Data The new pharmaceutical product that the company wishes

Data:

The new pharmaceutical product that the company wishes to introduce, Orchid Relief, uses two new ingredients. At this stage, Eli Orchid can procure limited amounts of each ingredient. The company has 4500 pounds of ingredient 1 and 3600 pounds of ingredient 2 available for this week.

Eli Orchid can manufacture the new product using any of its three existing processes that have different capabilities. The production with each of the processes is done in batches (a batch typically represents one full run of a machine from when it starts a task until it finishes it). Each batch of production by each of the processes uses different amounts of ingredients 1 and 2, and results in different number of units of Orchid Relief produced (note the difference between a batch and units of Orchid Relief produced). The table below outlines the cost per batch, amounts of the two ingredients required, and the number of units of Orchid Relief yielded per batch.

Process 1

Process 2

Process 3

Cost of production per batch

$14,000

$30,000

$11,000

Ingredient 1 required per batch (pounds)

180

120

540

Ingredient 2 required per batch (pounds)

60

420

120

Orchid Relief yielded per batch (units)

120

300

60

Eli Orchid needs to determine how many batches to produce with each process in the least costly way given the limited availability of the two ingredients. Also, the total production of Orchid Relief in units must be greater than or equal to the total forecasted demand (in units) for the following week.

The COO of the company asked the analyst[1]:

