6Assume that you are 10 years into a 30 year home loan at 5

6-Assume that you are 10 years into a 30 year home loan at 5%. You owe $200,000 left on your home at this time. You can refinance your loan at 4% for 20 years; however the TOTAL closing costs will be around $3,000.

If you go for refinancing, how many more months would you need to live in the home in order to get the closing cost back? Ignore time value of money and tax credits of the interest payments (i.e. Simple Payback)_______________

Answer Q6 again considering time value of money with annual MARR 10% compounded monthly.

Solution

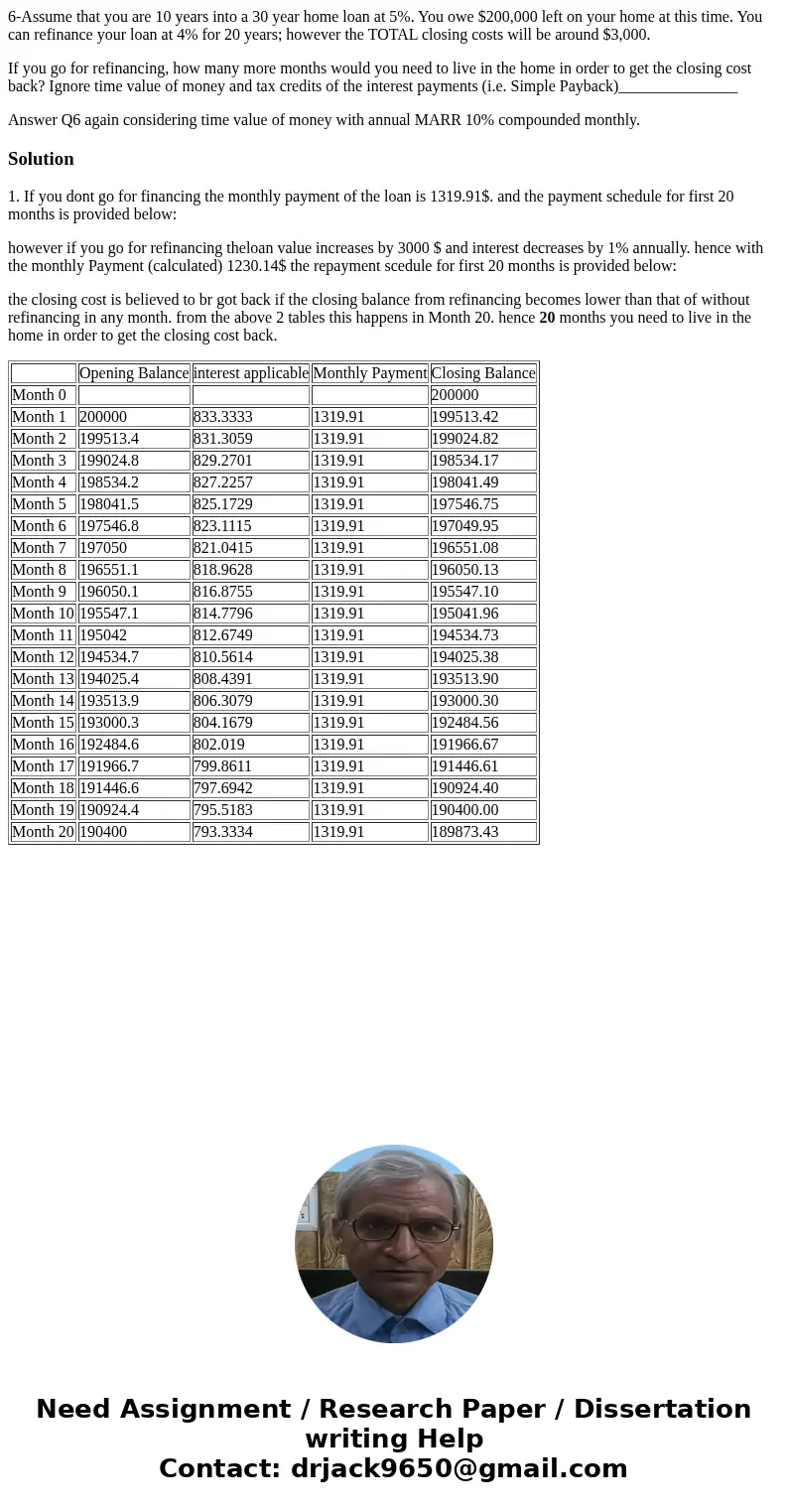

1. If you dont go for financing the monthly payment of the loan is 1319.91$. and the payment schedule for first 20 months is provided below:

however if you go for refinancing theloan value increases by 3000 $ and interest decreases by 1% annually. hence with the monthly Payment (calculated) 1230.14$ the repayment scedule for first 20 months is provided below:

the closing cost is believed to br got back if the closing balance from refinancing becomes lower than that of without refinancing in any month. from the above 2 tables this happens in Month 20. hence 20 months you need to live in the home in order to get the closing cost back.

| Opening Balance | interest applicable | Monthly Payment | Closing Balance | |

| Month 0 | 200000 | |||

| Month 1 | 200000 | 833.3333 | 1319.91 | 199513.42 |

| Month 2 | 199513.4 | 831.3059 | 1319.91 | 199024.82 |

| Month 3 | 199024.8 | 829.2701 | 1319.91 | 198534.17 |

| Month 4 | 198534.2 | 827.2257 | 1319.91 | 198041.49 |

| Month 5 | 198041.5 | 825.1729 | 1319.91 | 197546.75 |

| Month 6 | 197546.8 | 823.1115 | 1319.91 | 197049.95 |

| Month 7 | 197050 | 821.0415 | 1319.91 | 196551.08 |

| Month 8 | 196551.1 | 818.9628 | 1319.91 | 196050.13 |

| Month 9 | 196050.1 | 816.8755 | 1319.91 | 195547.10 |

| Month 10 | 195547.1 | 814.7796 | 1319.91 | 195041.96 |

| Month 11 | 195042 | 812.6749 | 1319.91 | 194534.73 |

| Month 12 | 194534.7 | 810.5614 | 1319.91 | 194025.38 |

| Month 13 | 194025.4 | 808.4391 | 1319.91 | 193513.90 |

| Month 14 | 193513.9 | 806.3079 | 1319.91 | 193000.30 |

| Month 15 | 193000.3 | 804.1679 | 1319.91 | 192484.56 |

| Month 16 | 192484.6 | 802.019 | 1319.91 | 191966.67 |

| Month 17 | 191966.7 | 799.8611 | 1319.91 | 191446.61 |

| Month 18 | 191446.6 | 797.6942 | 1319.91 | 190924.40 |

| Month 19 | 190924.4 | 795.5183 | 1319.91 | 190400.00 |

| Month 20 | 190400 | 793.3334 | 1319.91 | 189873.43 |

Homework Sourse

Homework Sourse