Gils outside basis in his interest in the GO Partnership is

Gil\'s outside basis in his interest in the GO Partnership is $100,000. In a proportionate non- liquidating distribution, the partnership distributes to him cash of $30,000, inventory (fair market value of $40,000, basis to the partnership of $20,000), and land (fair market value of $90,000, basis to the partnership of $40,000). The partnership continues in existence. a. Does the partnership recognize any gain or loss as a result of this distribution? Explain. b. Does Gil recognize any gain or loss as a result of this distribution? Explain. c. Calculate Gil\'s basis in the land, in the inventory, and in his partnership interest immediately following the distribution.

Solution

a. The partnership will not recognise any loss or gain as a result of this distribution.

b. In this case , Gil will also not recognise any loss or gain as a result of the distribution since the distribution is made on a proportionate non liquidating basis. Gil will only recognise the loss on distribution in any case his membership from the partnership is terminated. A profit on a non liquidating basis is recognised only to the extent of cash received exceeding the outside basis. Since cash received here does not exceed the outside basis, no gain is recognised.

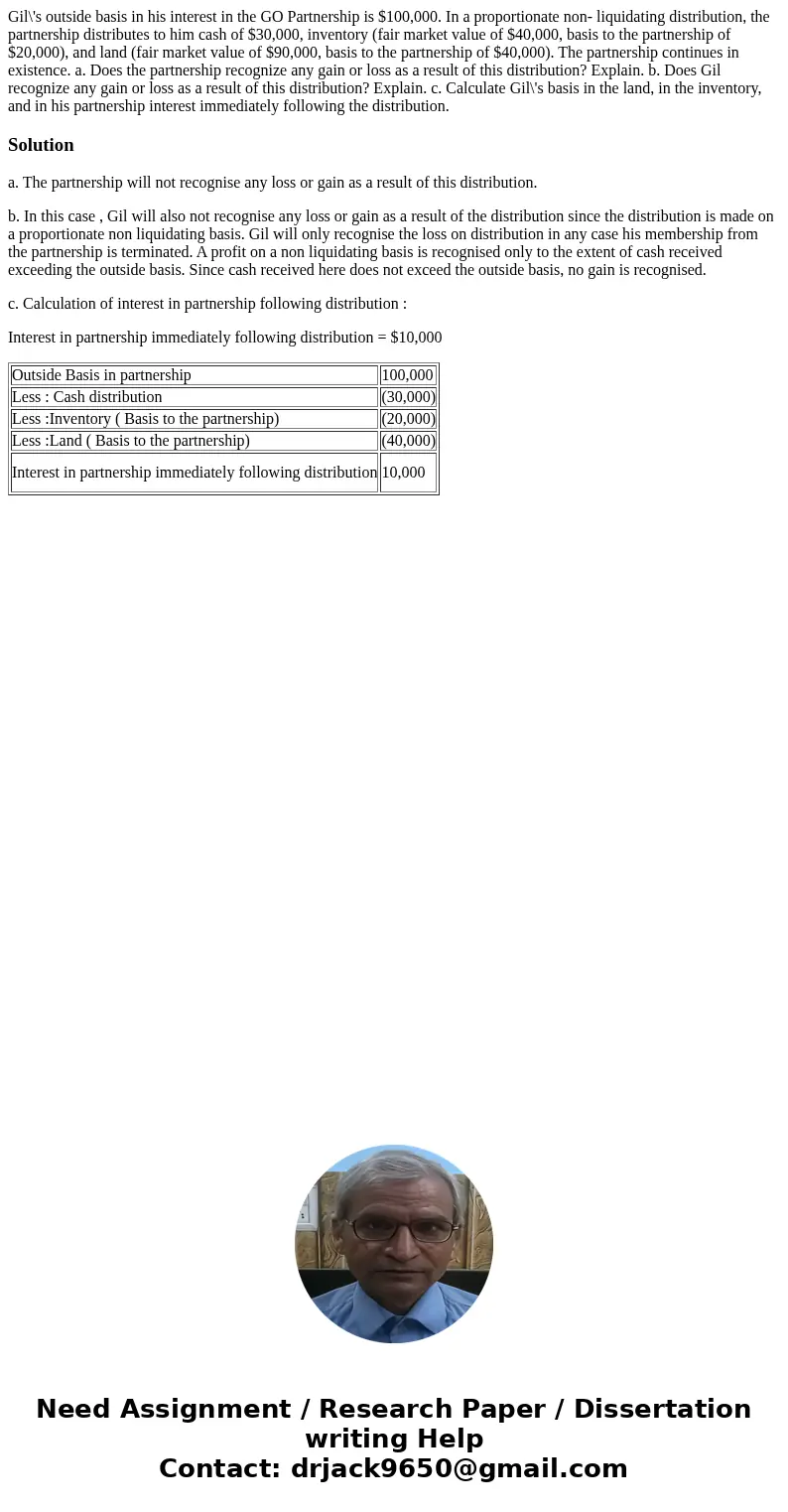

c. Calculation of interest in partnership following distribution :

Interest in partnership immediately following distribution = $10,000

| Outside Basis in partnership | 100,000 |

| Less : Cash distribution | (30,000) |

| Less :Inventory ( Basis to the partnership) | (20,000) |

| Less :Land ( Basis to the partnership) | (40,000) |

| Interest in partnership immediately following distribution | 10,000 |

Homework Sourse

Homework Sourse