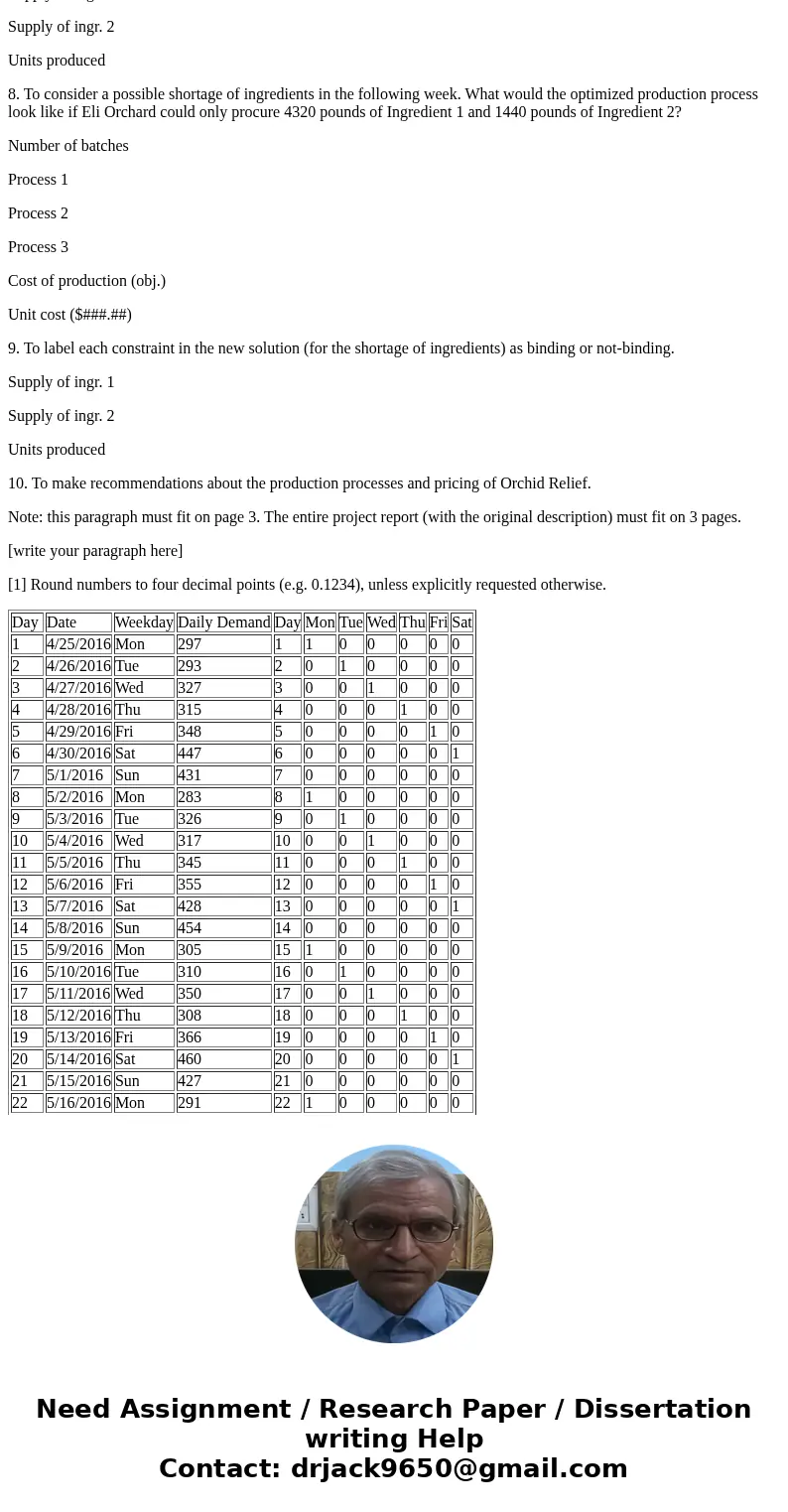

1. To use the new M3 model updated with week 9 data (d = 0.6568*Day -151.1703*Mon -136.2715*Tue -110.595*Wed -118.3629*Thu -74.7975*Fri + 1.7679*Sat + 434.5675) to predict the total demand (in units) for Week 10 (days 64-70).

M3

Mon.

Tue.

Wed.

Thu.

Fri.

Sat.

Sun.

TOTAL:

2. To state if this is a maximization or a minimization optimization problem?

3. To provide the mathematical formulation of the objective function assuming that X1, X2, and X3 are the decision variables representing the number of batches of each process to be used.

4. To provide the mathematical formulation of the model constraints.

Supply of ingr. 1

Supply of ingr. 2

Units produced

Non-negativity

X1, X2, X3 >= 0

Integer

X1, X2, X3 : Integer

5. To use the “Production” tab of the Excel file and complete the setup by:

entering the forecasted total demand in the pink cell

entering formulas in the five grey cells based on the mathematical formulation

Excel Formulas:

Cost of Production

Supply of Ingr. 1

Unit Cost

6. To set up Excel Solver (Assume Constraint Precision of 0.000001 and Integer Optimality (%) of 0) and provide the solution to the optimization problem.

Number of batches

Process 1

Process 2

Process 3

Cost of production (obj.)

Unit cost ($###.##)

7. To label each constraint in the solution as binding or not-binding.

Supply of ingr. 1

Supply of ingr. 2

Units produced

8. To consider a possible shortage of ingredients in the following week. What would the optimized production process look like if Eli Orchard could only procure 4320 pounds of Ingredient 1 and 1440 pounds of Ingredient 2?

Number of batches

Process 1

Process 2

Process 3

Cost of production (obj.)

Unit cost ($###.##)

9. To label each constraint in the new solution (for the shortage of ingredients) as binding or not-binding.

Supply of ingr. 1

Supply of ingr. 2

Units produced

10. To make recommendations about the production processes and pricing of Orchid Relief.

Note: this paragraph must fit on page 3. The entire project report (with the original description) must fit on 3 pages.

[write your paragraph here]

[1] Round numbers to four decimal points (e.g. 0.1234), unless explicitly requested otherwise.

| Day | Date | Weekday | Daily Demand | Day | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 4/25/2016 | Mon | 297 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| 2 | 4/26/2016 | Tue | 293 | 2 | 0 | 1 | 0 | 0 | 0 | 0 |

