Journalize the following transactions for Rivera Company usi

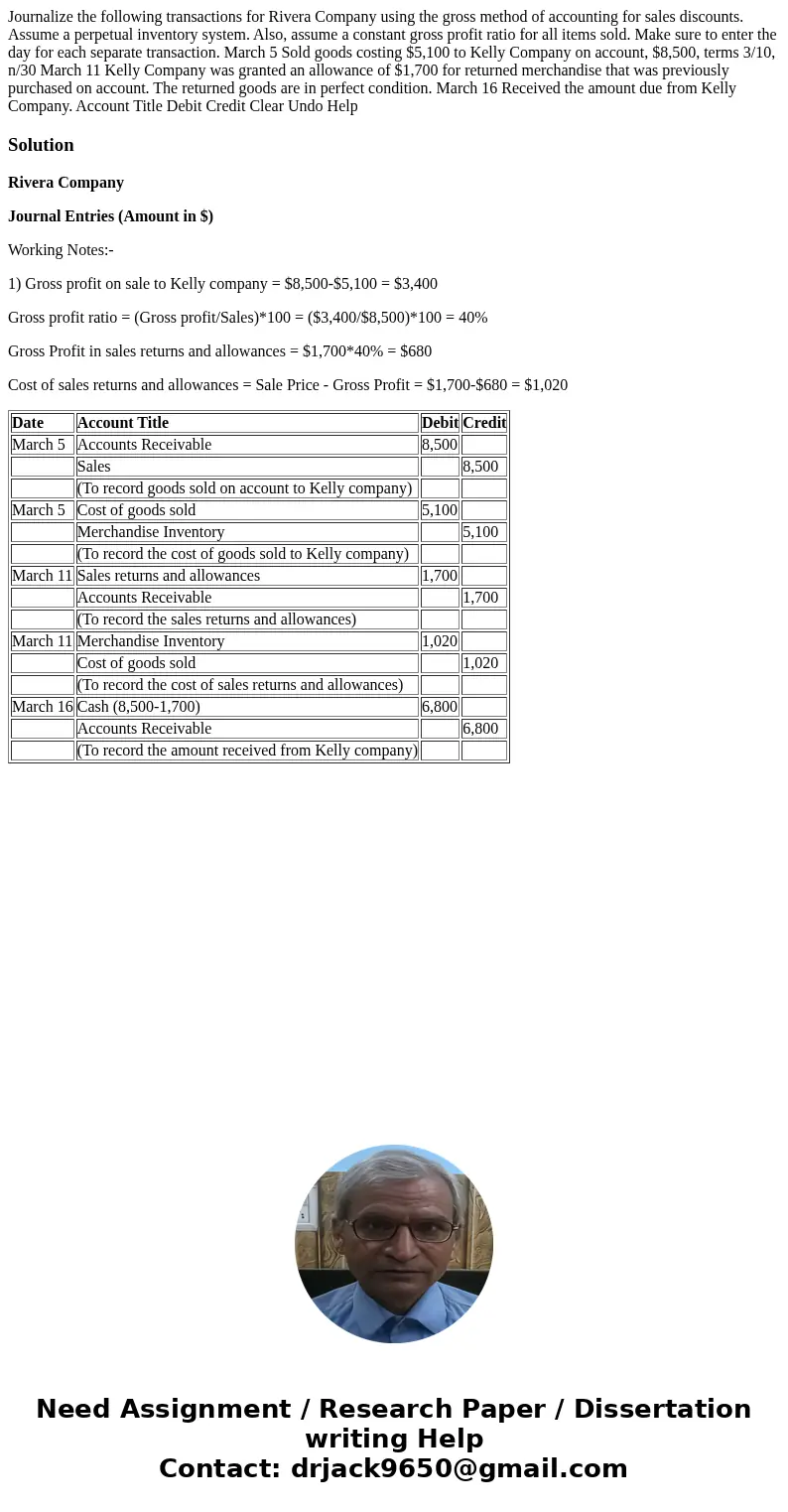

Journalize the following transactions for Rivera Company using the gross method of accounting for sales discounts. Assume a perpetual inventory system. Also, assume a constant gross profit ratio for all items sold. Make sure to enter the day for each separate transaction. March 5 Sold goods costing $5,100 to Kelly Company on account, $8,500, terms 3/10, n/30 March 11 Kelly Company was granted an allowance of $1,700 for returned merchandise that was previously purchased on account. The returned goods are in perfect condition. March 16 Received the amount due from Kelly Company. Account Title Debit Credit Clear Undo Help

Solution

Rivera Company

Journal Entries (Amount in $)

Working Notes:-

1) Gross profit on sale to Kelly company = $8,500-$5,100 = $3,400

Gross profit ratio = (Gross profit/Sales)*100 = ($3,400/$8,500)*100 = 40%

Gross Profit in sales returns and allowances = $1,700*40% = $680

Cost of sales returns and allowances = Sale Price - Gross Profit = $1,700-$680 = $1,020

| Date | Account Title | Debit | Credit |

| March 5 | Accounts Receivable | 8,500 | |

| Sales | 8,500 | ||

| (To record goods sold on account to Kelly company) | |||

| March 5 | Cost of goods sold | 5,100 | |

| Merchandise Inventory | 5,100 | ||

| (To record the cost of goods sold to Kelly company) | |||

| March 11 | Sales returns and allowances | 1,700 | |

| Accounts Receivable | 1,700 | ||

| (To record the sales returns and allowances) | |||

| March 11 | Merchandise Inventory | 1,020 | |

| Cost of goods sold | 1,020 | ||

| (To record the cost of sales returns and allowances) | |||

| March 16 | Cash (8,500-1,700) | 6,800 | |

| Accounts Receivable | 6,800 | ||

| (To record the amount received from Kelly company) |

Homework Sourse

Homework Sourse