Question Answer ALL parts of this question City Products ope

Question Answer ALL parts of this question. City Products operates a job-order cost system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). In computing a predetermined overhead rate at the beginning of the year, the company\'s estimates were manufacturing overhead cost, £600 000; and direct materials to be used in production, £400 000. The company\'s inventory accounts at the beginning and end of the year were: Beginning .- Ending £40 000 80 000 Finished goods 280000 350 000 Raw Materials £40 000 Work in progress 100 000 The following actual costs were incurred during the year Purchase of direct raw materials Direct labour cost Manufacturing overhead costs: Indirect labour Property taxes Depreciation of equipment Maintenance Insurance Rent, building £450 000 120000 150 000 52 000 260 000 105 000 9 000 150 000 1. Compute the predetermined overhead rate for the year (4 marks) 2. Compute the amount of under-or over-applied overhead for the year 4 marks) 3. Prepare a schedule of cost of goods manufactured for the year (5 marks) Question 1 continued on page 3 Page 2 of 6

Solution

Part 1 - Calculation of predetermined overhead rate

Predetermined Overhead rate = Estimated total manufacturing overhead cost/Estimated total amount of the allocation base

Here Allocation base is cost of direct material used in production

= 600000/400000 = 150%

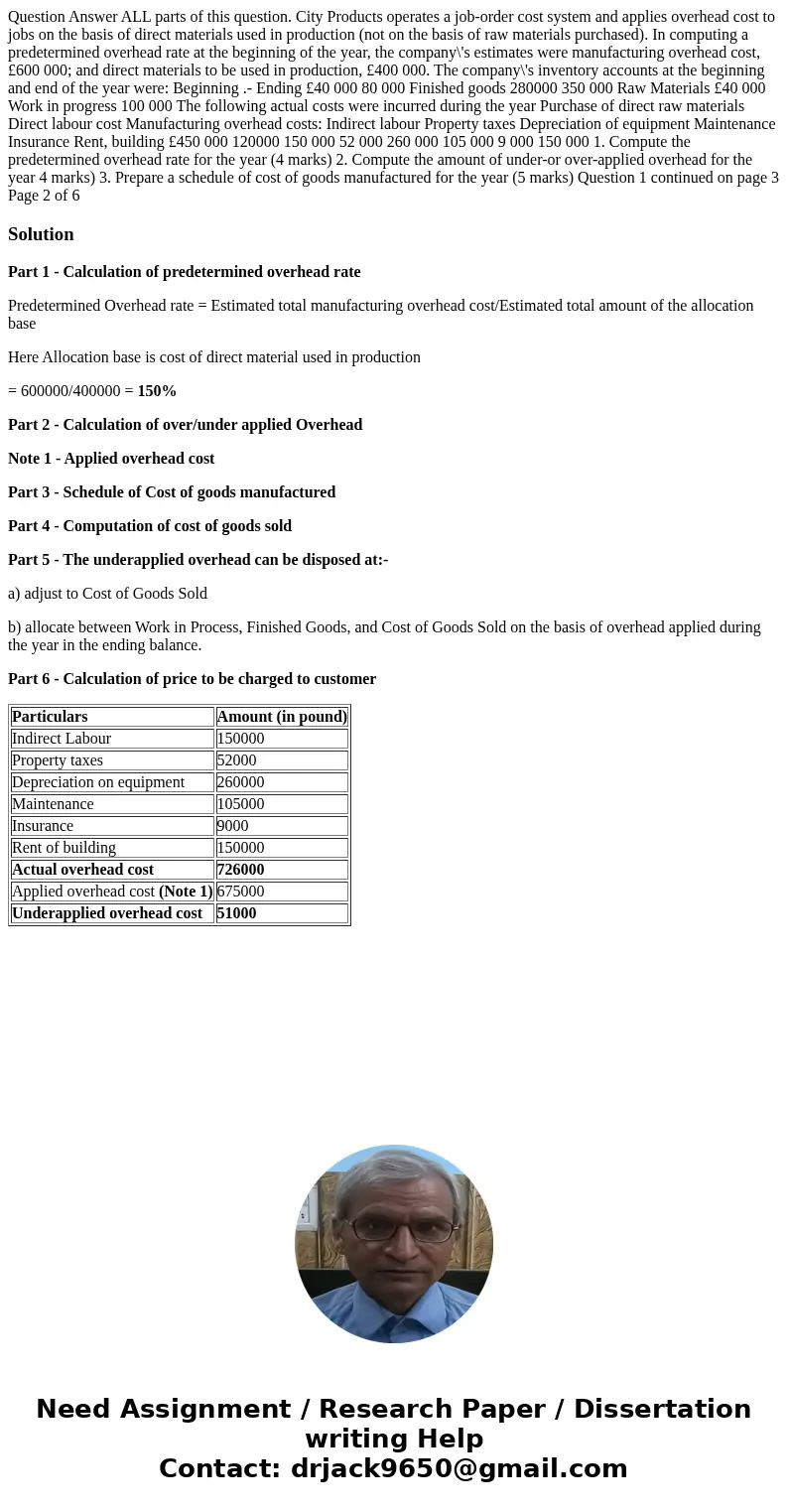

Part 2 - Calculation of over/under applied Overhead

Note 1 - Applied overhead cost

Part 3 - Schedule of Cost of goods manufactured

Part 4 - Computation of cost of goods sold

Part 5 - The underapplied overhead can be disposed at:-

a) adjust to Cost of Goods Sold

b) allocate between Work in Process, Finished Goods, and Cost of Goods Sold on the basis of overhead applied during the year in the ending balance.

Part 6 - Calculation of price to be charged to customer

| Particulars | Amount (in pound) |

| Indirect Labour | 150000 |

| Property taxes | 52000 |

| Depreciation on equipment | 260000 |

| Maintenance | 105000 |

| Insurance | 9000 |

| Rent of building | 150000 |

| Actual overhead cost | 726000 |

| Applied overhead cost (Note 1) | 675000 |

| Underapplied overhead cost | 51000 |

Homework Sourse

Homework Sourse