| 3 | 4/27/2016 | Wed | 327 | 3 | 0 | 0 | 1 | 0 | 0 | 0 |

| 4 | 4/28/2016 | Thu | 315 | 4 | 0 | 0 | 0 | 1 | 0 | 0 |

| 5 | 4/29/2016 | Fri | 348 | 5 | 0 | 0 | 0 | 0 | 1 | 0 |

| 6 | 4/30/2016 | Sat | 447 | 6 | 0 | 0 | 0 | 0 | 0 | 1 |

| 7 | 5/1/2016 | Sun | 431 | 7 | 0 | 0 | 0 | 0 | 0 | 0 |

| 8 | 5/2/2016 | Mon | 283 | 8 | 1 | 0 | 0 | 0 | 0 | 0 |

| 9 | 5/3/2016 | Tue | 326 | 9 | 0 | 1 | 0 | 0 | 0 | 0 |

| 10 | 5/4/2016 | Wed | 317 | 10 | 0 | 0 | 1 | 0 | 0 | 0 |

| 11 | 5/5/2016 | Thu | 345 | 11 | 0 | 0 | 0 | 1 | 0 | 0 |

| 12 | 5/6/2016 | Fri | 355 | 12 | 0 | 0 | 0 | 0 | 1 | 0 |

| 13 | 5/7/2016 | Sat | 428 | 13 | 0 | 0 | 0 | 0 | 0 | 1 |

| 14 | 5/8/2016 | Sun | 454 | 14 | 0 | 0 | 0 | 0 | 0 | 0 |

| 15 | 5/9/2016 | Mon | 305 | 15 | 1 | 0 | 0 | 0 | 0 | 0 |

| 16 | 5/10/2016 | Tue | 310 | 16 | 0 | 1 | 0 | 0 | 0 | 0 |

| 17 | 5/11/2016 | Wed | 350 | 17 | 0 | 0 | 1 | 0 | 0 | 0 |

| 18 | 5/12/2016 | Thu | 308 | 18 | 0 | 0 | 0 | 1 | 0 | 0 |

| 19 | 5/13/2016 | Fri | 366 | 19 | 0 | 0 | 0 | 0 | 1 | 0 |

| 20 | 5/14/2016 | Sat | 460 | 20 | 0 | 0 | 0 | 0 | 0 | 1 |

| 21 | 5/15/2016 | Sun | 427 | 21 | 0 | 0 | 0 | 0 | 0 | 0 |

| 22 | 5/16/2016 | Mon | 291 | 22 | 1 | 0 | 0 | 0 | 0 | 0 |

| 23 | 5/17/2016 | Tue | 325 | 23 | 0 | 1 | 0 | 0 | 0 | 0 |

| 24 | 5/18/2016 | Wed | 354 | 24 | 0 | 0 | 1 | 0 | 0 | 0 |

| 25 | 5/19/2016 | Thu | 322 | 25 | 0 | 0 | 0 | 1 | 0 | 0 |

| 26 | 5/20/2016 | Fri | 405 | 26 | 0 | 0 | 0 | 0 | 1 | 0 |

| 27 | 5/21/2016 | Sat | 442 | 27 | 0 | 0 | 0 | 0 | 0 | 1 |

| 28 | 5/22/2016 | Sun | 454 | 28 | 0 | 0 | 0 | 0 | 0 | 0 |

| 29 | 5/23/2016 | Mon | 318 | 29 | 1 | 0 | 0 | 0 | 0 | 0 |

| 30 | 5/24/2016 | Tue | 298 | 30 | 0 | 1 | 0 | 0 | 0 | 0 |

