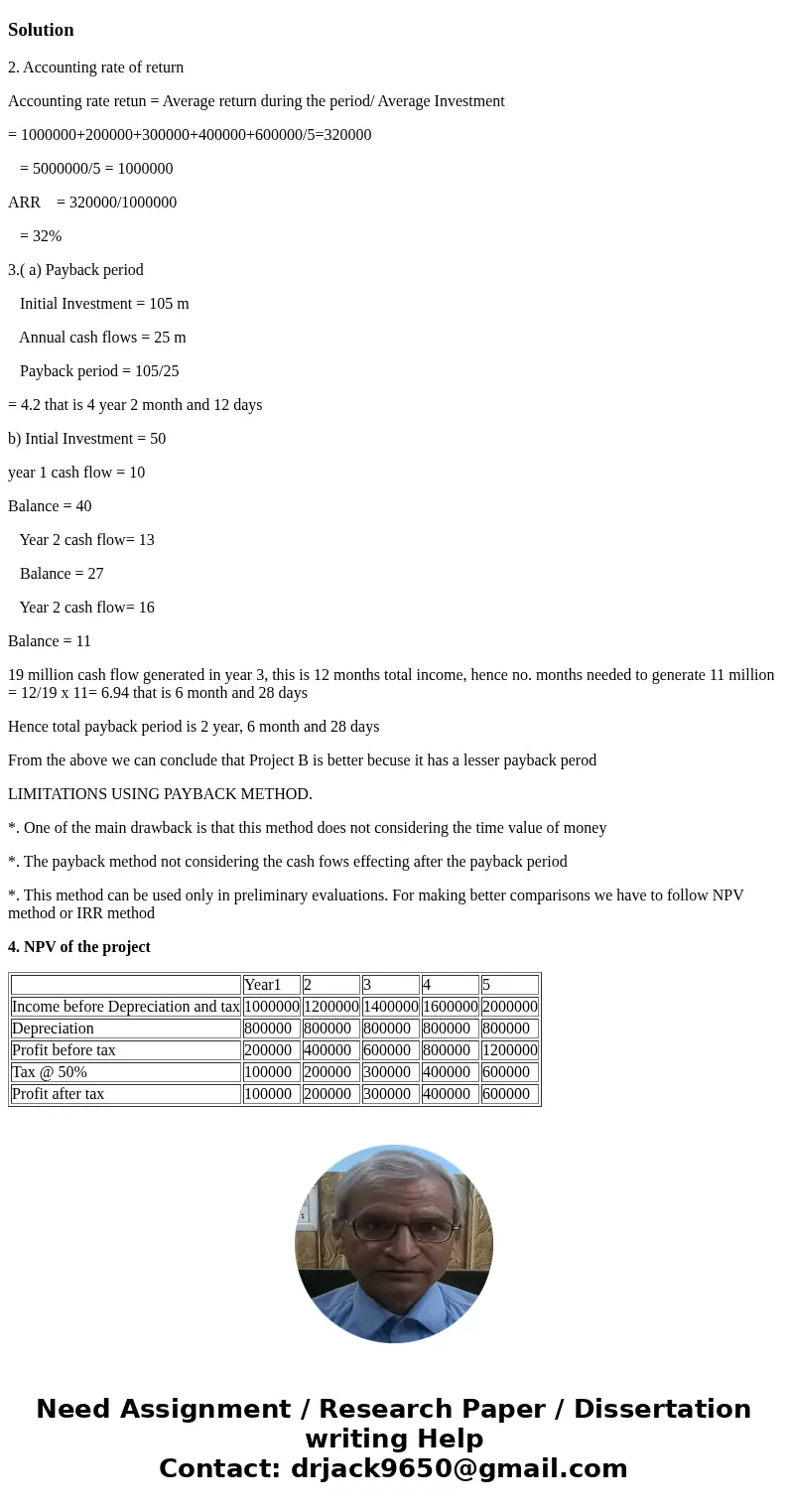

4. NPV of the project

| Year1 | 2 | 3 | 4 | 5 | |

| Income before Depreciation and tax | 1000000 | 1200000 | 1400000 | 1600000 | 2000000 |

| Depreciation | 800000 | 800000 | 800000 | 800000 | 800000 |

| Profit before tax | 200000 | 400000 | 600000 | 800000 | 1200000 |

| Tax @ 50% | 100000 | 200000 | 300000 | 400000 | 600000 |

| Profit after tax | 100000 | 200000 | 300000 | 400000 | 600000 |

Homework Sourse

Homework Sourse