| 31 | 5/25/2016 | Wed | 355 | 31 | 0 | 0 | 1 | 0 | 0 | 0 |

| 32 | 5/26/2016 | Thu | 355 | 32 | 0 | 0 | 0 | 1 | 0 | 0 |

| 33 | 5/27/2016 | Fri | 374 | 33 | 0 | 0 | 0 | 0 | 1 | 0 |

| 34 | 5/28/2016 | Sat | 447 | 34 | 0 | 0 | 0 | 0 | 0 | 1 |

| 35 | 5/29/2016 | Sun | 463 | 35 | 0 | 0 | 0 | 0 | 0 | 0 |

| 36 | 5/30/2016 | Mon | 291 | 36 | 1 | 0 | 0 | 0 | 0 | 0 |

| 37 | 5/31/2016 | Tue | 319 | 37 | 0 | 1 | 0 | 0 | 0 | 0 |

| 38 | 6/1/2016 | Wed | 333 | 38 | 0 | 0 | 1 | 0 | 0 | 0 |

| 39 | 6/2/2016 | Thu | 339 | 39 | 0 | 0 | 0 | 1 | 0 | 0 |

| 40 | 6/3/2016 | Fri | 416 | 40 | 0 | 0 | 0 | 0 | 1 | 0 |

| 41 | 6/4/2016 | Sat | 475 | 41 | 0 | 0 | 0 | 0 | 0 | 1 |

| 42 | 6/5/2016 | Sun | 459 | 42 | 0 | 0 | 0 | 0 | 0 | 0 |

| 43 | 6/6/2016 | Mon | 319 | 43 | 1 | 0 | 0 | 0 | 0 | 0 |

| 44 | 6/7/2016 | Tue | 326 | 44 | 0 | 1 | 0 | 0 | 0 | 0 |

| 45 | 6/8/2016 | Wed | 356 | 45 | 0 | 0 | 1 | 0 | 0 | 0 |

| 46 | 6/9/2016 | Thu | 340 | 46 | 0 | 0 | 0 | 1 | 0 | 0 |

| 47 | 6/10/2016 | Fri | 395 | 47 | 0 | 0 | 0 | 0 | 1 | 0 |

| 48 | 6/11/2016 | Sat | 465 | 48 | 0 | 0 | 0 | 0 | 0 | 1 |

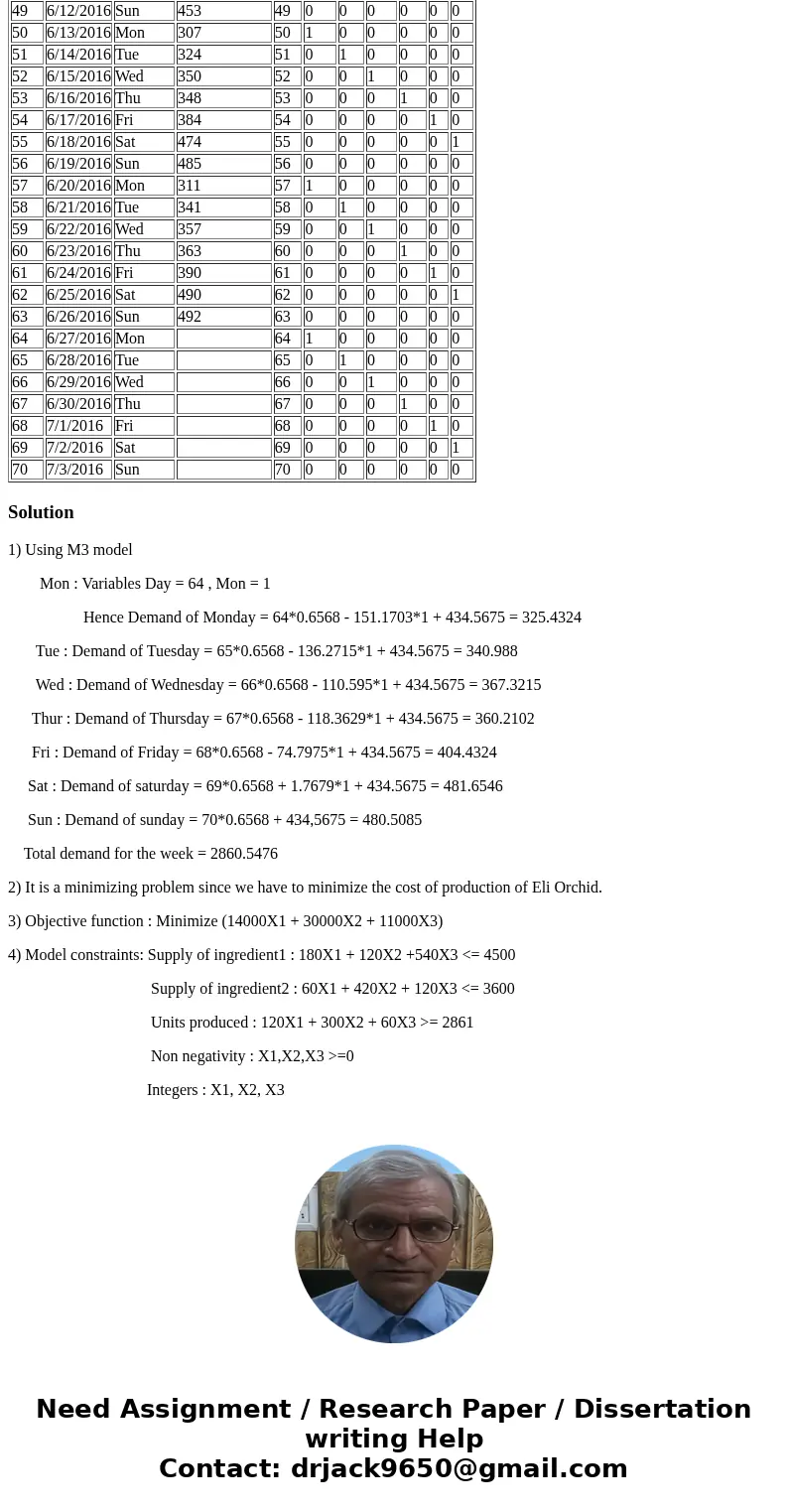

| 49 | 6/12/2016 | Sun | 453 | 49 | 0 | 0 | 0 | 0 | 0 | 0 |

| 50 | 6/13/2016 | Mon | 307 | 50 | 1 | 0 | 0 | 0 | 0 | 0 |

| 51 | 6/14/2016 | Tue | 324 | 51 | 0 | 1 | 0 | 0 | 0 | 0 |

| 52 | 6/15/2016 | Wed | 350 | 52 | 0 | 0 | 1 | 0 | 0 | 0 |

| 53 | 6/16/2016 | Thu | 348 | 53 | 0 | 0 | 0 | 1 | 0 | 0 |

| 54 | 6/17/2016 | Fri | 384 | 54 | 0 | 0 | 0 | 0 | 1 | 0 |

| 55 | 6/18/2016 | Sat | 474 | 55 | 0 | 0 | 0 | 0 | 0 | 1 |

| 56 | 6/19/2016 | Sun | 485 | 56 | 0 | 0 | 0 | 0 | 0 | 0 |

| 57 | 6/20/2016 | Mon | 311 | 57 | 1 | 0 | 0 | 0 | 0 | 0 |

| 58 | 6/21/2016 | Tue | 341 | 58 | 0 | 1 | 0 | 0 | 0 | 0 |

| 59 | 6/22/2016 | Wed | 357 | 59 | 0 | 0 | 1 | 0 | 0 | 0 |

| 60 | 6/23/2016 | Thu | 363 | 60 | 0 | 0 | 0 | 1 | 0 | 0 |

| 61 | 6/24/2016 | Fri | 390 | 61 | 0 | 0 | 0 | 0 | 1 | 0 |

| 62 | 6/25/2016 | Sat | 490 | 62 | 0 | 0 | 0 | 0 | 0 | 1 |

| 63 | 6/26/2016 | Sun | 492 | 63 | 0 | 0 | 0 | 0 | 0 | 0 |

| 64 | 6/27/2016 | Mon | 64 | 1 | 0 | 0 | 0 | 0 | 0 | |

| 65 | 6/28/2016 | Tue | 65 | 0 | 1 | 0 | 0 | 0 | 0 | |

| 66 | 6/29/2016 | Wed | 66 | 0 | 0 | 1 | 0 | 0 | 0 | |

| 67 | 6/30/2016 | Thu | 67 | 0 | 0 | 0 | 1 | 0 | 0 | |

| 68 | 7/1/2016 | Fri | 68 | 0 | 0 | 0 | 0 | 1 | 0 | |

| 69 | 7/2/2016 | Sat | 69 | 0 | 0 | 0 | 0 | 0 | 1 | |

| 70 | 7/3/2016 | Sun | 70 | 0 | 0 | 0 | 0 | 0 | 0 |

Solution

1) Using M3 model

Mon : Variables Day = 64 , Mon = 1

Hence Demand of Monday = 64*0.6568 - 151.1703*1 + 434.5675 = 325.4324

Tue : Demand of Tuesday = 65*0.6568 - 136.2715*1 + 434.5675 = 340.988

Wed : Demand of Wednesday = 66*0.6568 - 110.595*1 + 434.5675 = 367.3215

Thur : Demand of Thursday = 67*0.6568 - 118.3629*1 + 434.5675 = 360.2102

Fri : Demand of Friday = 68*0.6568 - 74.7975*1 + 434.5675 = 404.4324

Sat : Demand of saturday = 69*0.6568 + 1.7679*1 + 434.5675 = 481.6546

Sun : Demand of sunday = 70*0.6568 + 434,5675 = 480.5085

Total demand for the week = 2860.5476

2) It is a minimizing problem since we have to minimize the cost of production of Eli Orchid.

3) Objective function : Minimize (14000X1 + 30000X2 + 11000X3)

4) Model constraints: Supply of ingredient1 : 180X1 + 120X2 +540X3 <= 4500

Supply of ingredient2 : 60X1 + 420X2 + 120X3 <= 3600

Units produced : 120X1 + 300X2 + 60X3 >= 2861

Non negativity : X1,X2,X3 >=0

Integers : X1, X2, X3

Homework Sourse

Homework Sourse